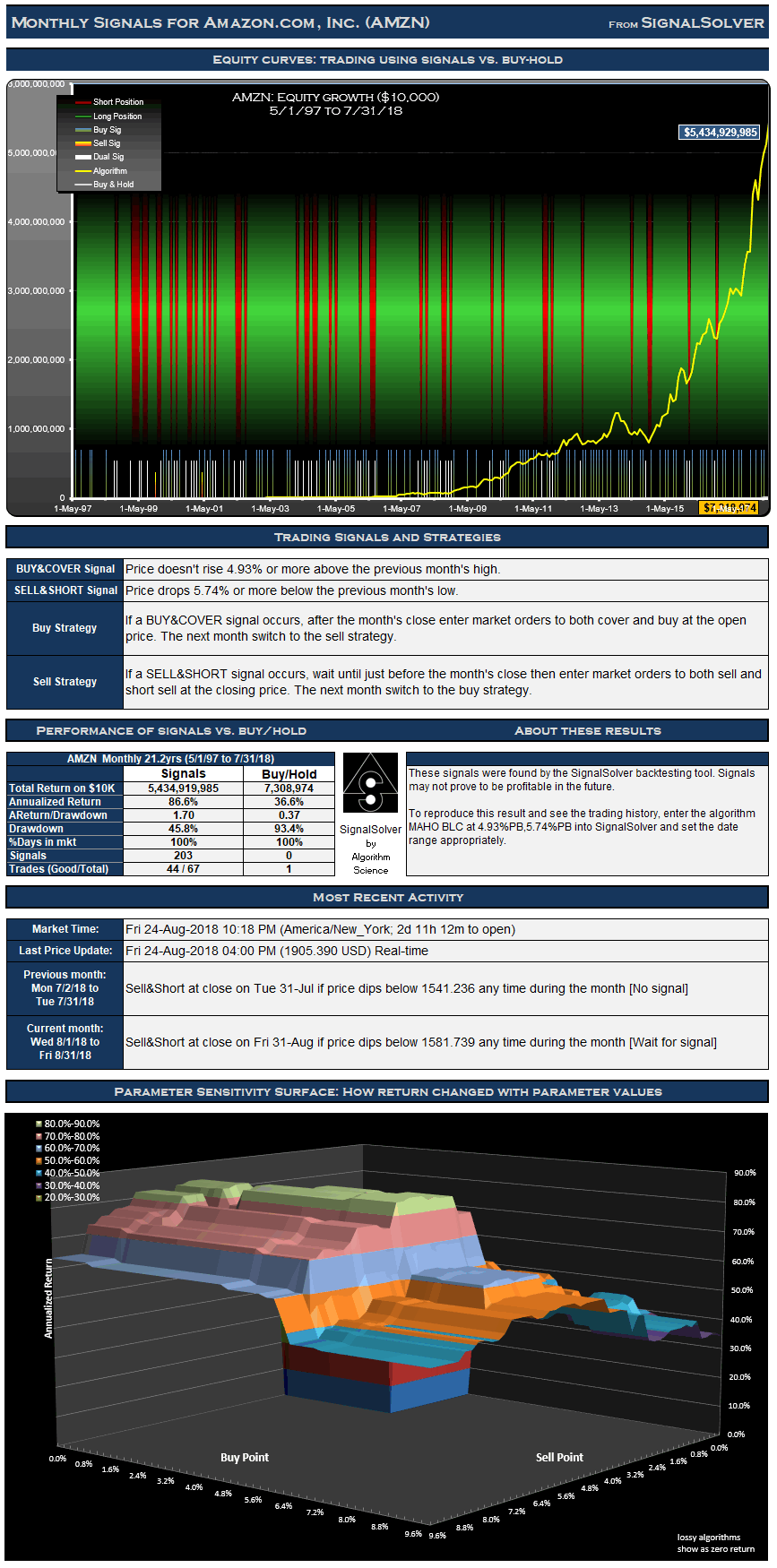

From Jul 2008 to Aug 2018, these trading signals for Amazon (AMZN) used as directed would have performed around 744 times better than buy-hold.

For the 255 month (21.2 year) period from May 1 1997 to Jul 31 2018, these signals for Amazon.com, Inc. (AMZN) traded long and short would have yielded $5,434,919,985 in profits from a $10,000 initial investment, an annualized return of 86.6%. The long-side profit (buy/sell only, no shorts) for the signals was $462,171,488, an annualized return of 66.1%. If you had bought and held the stock for the same period the profit would have been $7,308,974 (an annualized return of 36.6%). The trading style was Long & Short, meaning that you would be long or short the security at all times.

For this type of strategy, not every signal is acted upon and signals are often reinforced. If you are long in the security, buy signals can be ignored, for example. Similarly if you are short you can ignore sell signals. For this particular AMZN strategy there were 150 buy signals and 53 sell signals.These led to 34 long trades of which 22 were profitable, and 33 short trades of which 22 were profitable.

This is a monthly strategy; monthly OHLC data is used to derive all signals and there is at most one buy and sell signal and one trade per month. Drawdown (the worst case loss for an single entry and exit into the strategy) was 46% vs. 93% for buy-hold. Using drawdown plus 5% as our risk metric, and annualized return as the reward metric, the reward/risk for the strategy was 1.70 vs. 0.37 for buy-hold, an improvement factor of around 4.6