TRADING SIGNALS

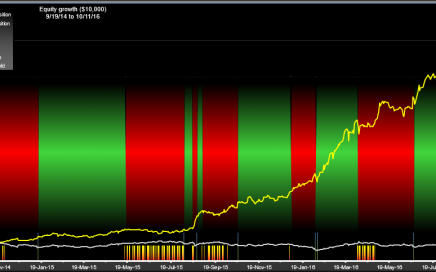

Buy and sell trading signals for popular stocks

Search for trading signals:- enter a stock symbol or company name

Trading signals with interesting results

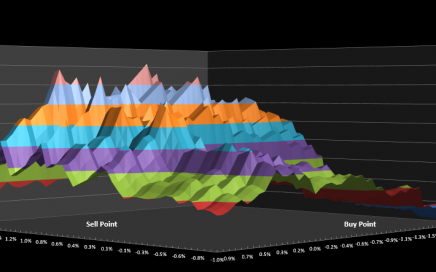

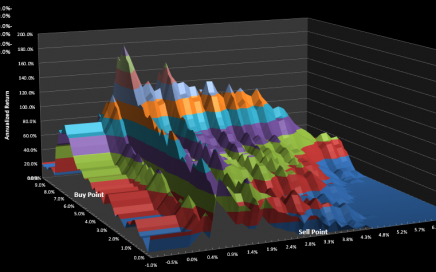

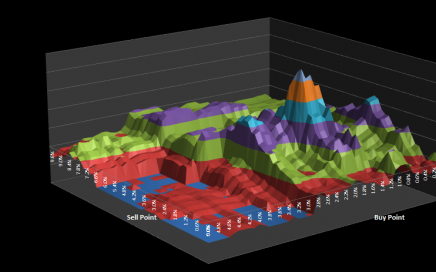

SignalSolver finds historically profitable trading methods by backtesing signals against the price movements of stocks and ETFs. As such, it can answer questions like "What percentage drop from a 52 week high was the best to buy at?", or "That 6% gap overnight, has that been a good buy point in the past?". However, even when you answer such questions, it doesn't mean that the signals will continue to profit moving forward. That's because market trends change and SignalSolver can't predict the future. Below are a selection of trading systems found by SignalSolver which gave interesting results. We track many of them to see how they did. Some did quite well, but there's a few failures in there too! Please be aware we publish them for illustrative purposes only and are not suggesting they are good investment strategies.

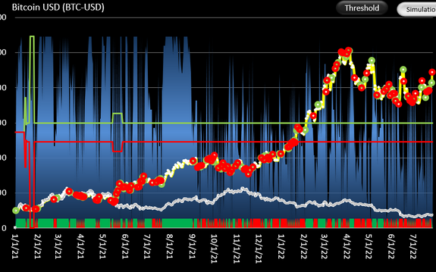

Bitcoin trading strategy using SignalSolver Sentiment

Bitcoin Trading Strategy using SignalSolver Sentiment This trading strategy for Bitcoin uses SignalSolver Sentiment to generate trading signals. It is currently showing a 22% drawdown, but it has been a good performer overall. Sentiment on any given day is determined by backtesting up to that day, selecting the top algorithms and evaluating the ratio of […]

AAPL signals prove versatile

AAPL signals prove versatile Work on TQQQ, FNGU, NFLX and many others The SignalSolver Sentiment indicator is calculated by aggregating multiple algorithm sentiments. The Sentiment technical indicator has a value between 0% (completely bearish) to 100% (completely bullish). Intuitively, you would think that a 50% threshold would be the best threshold value from which […]

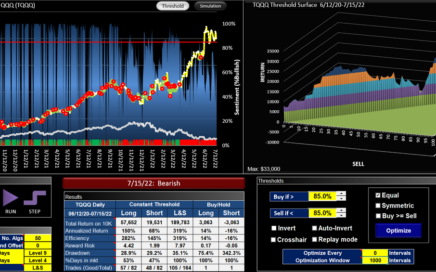

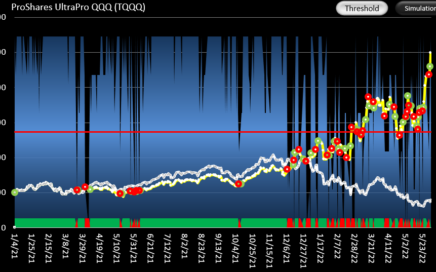

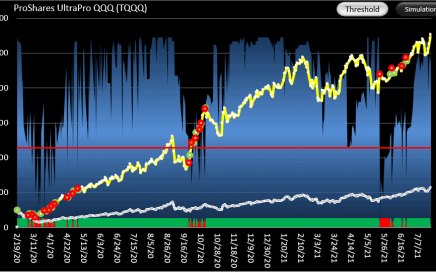

TQQQ Trading Strategy using SignalSolver Sentiment

TQQQ Trading Strategy using SignalSolver Sentiment Post Updated June 29th 2022 This trading strategy for TQQQ uses SignalSolver Sentiment to generate trading signals. We are updating the original post using improved settings. Two settings have been changed: The new post uses a Seek level of 4 instead of 2. So more algorithms are explored (although […]

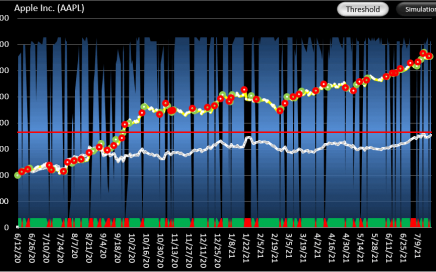

AAPL Trading using SignalSolver Sentiment

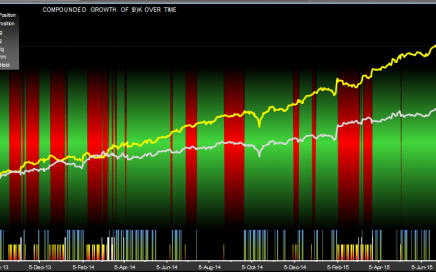

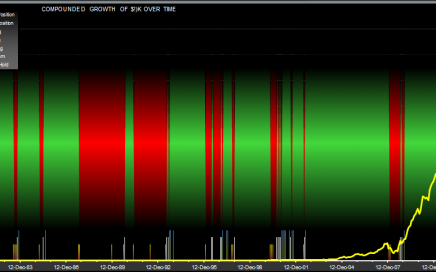

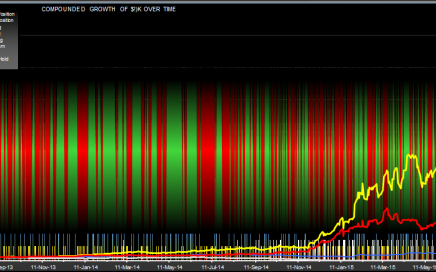

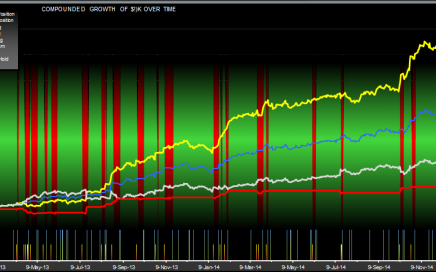

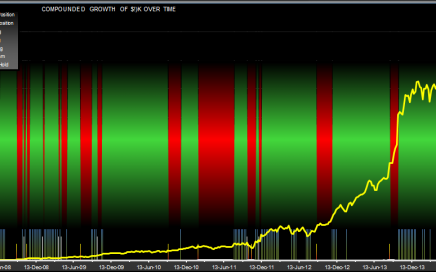

AAPL trading using SignalSolver Sentiment Using multiple algorithms to drive trading strategy Methodology Shown above is the simulated result of trading AAPL using SignalSolver Sentiment. The sentiment is shown as a blue area chart in the background. The equity curve for the strategy is shown in yellow, buy-hold equity in white. Sentiment is calculated each […]

Updates to SignalSolver Sentiment Results

Updates to SignalSolver Sentiment Results Daily updates of Sentiment for selected symbols Final Update The Feb 6th update will be the final one. While the algorithms gave encouraging initial results (annualized returns averaging around 27%), they began to reduce around Nov 2021. In the coming weeks, I will publish the results for the individual constituents […]

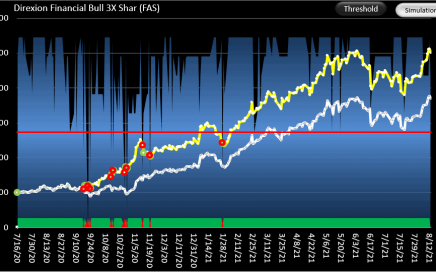

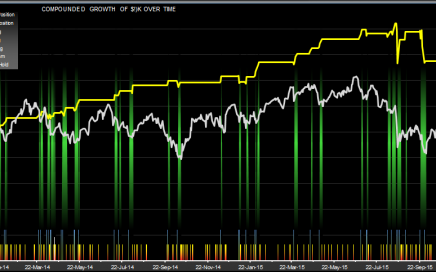

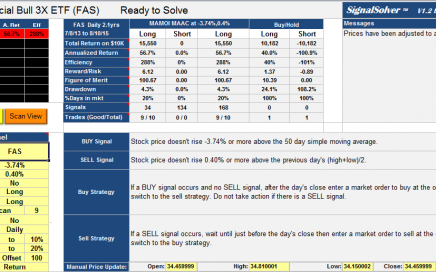

FAS trading strategy using SignalSolver Sentiment

FAS trading using SignalSolver Sentiment A sentiment driven trading strategy with adaptive thresholds Methodology Sentiment is usually based on a consensus of opinions of expert humans. In contrast, SignalSolver sentiment is the consensus opinion of multiple backtest algorithms. This is a trading strategy for the FAS financials triple leveraged ETF using SignalSolver sentiment as the […]

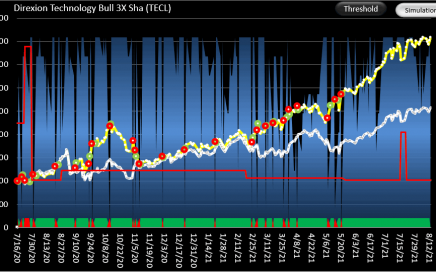

TECL Trading Strategy Using SignalSolver Sentiment

TECL trading using SignalSolver Sentiment A sentiment driven trading strategy with adaptive thresholds Methodology Sentiment is usually based on a consensus of opinions of expert humans, however SignalSolver sentiment is the consensus opinion of multiple backtest algorithms. In the same vein as the previous few posts, this is a TECL trading strategy using SignalSolver sentiment […]

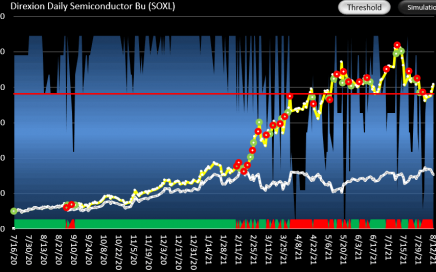

SOXL Trading Strategy using SignalSolver Sentiment

SOXL trading strategy using SignalSolver Sentiment Another Sentiment driven trading strategy Methodology In the same vein as the previous few posts, this is another SOXL trading strategy using SignalSolver sentiment, this time we use a threshold of 70%. For a full explanation of the SignalSolver sentiment methodology and how to interpret the simulation results, please […]

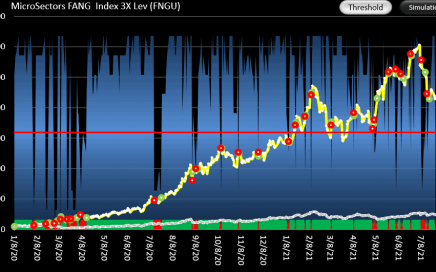

FNGU Trading using SignalSolver Sentiment

FNGU trading using SignalSolver Sentiment Using multiple algorithms to drive trading strategy Original Post July 27 2021 Sentiment Sentiment usually refers to an analyst opinion on whether a financial instrument will increase in value (bullish sentiment), or decrease (bearish sentiment). However, in this FNGU trading strategy using SignalSolver sentiment we are combining the opinion of […]

TQQQ Trading strategy using SignalSolver Sentiment

TQQQ trading using SignalSolver Sentiment Using multiple algorithms to drive trading strategy Original Post July 25 2021 Sentiment Sentiment usually refers to an analyst opinion on whether a financial instrument will increase in value (bullish sentiment), or decrease (bearish sentiment). However, in this TQQQ trading strategy using SignalSolver sentiment we are combining the opinion of […]

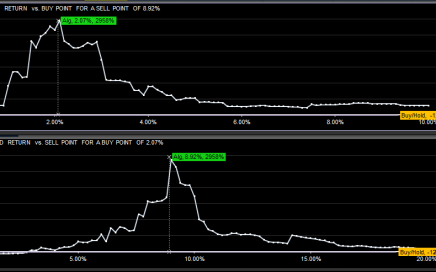

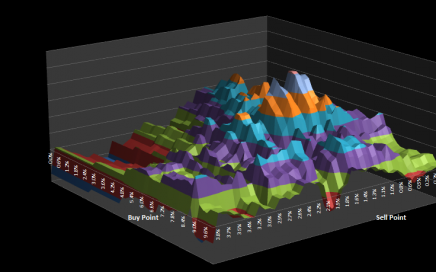

SignalSolver Sentiment Explained

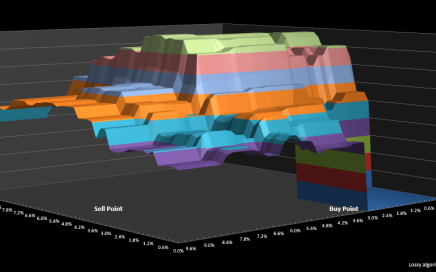

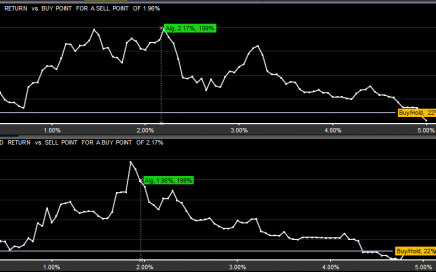

SignalSolver Sentiment Results Explained How to interpret a sentiment run We will be posting results based on SignalSolver sentiment and tracking them (paper trading them) moving forward. The purpose of this article is to explain how those results are arrived at. The postings will have two charts and a table to describe the results of […]

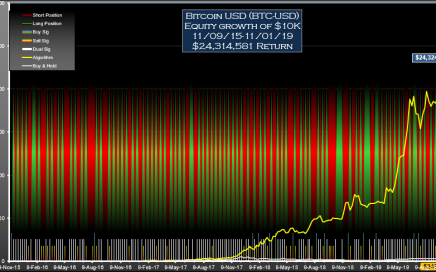

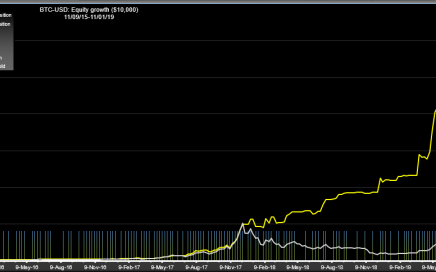

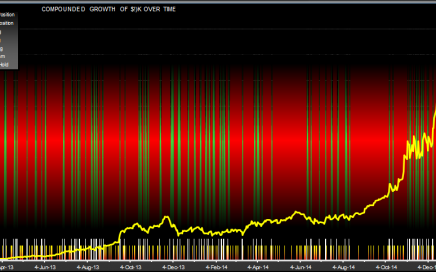

Bitcoin (BTC-USD) Signals-Weekly (ACS AAO)

Original Post Nov 2019: While shorting Bitcoin might be tricky, with this algorithm it would have paid off. Traded as directed these signals would have performed around 103.1 times better than buy-hold for the period 09-Nov-15 to 01-Nov-19. The trading signals for Bitcoin USD (BTC-USD) were selected for their reward/risk, longevity and parameter sensitivity characteristics. […]

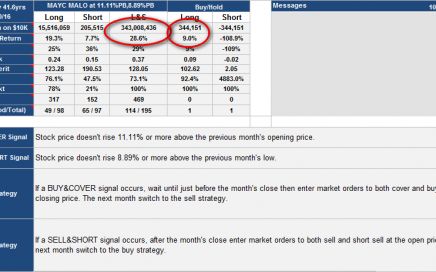

Ford (F) Monthly Trading Strategy

Thought I’d look at how this algorithm has done since publication in 2016. Annualized return was 12.4% compared with buy-hold annualized return of 3.9%. You would probably have re-parameterized or seeked for a new algorithm over that timeframe, but its nice to know the original did OK. This algorithm continues to perform well, outperforming buy-hold […]

GASX Daily (ACS BCS)

These Direxion Daily Natural Gas Related Bear 3X Shares (GASX) signals traded as directed would have provided returns around 172.0 times better than buy-hold for the period 06-Dec-17 to 06-Dec-19. I was able to optimize this algorithm for around $4m return, but I backed off the optimization a bit to account for lifetime and drawdown […]

GASX Daily (ACS BOS OO)

Trades since first publication. Note that some days there was 2 signals and 2 trades, but because we use daily OHLC prices the backtester can’t tell if the buy or sell signal came first. In this case we average the profits from the buy-sell and short-cover transactions. These transactions show up as S/Sh and C/B […]

ROKU Signals Daily (MBCYI MBHOI)

Its not often that I run into algorithms with a Reward/Risk in excess of 28, but here’s one. Its kind of obscure, but it shows what SignalSolver is capable of digging up. These Roku, Inc. (ROKU) signals traded as directed would have performed around 18.5 times better than buy-hold with an ROI of 13223% for […]

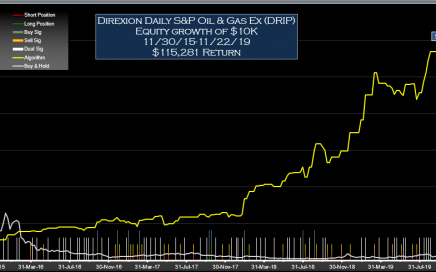

DRIP Signals Weekly (BYS BHS OO)

These Direxion Daily S&P Oil & Gas Ex (DRIP) signals would have performed around 15.8 times better than shorting the stock (buy-hold had negative returns over the period) with an ROI of 1153% for the period 30-Nov-15 to 22-Nov-19 The trading signals for Direxion Daily S&P Oil & Gas Ex (DRIP) were selected for their […]

Bitcoin Signals (BTC-USD ACS AAC OO Weekly)

This simple strategy requires no shorting and that positions are closed at the weekly open (which is midnight GMT on Sunday). Traded as directed, the Bitcoin signals would have performed around 15.5 times better than buy-hold for the period 09-Nov-15 to 01-Nov-19. Note that it uses the same buy signal as this other strategy. The […]

GUSH Signals Weekly (BCS BOS OO)

These Direxion Daily S&P Oil & Gas Ex (GUSH) signals traded as directed would have performed around 27.7 times better than short-hold with an ROI of 2639% for the period 02-Nov-15 to 25-Oct-19 The trading signals for Direxion Daily S&P Oil & Gas Ex (GUSH) were selected for their reward/risk, longevity and parameter sensitivity characteristics. […]

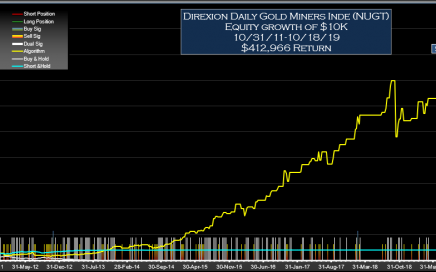

NUGT Signals Weekly (BYS BAS OO)

These Direxion Daily Gold Miners Inde (NUGT) signals traded as directed would have performed only around 0.7 times as well as buy-hold with an ROI of 56% for the period 22-Oct-18 to 18-Oct-19. However the reward/risk was twice as good as buy-hold because drawdown was only 8% compared with 34% for buy-hold. Furthermore the capital […]

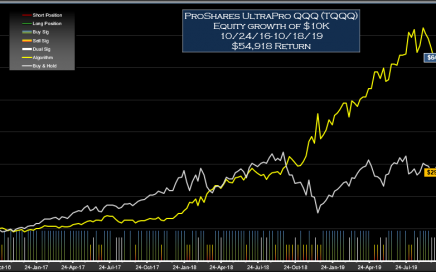

TQQQ Signals Weekly (ASS BAS OO)

We tracked this algorithm from Oct 2019 through to Dec 2021. The optimum time to exit the algorithm would have been in April 2020 when the equity was about 3 times the underlying stock. But algorithms don’t typically perform forever. We keep the original posts as an illustration of the value of SignalSolver in finding […]

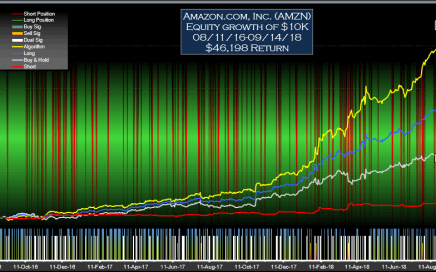

Amazon (AMZN) Signals-Daily

These Amazon.com, Inc. (AMZN) signals traded as directed would have performed around 3.6 times better than buy-hold with an ROI of 391% for the period 02-Nov-16 to 07-Dec-18. This is a symmetrical algorithm with no buy or sell bias. “The trading signals for Amazon.com, Inc. (AMZN) were selected for their reward/risk, longevity and parameter sensitivity […]

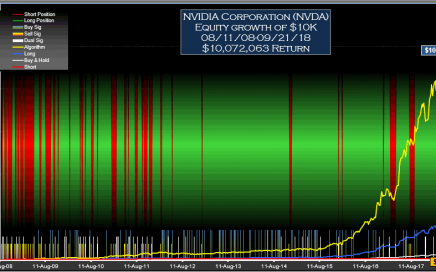

NVIDIA (NVDA) Signals-Weekly

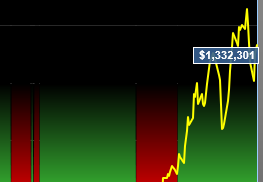

The NVIDIA (NVDA) signals presented here would have performed around 41.0 times better than buy-hold with an ROI of 100,721% for the period 11-Aug-08 to 21-Sep-18 The trading signals for NVIDIA (NVDA) were selected for their reward/risk, longevity and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be counted on moving forward […]

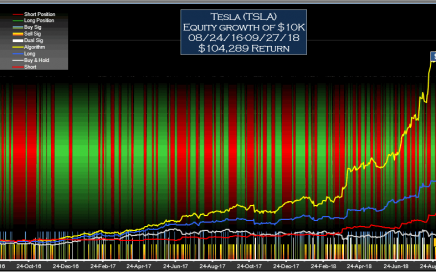

Tesla (TSLA) Signals-Daily

These Tesla (TSLA) signals would have performed around 29 times better than buy-hold with an ROI of 1,043% for the period 24-Aug-16 to 27-Sep-18 The trading signals for Tesla (TSLA) were for their reward/risk, longevity and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be counted on moving forward but many traders […]

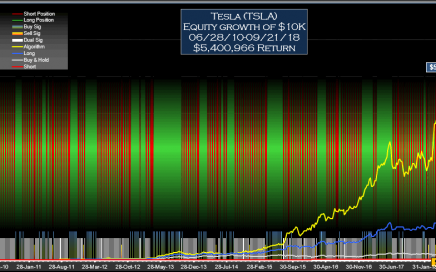

Tesla (TSLA) Signals-Weekly

These Tesla (TSLA) signals would have performed around 36.7 times better than buy-hold with an ROI of 54,010% for the period 28-Jun-10 to 21-Sep-18 The trading signals for Tesla (TSLA) were selected for their reward/risk, longevity and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be counted on moving forward but many […]

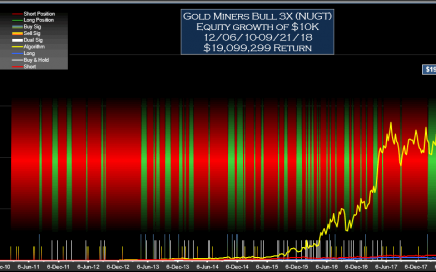

Gold Miners Bull 3X (NUGT) Signals-Weekly

These Gold Miners Bull 3X (NUGT) signals traded as directed would have performed around 1913.6 times better than short-hold with an ROI of 190,993% for the period 06-Dec-10 to 21-Sep-18 The trading signals for Gold Miners Bull 3X (NUGT) were selected for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which […]

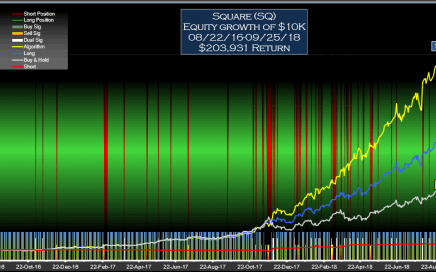

Square (SQ) Signals-Daily

These Square (SQ) signals traded as directed would have performed around 2.9 times better than buy-hold with an ROI of 2039% for the period 22-Aug-16 to 25-Sep-18 The trading signals for Square (SQ) were selected for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be counted on moving forward […]

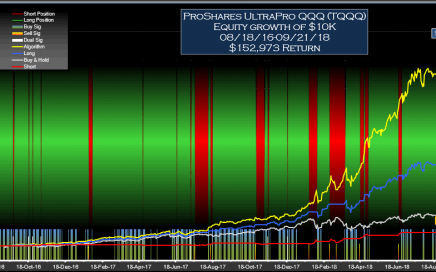

TQQQ Signals-Daily

These TQQQ signals would have performed around 6.6 times better than buy-hold with an ROI of 1530% for the period 18-Aug-16 to 21-Sep-18 The trading signals for TQQQ were selected for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be counted on moving forward but many traders find value […]

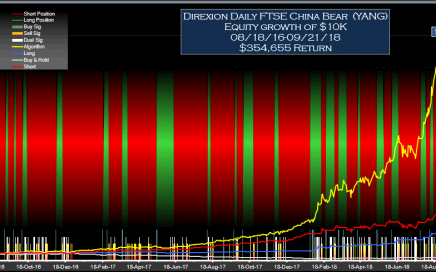

YANG Signals-Daily

These YANG signals traded as directed would have performed around 56.3 times better than short-hold with an ROI of 3,547% for the period 18-Aug-16 to 21-Sep-18 The trading signals for YANG were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be […]

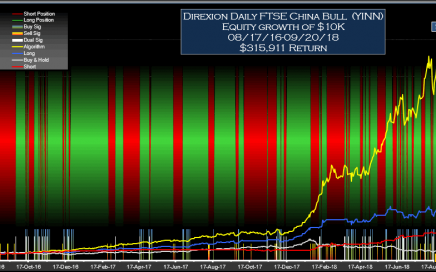

Direxion Daily FTSE China Bull (YINN) Signals-Daily

The Direxion Daily FTSE China Bull (YINN) signals shown below and traded as directed would have performed around 88.5 times better than buy-hold with an ROI of 3,159% for the period 17-Aug-16 to 20-Sep-18 The trading signals for Direxion Daily FTSE China Bull (YINN) were selected for their reward/risk and parameter sensitivity characteristics. Backtests don’t […]

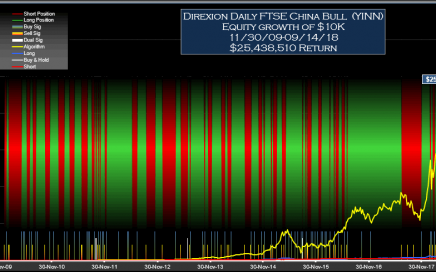

YINN Signals-Weekly

These Direxion Daily FTSE China Bull (YINN) signals (weekly) traded as directed would have performed around 5604 times better than short-hold with an ROI of 254,385% for the period 30-Nov-2009 to 14-Sep-2018 The Direxion Daily FTSE China Bull (YINN) signals (weekly) shown above were selected for their reward/risk and parameter sensitivity characteristics. Backtests don’t always […]

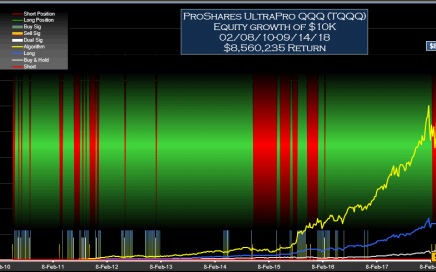

TQQQ Signals-Weekly

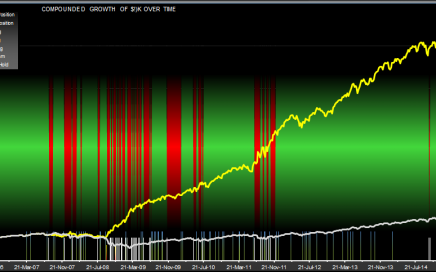

These TQQQ signals (weekly) traded as directed would have performed around 20.8 times better than buy-hold with an ROI of 85,602% for the period 08-Feb-10 to 14-Sep-18 TQQQ signals (weekly) shown above were chosen for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be counted on moving forward but […]

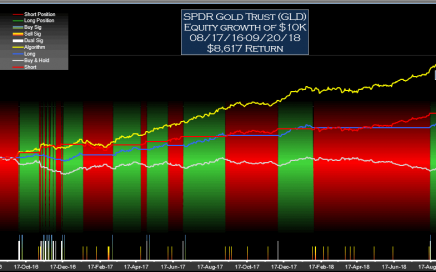

SPDR Gold Trust (GLD) Signals-Daily

These SPDR Gold Trust (GLD) signals traded as directed would have performed around 7.9 times better than short-hold with an ROI of 86% for the period 17-Aug-16 to 20-Sep-18 The SPDR Gold Trust (GLD) signals shown above were selected for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be […]

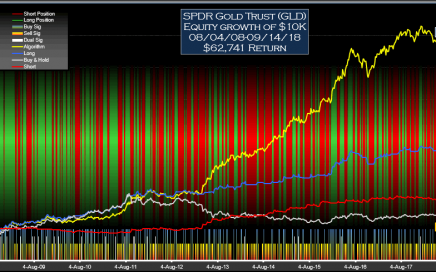

SPDR Gold Trust (GLD) Signals-Weekly

These SPDR Gold Trust (GLD) signals traded as directed would have performed around 22.8 times better than buy-hold with an ROI of 627% for the period 04-Aug-08 to 14-Sep-18 The trading signals for SPDR Gold Trust (GLD) were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always […]

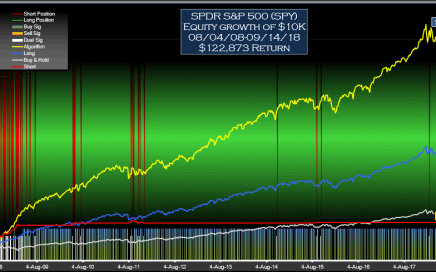

SPDR S&P 500 (SPY) Signals-Weekly

These SPDR S&P 500 (SPY) signals (weekly) traded as directed would have performed around 6.7 times better than buy-hold with an ROI of 1,229% for the period 04-Aug-08 to 14-Sep-18 The featured trading signals for SPDR S&P 500 (SPY) were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests […]

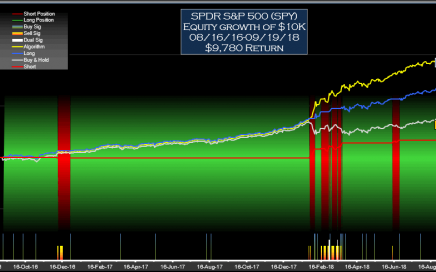

SPDR S&P 500 (SPY) Signals-Daily

These SPDR S&P 500 (SPY) signals traded as directed would have performed around 2.5 times better than buy-hold with an ROI of 98% for the period 16-Aug-16 to 19-Sep-18 The SPDR S&P 500 (SPY) signals were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable […]

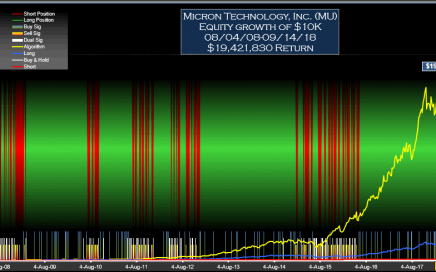

Micron (MU) Signals-Weekly

These Micron (MU) signals traded as directed would have performed around 233 times better than buy-hold with an ROI of 194,218% for the period 04-Aug-08 to 14-Sep-18 The trading signals for Micron (MU) shown here were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable […]

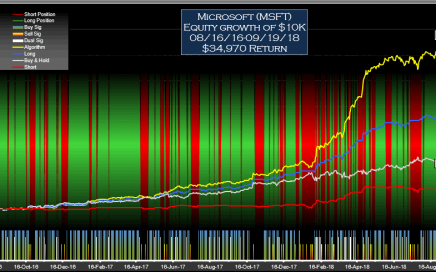

Microsoft (MSFT) Signals-Daily

These Microsoft (MSFT) signals traded as directed would have performed around 3.4 times better than buy-hold with an ROI of 350% for the period 16-Aug-16 to 19-Sep-18 The above trading signals for Microsoft (MSFT) were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals […]

Micron (MU) Signals-Daily

These Micron (MU) signals traded as directed would have performed around 7.3 times better than buy-hold with an ROI of 1379% for the period 16-Aug-16 to 19-Sep-18 The Micron (MU) signals were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can be […]

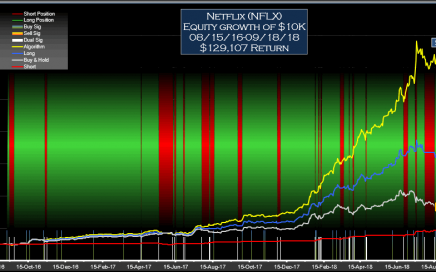

Netflix (NFLX) Signals-Daily

These Netflix (NFLX) signals traded as directed would have performed around 4.6 times better than buy-hold with an ROI of 1291% for the period 15-Aug-16 to 18-Sep-18 These trading signals for NFLX were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can […]

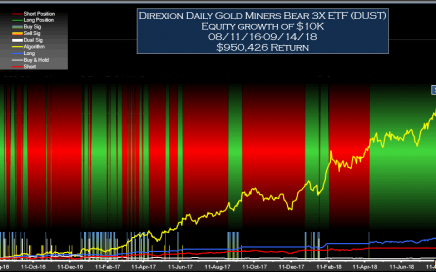

Direxion Daily Gold Miners Bear 3X ETF (DUST) Signals-Daily

These Direxion Daily Gold Miners Bear 3X ETF (DUST) signals traded as directed would have performed around 117.8 times better than buy-hold with an ROI of 9504% for the period 11-Aug-16 to 14-Sep-18 These trading signals for DUST were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t […]

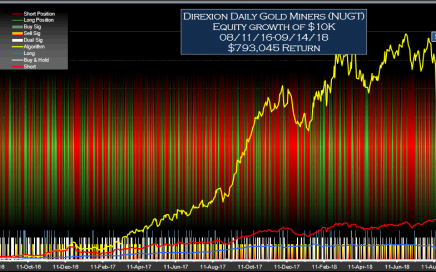

Direxion Daily Gold Miners (NUGT) Signals-Daily

These Direxion Daily Gold Miners (NUGT) signals traded as directed would have performed around 86.8 times better than short-hold with an ROI of 7930% for the period 11-Aug-16 to 14-Sep-18. These trading signals for NUGT were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable […]

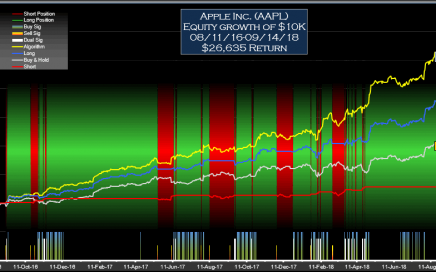

Apple (AAPL) Signals-Daily

These Apple (AAPL) signals traded as directed would have performed around 2.4 times better than buy-hold with an ROI of 266% for the period 11-Aug-16 to 14-Sep-18 These trading signals for AAPL were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. Backtests don’t always generate reliable signals which can […]

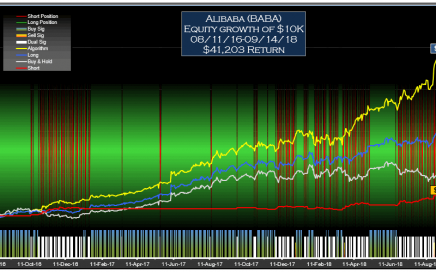

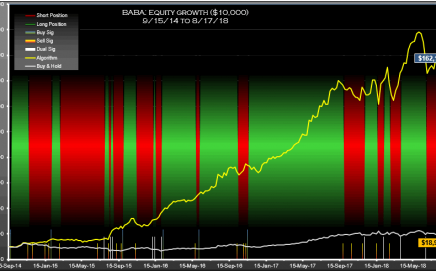

Alibaba (BABA) Signals – Daily

From 11-Aug-16 to 14-Sep-18, these trading signals for Alibaba (BABA) used as directed would have performed around 5.2 times better than buy-hold. These trading signals for BABA were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics.While backtests don’t always provide reliable signals which can be counted on moving forward, […]

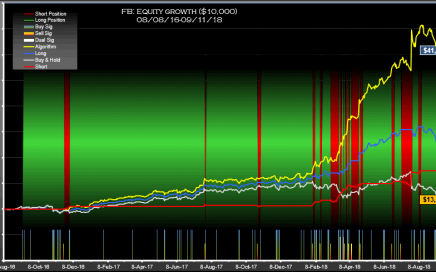

Facebook (FB) Signals – Daily

From 09-Aug-16 to 12-Sep-18, these trading signals for Facebook (FB) used as directed would have performed around 10.6 times better than buy-hold. These trading signals for FB were selected from over a million backtest results for their reward/risk and parameter sensitivity characteristics. While backtests don’t always provide reliable signals which can be counted on moving […]

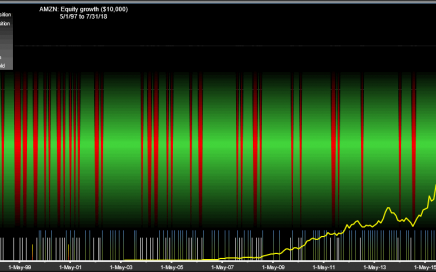

AMZN (Amazon) Signals – Monthly

From Jul 2008 to Aug 2018, these trading signals for Amazon (AMZN) used as directed would have performed around 744 times better than buy-hold. For the 255 month (21.2 year) period from May 1 1997 to Jul 31 2018, these signals for Amazon.com, Inc. (AMZN) traded long and short would have yielded $5,434,919,985 in profits […]

BABA (Alibaba) Signals – Weekly

From Jul 2008 to Aug 2018, these trading signals for Alibaba (BABA) used as directed would have performed around 14 times better than buy-hold. These trading signals for BABA were selected from 1,173,290 backtest results for their reward/risk and parameter sensitivity characteristics.While backtests don’t always provide reliable signals which can be counted on moving forward, […]

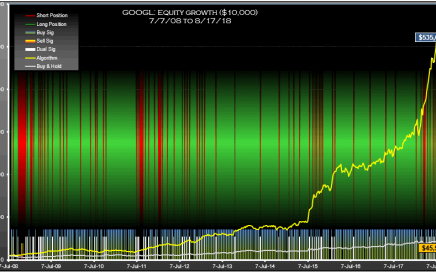

GOOGL (Alphabet Inc.) Signals – Weekly

These Alphabet Inc. GOOGL signals were selected from 1,240,000 backtest results for their reward/risk and parameter sensitivity characteristics. While backtests don’t typically provide reliable signals which can always be counted on moving forward, many swing traders find value in knowing what buy and sell signals would have worked over time. For the 528 week (10.1 […]

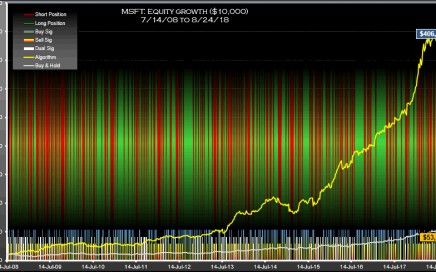

MSFT (Microsoft) Signals – Weekly

These trading signals for MSFT were selected from 1,220,000 backtest results for their reward/risk and parameter sensitivity characteristics. While backtests don’t typically provide reliable signals which can always be counted on moving forward, many swing traders find value in knowing what buy and sell signals would have worked over time. For the 528 week (10.1 […]

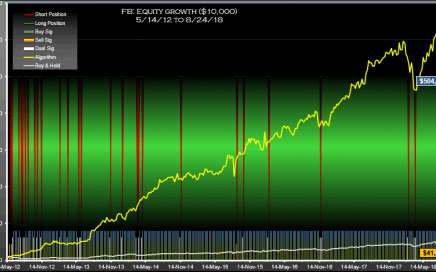

FB (Facebook) Signals – Weekly

These trading signals for FB were selected from 1,210,488 backtest results for their reward/risk and parameter sensitivity characteristics. While backtests don’t typically provide reliable signals which can be counted on moving forward, many swing traders are curious as to what buy and sell signals would have worked up until now. For the 327 week (6.2 […]

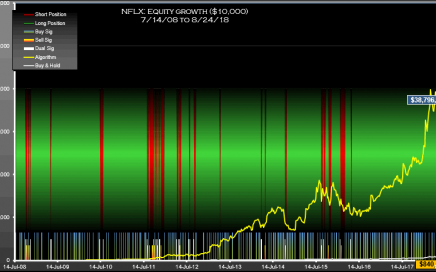

NFLX (Netflix) Signals Weekly

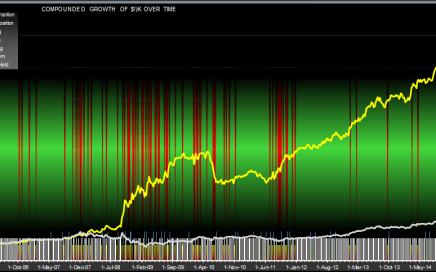

For the 528 week (10.1 year) period from Jul 7 2008 to Aug 17 2018, these signals for Netflix, Inc. (NFLX) traded long and short would have yielded $38,786,358 in profits from a $10,000 initial investment, an annualized return of 126.6%. The long-side profit (buy/sell only, no shorts) for the signals was $7,434,281, an annualized […]

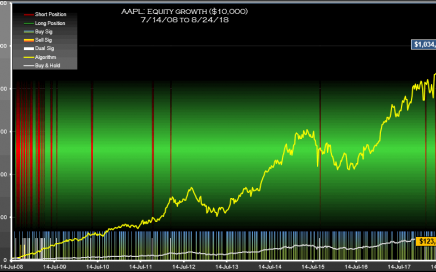

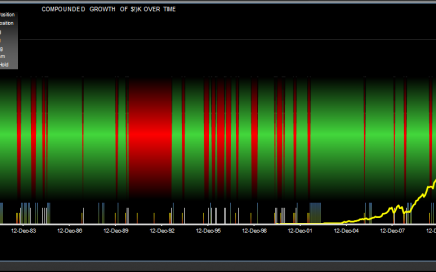

AAPL (Apple) Signals – Weekly

For the 528 week (10.1 year) period from Jul 7 2008 to Aug 17 2018, these signals for Apple Inc. (AAPL) traded long and short would have yielded $1,024,775 in profits from a $10,000 initial investment, an annualized return of 58.3%. The long-side profit (buy/sell only, no shorts) for the signals was $414,729, an annualized […]

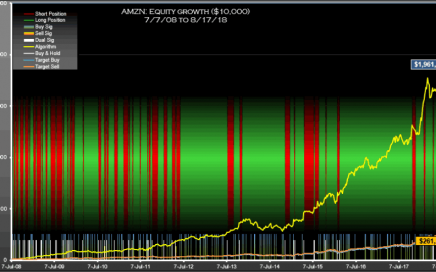

AMZN (Amazon) Signals – Weekly

For the 528 week (10.1 year) period from Jul 7 2008 to Aug 17 2018, these trading signals for Amazon.com, Inc. (AMZN) would have yielded $1,951,107 in profits from a $10,000 initial investment, an annualized return of 68.6%. If you had bought and held the stock for the same period the profit would have been […]

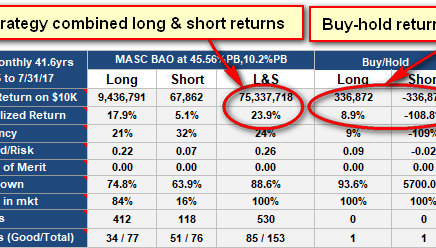

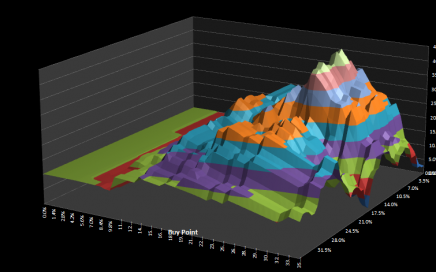

The MASC BAO Trading Strategy

The MASC BAO trading strategy frequently shows up in the top ten backtests. It has the distinction of being the strategy used in the most profitable backtest SignalSolver has ever found–AAPL Monthly MASC BAO which would have generated over $400 Billion from $10,000 invested. Here we look for MASC BAO strategies which beat Buy/Hold for […]

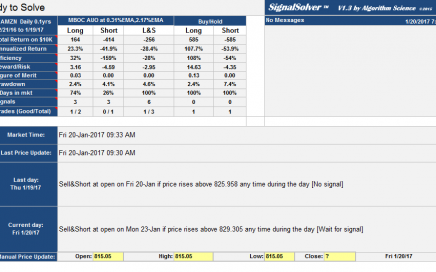

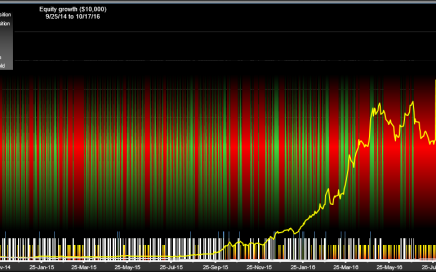

AMZN top 4 algorithms day by day

The out of sample multi-algorithm approach was quite successful for AMZN (see results) so lets do it live and see how it ends up. On Dec 21st, I did the optimization using the EMA band and Figure of merit optimization I have been talking about in the last few posts. For the next 25 trading […]

AAPL $31,000,000 Algorithm

This AAPL trading strategy would have given a return of $31,712,009 for every dollar invested in December 1980. That’s 123,000 times better than buy-hold, with nearly four times the annualized return (61.4% vs 16.7% for buy-hold) and roughly half the drawdown which amounts to over six times better reward/risk than buy-hold. This is a variation […]

Multi-algorithm study results for NUGT DUST and X

In the interests of scientific method, I’d like to continue the multi-algorithm study by discussing the worst results, those for X (United States Steel Corp. ), NUGT(Direxion Daily Gold Miners Bull 3X ETF) and DUST(Direxion Daily Gold Miners Bear 3X ETF). There was plenty of potential for disaster in these stocks, very large swings indeed. […]

Multi-algorithm results for UWTI

Oil had a rocky year, lets look at how our multi-algorithm approach worked on an oil related stock, UWTI (VelocityShares 3x Long Crude Oil ETN). In this post, I’m just going to summarize the results:Briefly, the method used is to run SignalSolver to find trading systems which worked for a 250 day period, then run […]

Multi-algorithm analysis for FB (Facebook)

Today, I’ll just throw out some more results from the multi-algorithmic testing I’ve been doing with SignalSolver. This time for Facebook (symbol FB). This is a stock which moved a lot in the time-frames used in the study. Could SignalSolver correctly predict and capitalize on these price movements? Let’s see… As described in the methodology […]

Multi-algorithm tests for AMZN

Today I will be looking at some very interesting results of multi-algorithm testing on the stock AMZN (Amazon). The idea here is to use SignalSolver to find multiple trading systems which performed well in the past, then run those systems simultaneously on out-of-sample forward data to see what would have happened had you followed them […]

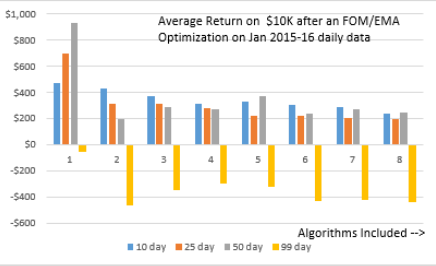

Preliminary results of multi-algorithm testing

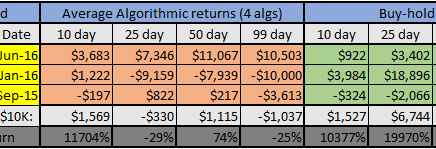

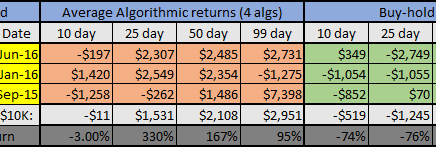

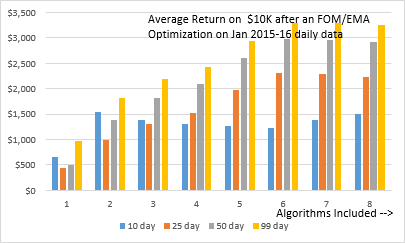

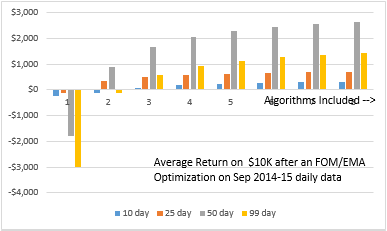

The portfolio and methodology for this multi algorithm study are described in my previous post. Here are links to the results spreadsheets:EMA/Figure of merit optimization periods: Sept 2014-15 Jan 2014-15 June 2015-16PB/Return optimization period: Jun 2015-16On these spreadsheets you can use the autofilter to include and exclude stocks of interest. For any stock you can […]

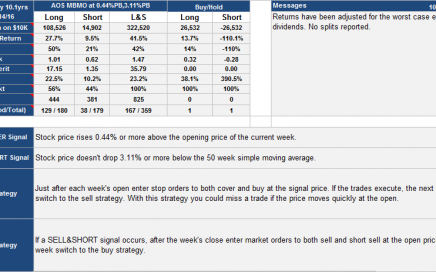

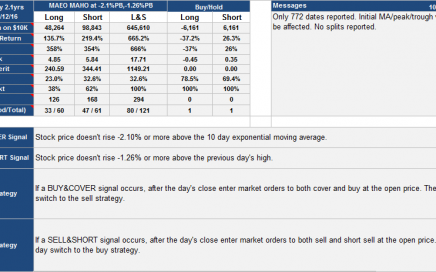

Multi-algorithm trading strategy testing- Portfolio and Methodology

“Two heads are better than one”, the saying goes. But can averaging improve trading systems? Can a multi-algorithm technique improve profitability and lower risk? After compiling the “Summary of Strategy Performance”, I was very curious to quantify if and for how long strategies such as those published here were profitable for. To do that, I […]

Summary of Strategy Performance Oct 2016

This update covers 26 strategies published 2/10/15 through 9/18/15. For the analysis we measure the results of investing $10K in each strategy on the day of publication. 17 of the strategies made a loss over the entire period, however 5 of these were strategies that broke down after showing a profit. Overall Results vs HoldTotal […]

IBB Trading System (Weekly)

This weekly trading strategy for IBB had 3 times better annualized returns than IBB and more than 10 times better return over the 10.1 years. For each 2.5 year period within the 10 years, the annualized return was between 30 and 50%.

KERX Trading System

This is a trading system for Keryx Biopharmaceuticals Inc. (KERX). It requires daily intervention, trading at the open of business. KERX Trading System: Trades Spreadsheet

FEYE Trading System

A trading system which worked for FEYE (FireEye). This is based on daily data, so traded at most once per day. FEYE Trading System: Trades List As always, future performance is not guaranteed.

TSLA Daily Trading System

Not many trades, but performed well. TSLA Daily Trading System List of Trades Spreadsheet

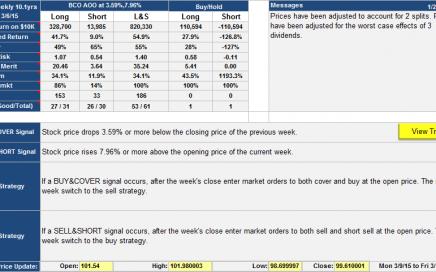

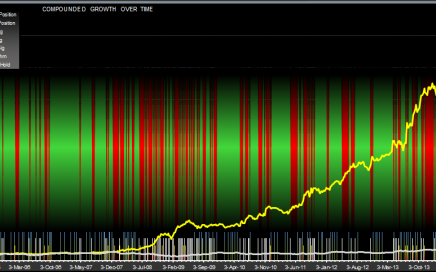

AMZN 20,000,000% total return

In the time frame May 16th 1997 to Aug 1st 2016, this strategy gave a return of 88.9% compounded which amounts to over $219,000 for every dollar invested, that’s 518 times better than the performance of buy-hold which only gave $423. This screenshot shows the strategy description and performance along with messages warning if something […]

Berkshire Hathaway trading strategy

This is a Berkshire Hathaway trading strategy which would have given almost ten times the return performance of buy/hold over the last 10 years with half the drawdown. The strategy is detailed in the table below, it was straightforward, with 123 trades over the 10 year backtest period. All trading was done at the weekly […]

GOOGL Trading Strategy (Weekly)

Here is a Google Inc (GOOGL) trading strategy with once a week intervention which would have performed significantly better than buy-hold over the last 10 years. Annualized return was 31.5% vs. 16.5% (returning $149K for 10K outlay vs $36.7K, compounded), drawdown was 40.2% vs. 62.4%, so reward/risk was better. The buy and cover signal (see […]

DIS Trading Strategy

Here is a Walt Disney Company (DIS) trading strategy with daily maintenance which had quite nice characteristics; 59% annualized return over the last 2 years. The performance was better than long buy-hold with lower drawdown and about three times the reward-risk. Signal reinforcement was good, and not many dual signal days. Below I show the […]

Two GLD Trading Strategies (Daily)

GLD is the much traded SPDR Gold Trust ETF. I find these two GLD trading strategies interesting because they gave reasonable results (32.6% and 48% annualized return) for each of the four 6 month periods of the analysis. The strategies require daily intervention. Strategy 1: BCS AHC This is a buy on fall, sell on […]

TSLA Trading Strategy (Daily)

This TSLA trading strategy would have given a 1062% return over 2.1 years vs. a buy-hold return of 86% for the same period. The strategy is based on buying and selling when the stock price rises above specific thresholds. The buy side keyed off the day’s open price; the buy and cover signal appeared when […]

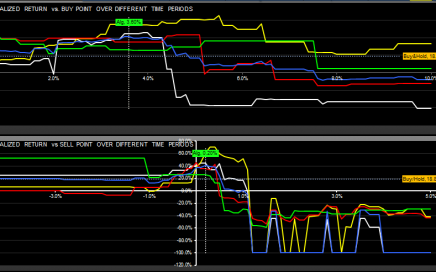

TQQQ Trading Strategy (Weekly)

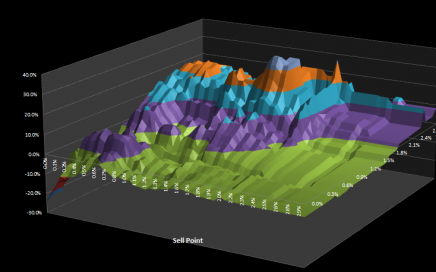

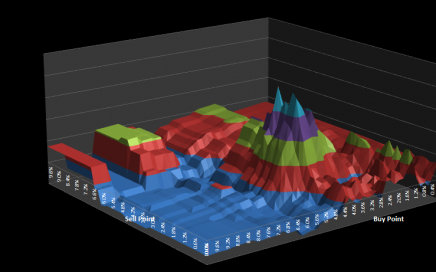

Today I present two TQQQ trading strategy backtest results with weekly setup with similar reward-risk but very different characteristics. TQQQ is the ProShares UltraPro QQQ, a triple leveraged ETF tracking the Nasdaq. The backtests were for the 288 weeks 2/11/10 through 8/14/15. The first trading strategy was found by optimizing the scanner for low drawdown, […]

OMER Trading Strategy (Daily)

Frequent reversals characterize this strategy for Omeros Corporation This OMER trading strategy is signal rich; there were 174 dual signal days out of the 528 days in the analysis. Added to that 151 buy signal only days and 39 sell signal only days and you get 364 signal days, of which 250 were actionable signals […]

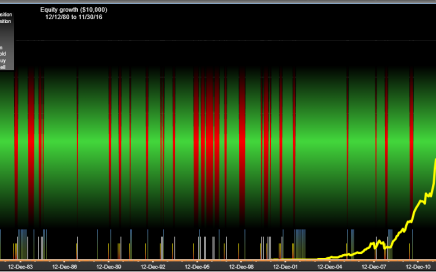

AAPL Trading Strategy (2)

This is an interesting AAPL trading strategy for the period 12/12/80 through 7/31/15, which would have generated $8,521,705,763 in profits from $10,000 initial investment. Buy and hold would have generated $2,744,894 in profit in the same period. The cover and buy signals were generated when the stock price dropped 37.77% below the 20 month exponential […]

UWTI Trading Strategy (daily)

This UWTI trading strategy would have returned $676,147 for $10K outlay over a 2 year period. It was a very straightforward strategy with simple maintainence, once a day you would have put in either market orders to cover and buy or stop orders to sell and short before the open. This is another result discovered […]

TNA Trading Strategy (Daily)

In contrast to yesterday’s TNA trading strategy optimized for low drawdown, this one is optimized for minimum quartus annual return, a new feature of SignalSolver. A quartus is one quarter of the data, 132 days in this instance, and the minimum return was 99% annualized for the most recent quartus Feb 3 to Aug 11th […]

TNA Trading Strategy

In the same vein as yesterday’s FAS analysis, here is a low drawdown trading strategy for TNA, with daily intervention. Prasad had asked me to search for low drawdown strategies for a few of the triple leveraged ETFs, this being one of them. As with FAS, the algorithm was found by optimizing the SignalSolver backtest […]

FAS (daily)

This is one of the triple leveraged funds which Prasad had asked me to come up with a low drawdown trading strategy for, I’ll be looking at the others soon. You can set up SignalSolver to optimize for low drawdown. The way you do that is by setting up the Figure of Merit parameters to […]

DUST Daily Trading Strategy

This trading strategy is for stock symbol DUST the Direxion Daily Gold Miners Bear 3X ETF. It is the complementary stock to NUGT which I analyzed last week. Its not hard to find strategies which would have exploited the intense volatility of this kind of security, if you have access to an optimizing backtester. The […]

IBM Trading Strategy (Weekly)

This IBM trading strategy made 11x the total returns (4x the annualized return) of the underlying stock with half the drawdown. The backtest period was 10years. The strategy itself (see table below) was straightforward with both buy and sell signals triggered by falling prices. The buy signal keyed off the 52 week high while the […]

NUGT Trading Strategy (Daily)

Please note, this post was corrected 1-3-16 to account for a short-side error in the original calculations. Apologies for this.This NUGT trading strategy (Direxion Daily Gold Miners Bull 3X ETF) gave a theoretical $1.8 million profit for a $10K initial investment over 2.1 years. The trading strategy required once a day attention. Signals were triggered […]

AAPL Trading System (Monthly)

With $94 billion in profits (for $10K initial investment) this has one of the highest total returns I have seen for any algorithm.It is an interesting study, but I wouldn’t recommend it as a good system to trade moving forward. It is somewhat over-tuned, and the parameters are close to regions which would have failed. […]

GILD Trading Strategy (Weekly intervention)

This is a GILD trading strategy with weekly intervention required. I found algorithms with better returns, but they were less consistent over time and had more parameter sensitivity. I chose this one because of many favorable characteristics:-Buy low, sell high type of algorithm, biased towards buying as befitting an upward trending stock like GILD.Buy and […]

PANW Trading Strategy (Daily Intervention)

This Palo Alto Networks PANW trading strategy would have given a 119% annualized return. Here, I chose to show only the long side of the algorithm because its more impressive than the short side (which only gave 27% annualized return). To appreciate the algorithm more, notice that the efficiency of the algorithm was close to 200%. […]

GOOGL Trading Strategy (Weekly Setup)

Algorithm for GOOGL based on monthly OHLC data and requiring monthly setup.

MSFT Trading Strategy (Daily)

Here is a strategy that worked on MSFT for the last 2 years. It gave returns around five times better than buy-hold, a total return of 360% vs. 70% for buy-hold. Drawdown was 10.6% vs. 17.9% for buy-hold. Backtest results are shown in the graphs below. On Jan-5-2016 this post was corrected for a short-side […]

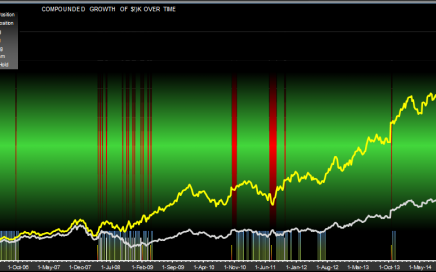

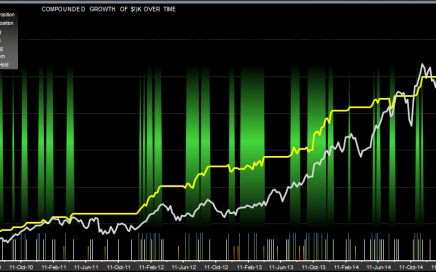

SPY Trading Strategy (Weekly)

Shows the results of backtesting a trading strategy for the stock SPY (SPDR S&P 500 ETF) over the 10 year period 1/18/05 to 2/23/15. This was a weekly strategy meaning that it needed setting up once a week, and it traded once a week or less. I chose this strategy because it gave the best […]

MU Trading Strategy (Monthly)

Please note, this post was edited Jan 6th 2016 to correct an error in the short-side calculations. The original post showed an annualized return of 57%, which was erroneous. Below are shown the corrected results for this algorithm.

MSFT Trading System (Weekly)

Update 10/19/2016 This strategy has lost around 22% since inception, the underlying stock has gained 48%.

LRN Trading Strategy (Weekly)

K12 Inc (LRN) Update 12/27/2015 The above plots have been corrected for an error in the short side calculations. Below are updated equity curves and tables up until Dec 2015. The algorithm lost 13.6% over this time. The underlying stock dropped by 37.2%. Update 10/19/2016 Since first publication in Feb 2015, this strategy has outperformed […]