AAPL signals prove versatile

Work on TQQQ, FNGU, NFLX and many others

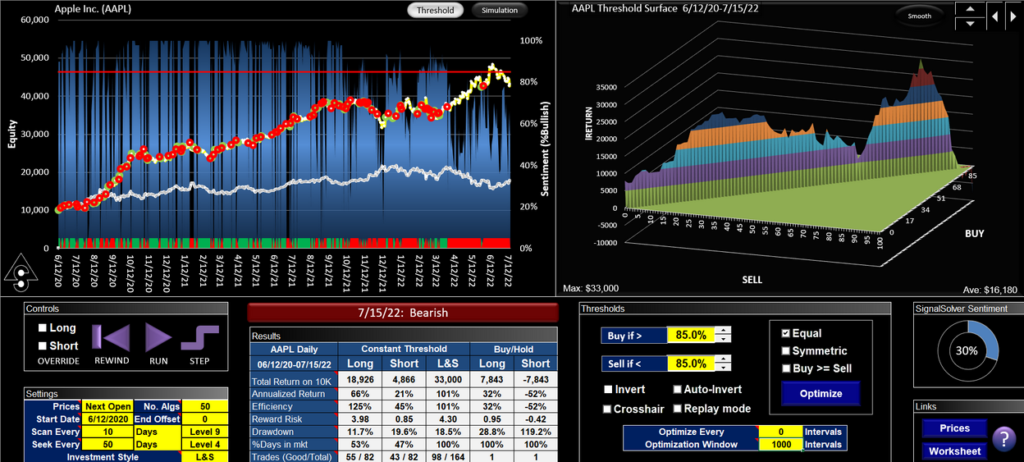

The SignalSolver Sentiment indicator is calculated by aggregating multiple algorithm sentiments. The Sentiment technical indicator has a value between 0% (completely bearish) to 100% (completely bullish). Intuitively, you would think that a 50% threshold would be the best threshold value from which to generate buy and sell signals, and often this is the case. However, in the case of AAPL, the overall best Buy=Sell threshold (for the settings we are using) has been 85%. The result is shown below in the "L&S" column of the table:

The buy/sell signals generated by this algorithm have shown surprising versatility. Below are shown images showing the result of using the AAPL signals for AMZN, FB, FNGU, GOOG, MSFT, NFLX, NVDA, QQQ, TECL and TQQQ. In each case the result was better than both buy-hold and short-hold, often by an enormous margin.

The AAPL 85% Threshold

Success at using Sentiment to signal trades comes down to finding the best threshold to use. There are always values for the buy and sell threshold that generate equal or better returns than both buy-hold and short-hold. But you can only know these values retrospectively.

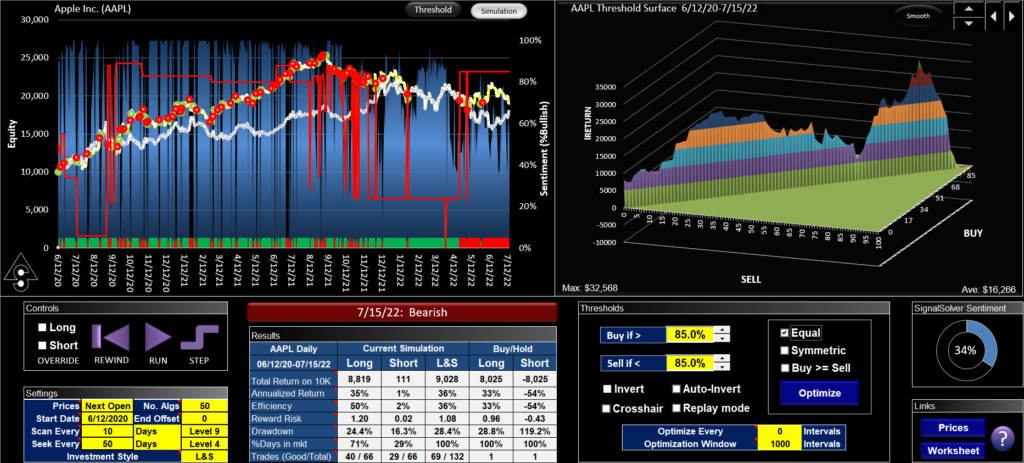

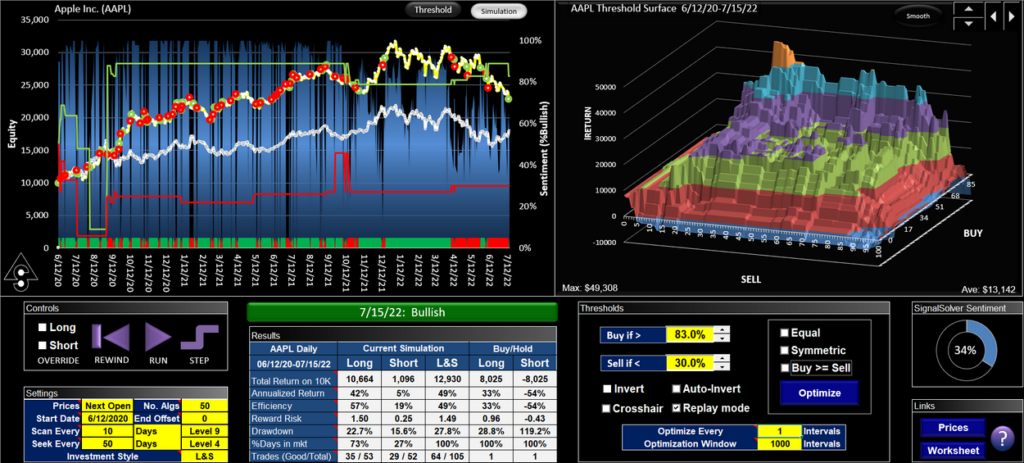

There was no way to predict that an 85% threshold would be optimum. However we can simulate (or run live) using an adaptive thresholds where the program optimizes the thresholds daily as you go along. When using this method, (as you might do in reality) the Buy=Sell constrained threshold was in the 80-90% range from Sept 2020 to Aug 2021 but then became unstable, with declining returns.

The threshold surface (shown below) is a very nice solid structure yielding a positive return for all constant values of threshold except the extreme edges. Notably, 50/50 yielded a return of twice that of buy-hold. The Buy>Sell adaptive threshold (also shown below) gave a better return than the Buy=Sell adaptive threshold, Here we optimize the thresholds every cycle as before.

Comparing the two results, you can see that when the Buy=Sell constraint is applied, the adaptive threshold appears to oscillate between the optimum buy threshold region and the optimum sell threshold region.