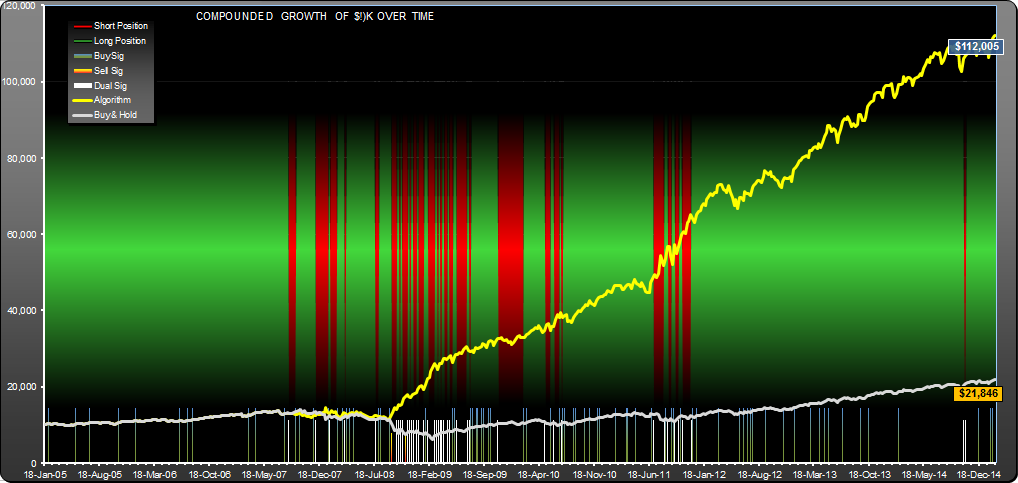

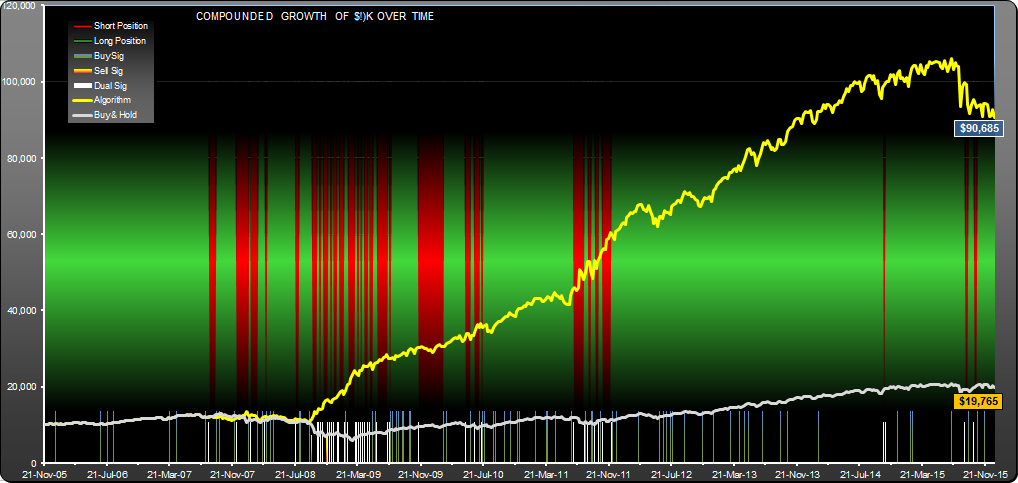

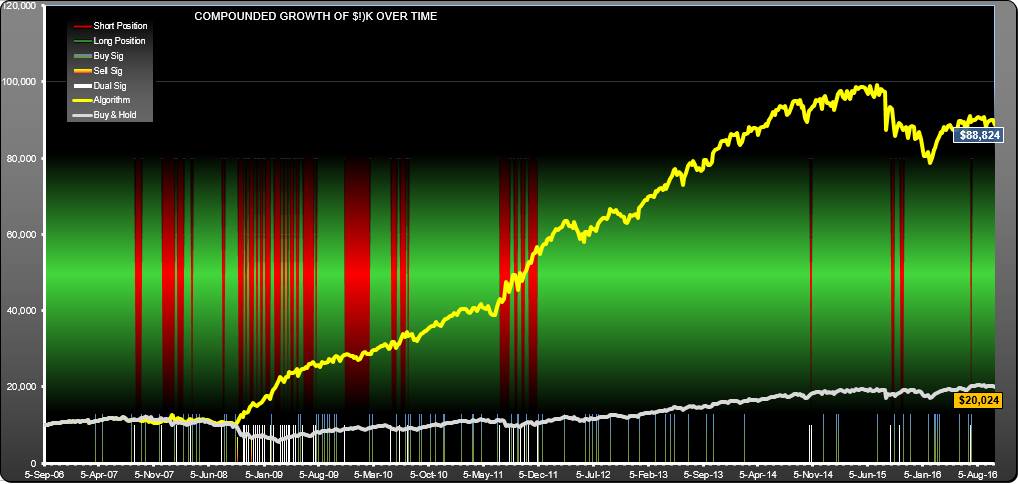

Shows the results of backtesting a trading strategy for the stock SPY (SPDR S&P 500 ETF) over the 10 year period 1/18/05 to 2/23/15. This was a weekly strategy meaning that it needed setting up once a week, and it traded once a week or less. I chose this strategy because it gave the best total return (1020% vs 120% for buy-hold), not because of its longevity characteristics which are not superlative. That said, it was reasonably well behaved, staying long in the run up to the 2009 crisis, going mostly short then essentially staying long since 2011. It also displayed a good tolerance to changes in the buy and sell points.

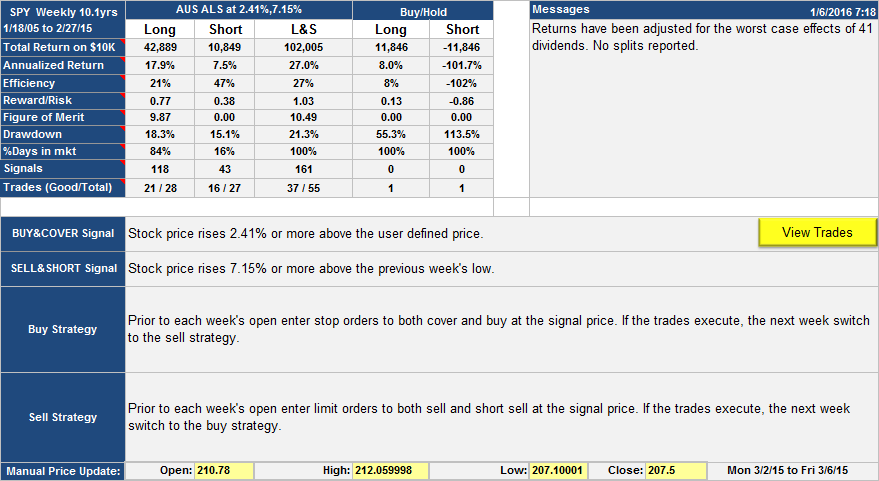

Note that this was a buy high, sell high strategy; a sell signal was (with one exception) always accompanied by a buy signal in the same week, but since each week you were following either the buy or the sell strategy, there was never two trades in a week. There were a total of 118 buy signals and 43 sell signals.

Please note, this post was edited Jan 6th 2016 to correct an error in the short-side calculations.

Trading strategy for SPY with a weekly setup. The strategy (yellow line) returned $102,005 over a 10 year period for a $10K initial investment. Buy and hold returned $11,846. Trading signals were reinforcing--note that every week with a sell signal also had a buy signal.

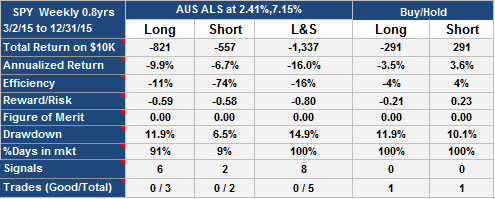

SPY Weekly, tabular view of the backtest. Trading strategy gave 27% annualized return vs. 8% for buy-hold. Reward/risk was around 7x better for the strategy. Note that the "user defined" referred to in the buy signal is the average of the current weeks open price, the previous week's high and the previous week's low. Also of note, drawdown was only 21.3% (Sept '08) vs. 55.3% for buy-hold (March '09).

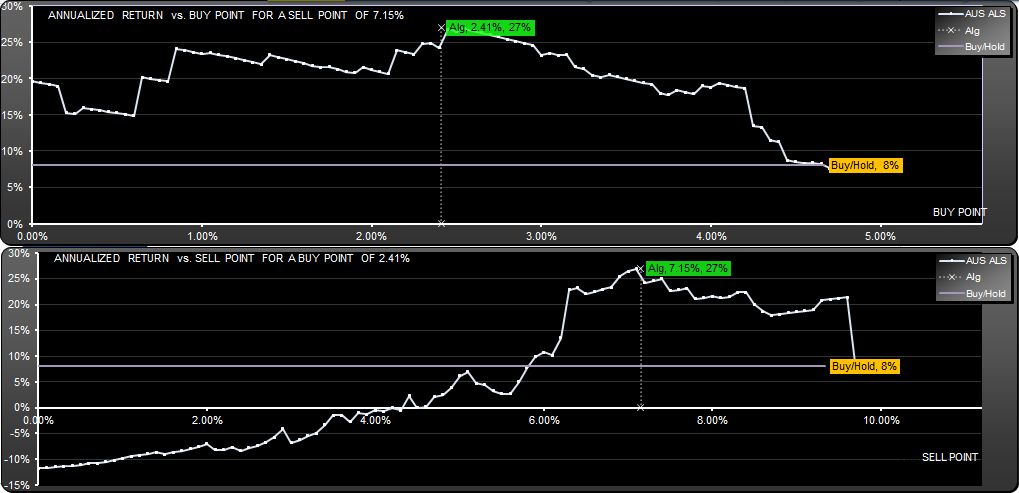

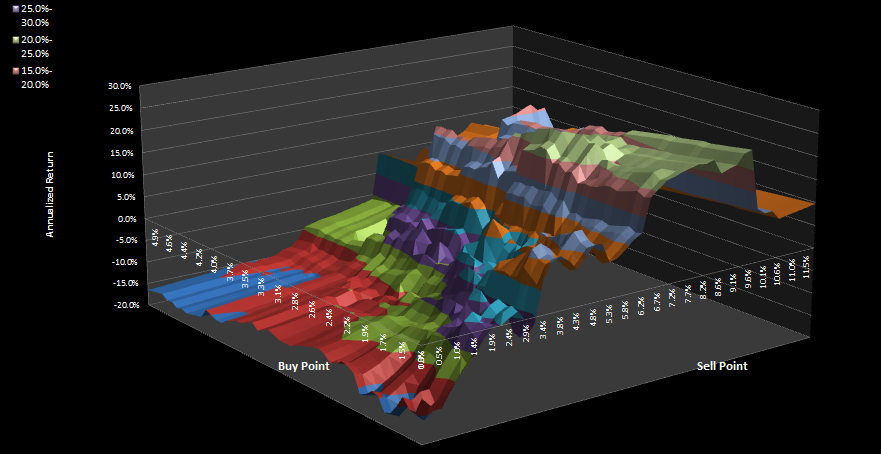

Charts show how annualized return varies with buy/sell point (for a fixed sell/buy point). For a sell point of 7.15% all buy points 0-6.5% were profitable. For a buy point of 2.41%, all sell points in the range 4.1%-9.6% were profitable.

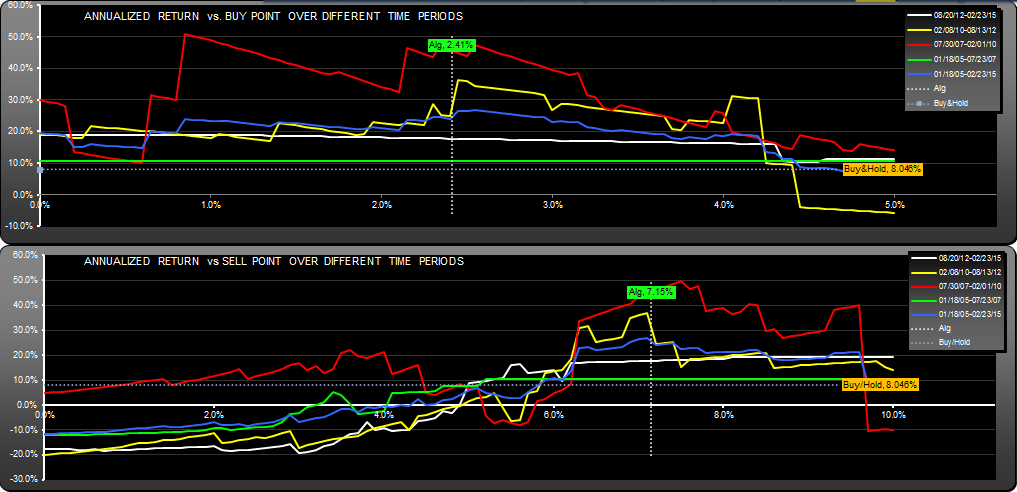

This chart shows return of the algorithm for different time periods, and how they change with buy and sell point. The green line (1/05 to 7/07) shows little improvement over buy-hold. The white line (8/12 to present) is distinctly lower showing a tailing off in performance in recent times. In fact, the algorithm has sub-performed buy-hold for the last 3 years, by a small margin. You can see from the time chart that the algorithm has stayed mostly long for 3 years. Some may like this behavior; an algorithm that stays largely out of the way in the good times. Others may argue that the algorithm fails to exploit recent price fluctuations.

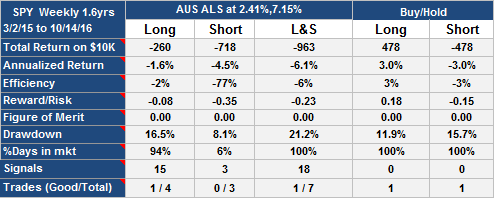

Update 5/26/2015:

Since publication 2/26/2015, the strategy has stayed long with no trades, gaining 1.42%(6.1% annualized)

Andrew

Hi Andrew,

I recently came across your website and it is very informative. I am especially interested in the SPY Weekly system as I currently trade a monthly system.

One question: when Shorting SPY, is the only rule to Short when SPY rises 7.15% or more above the previous week’s low? Or are there any other Short rules – e.g. Short when SPY falls X% below the previous week’s high?

Thanks,

Malcolm

Hi Malcolm

No, the only rule is to sell and short when SPY rises 7.15% or more above the previous week’s low.

The last buy I show is the week of 27th Oct 2014. Since then there has been no sell/short, and the gains have been flat since publication last Feb.

Andrew

Thank you, Andrew.

Update 8/28/15:

The strategy has been long since publication on 2/23. SPY has lost around 5% in that time.