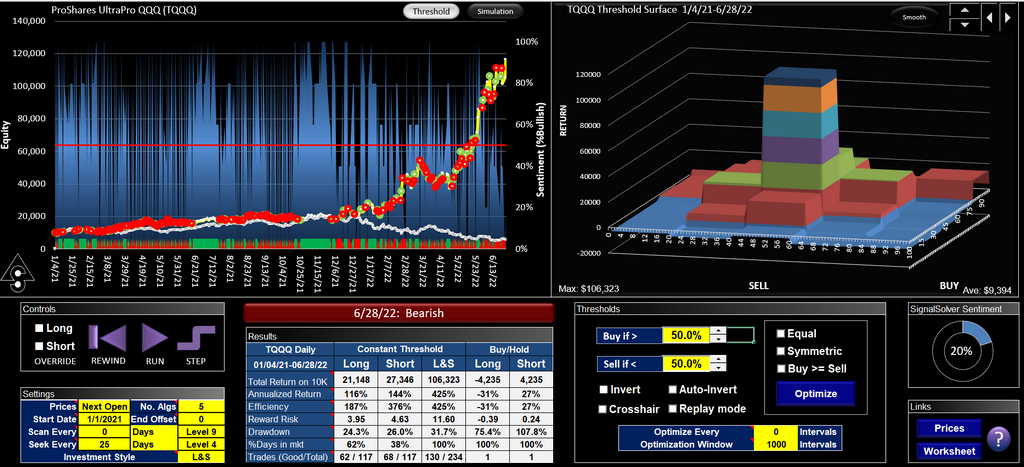

TQQQ Trading Strategy using SignalSolver Sentiment

Post Updated June 29th 2022

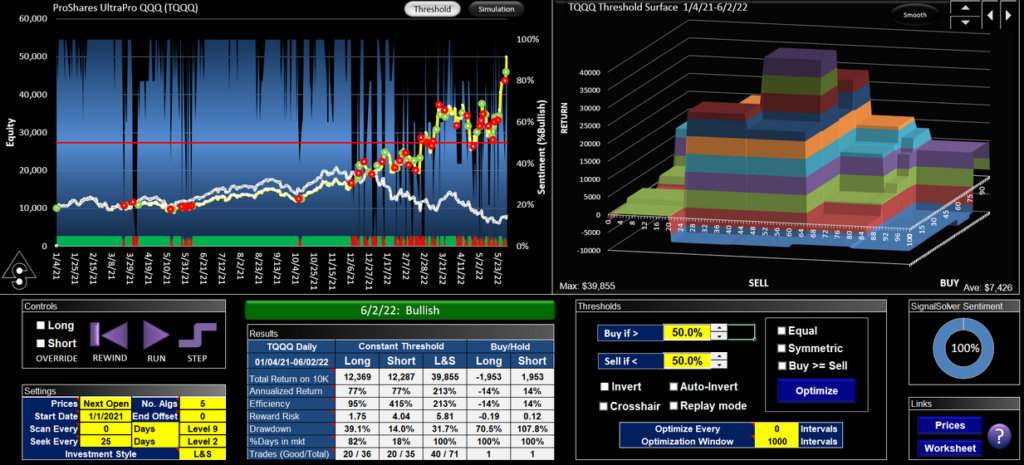

This trading strategy for TQQQ uses SignalSolver Sentiment to generate trading signals.

We are updating the original post using improved settings. Two settings have been changed:

- The new post uses a Seek level of 4 instead of 2. So more algorithms are explored (although it takes a little longer)

- "A" suffix algorithms (those which buy and sell on the same day) have been excluded

The combined effect of these changes was to double the annualized return from 213% to 425%

50% Threshold is still the optimum, as you can see from the threshold surface. Additionally, this Sentiment run is 17 trading days further along than the Original Post, in which time the return has increased another 20% or so.

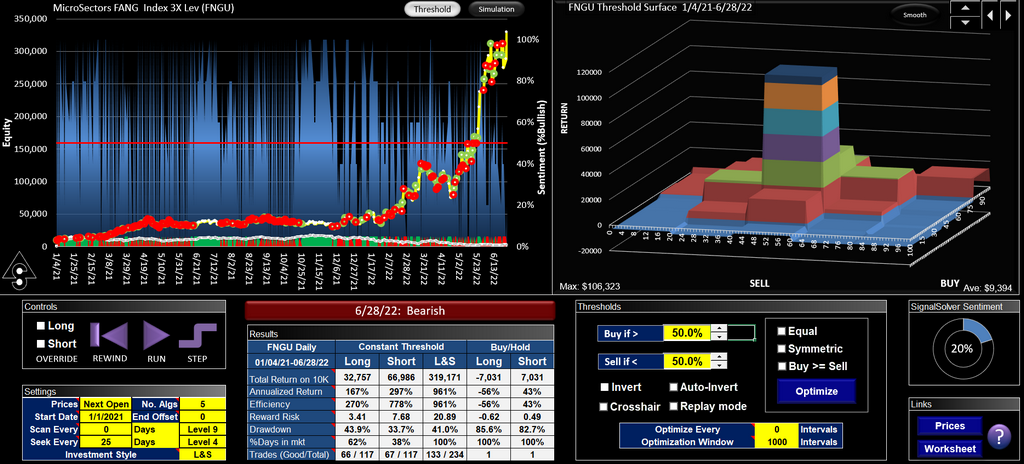

Trading FNGU using TQQQ signals

The signals generated by TQQQ Sentiment have been found to work well for FNGU (and many other symbols also):

This is the same Sentiment profile as generated by TQQQ, but the signals are used to trade FNGU (easy to simulate in SignalSolver, just change the symbol). Here the annualized return was 961%.

The settings for these runs are exactly the same as the Original Post (click below), with the two changes noted above.

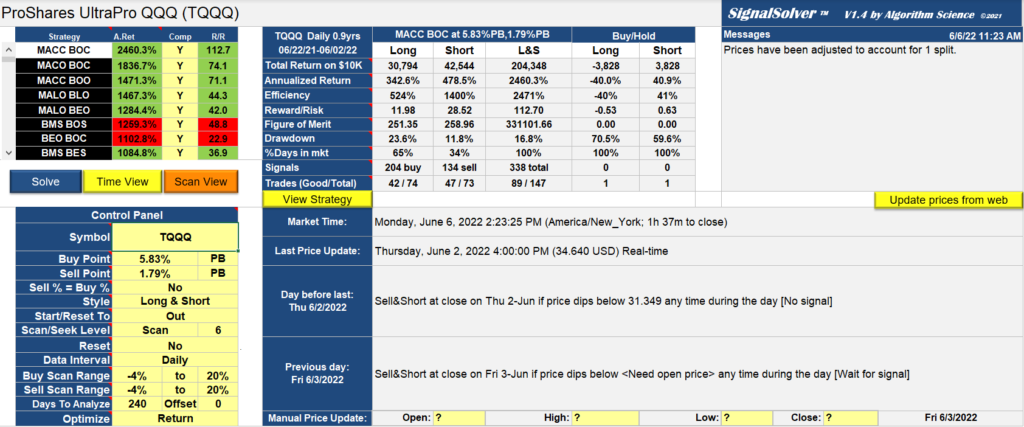

This TQQQ trading strategy using SignalSolver Sentiment gave 213% annualized return for the period Jan 4th 2021 to June 2nd 2022. The sentiment threshold was set to 50% for the entire period.

TQQQ Sentiment Run showing 213% Annualized Return. Notice good symmetry and structure on the Threshold Surface.

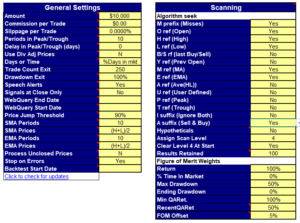

Settings are shown below:

Notice that only OHLC prices and short period (10 day) SMAs and EMAs are used in the backtests.

Below are shown the Report Tab settings, notably 240 days of data were used for the backtests, and only percentage band was used (PB). As with all Sentiment runs, out-of-sample walk-forward simulation is used. Sentiment is determined for a particular day by using the backtester on prior data, using the top 5 algorithms’ long or short state. If the sentiment crosses the 50% threshold in either direction, a trade is performed appropriately.