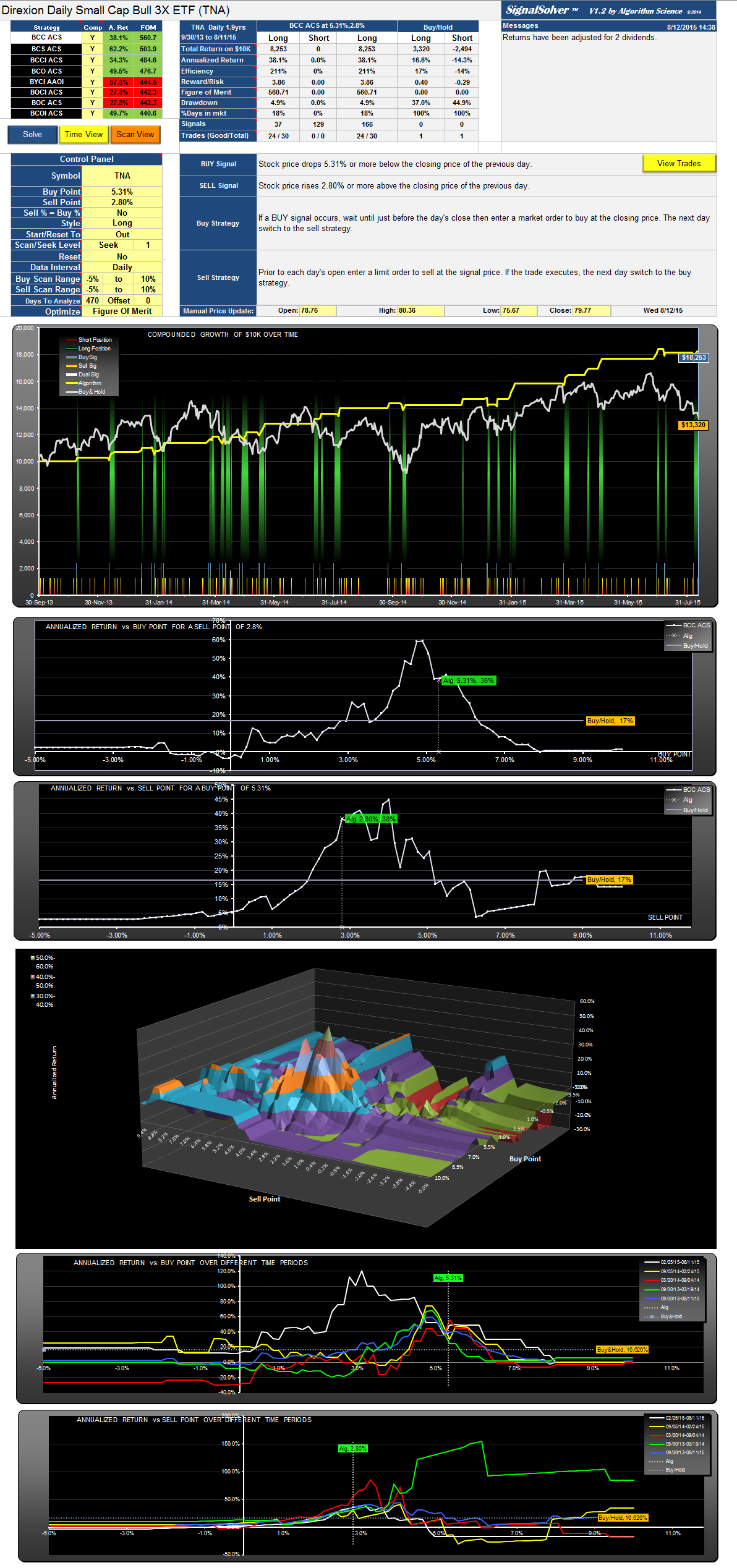

Another low drawdown trading strategy-TNA Direxion Daily Small Cap Bull 3X

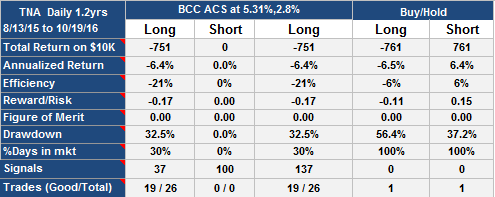

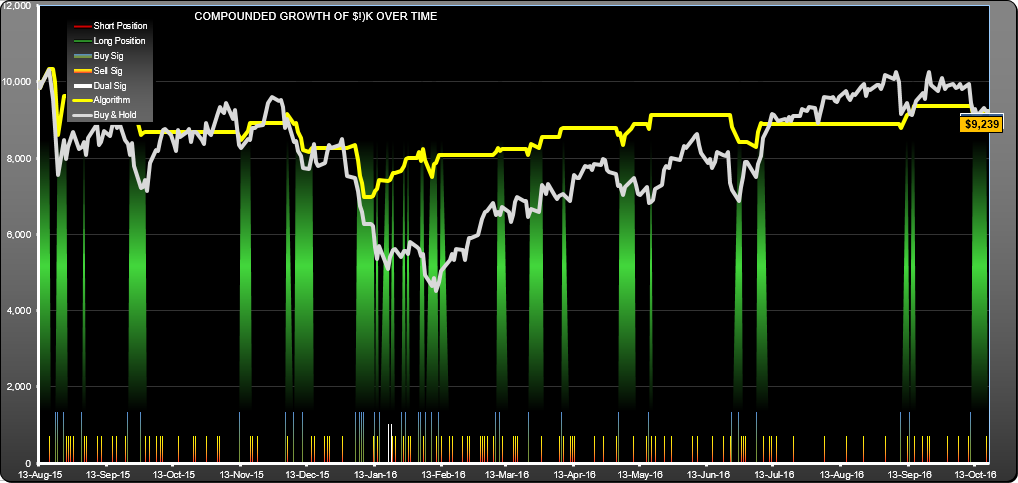

In the same vein as yesterday's FAS analysis, here is a low drawdown trading strategy for TNA, with daily intervention. Prasad had asked me to search for low drawdown strategies for a few of the triple leveraged ETFs, this being one of them. As with FAS, the algorithm was found by optimizing the SignalSolver backtest engine for drawdown (100% weighting), with a min QA return weight of 50% thrown in to get rid of all the zero trades-zero return hits. Period of the analysis was 1.9 years.

Again, the result had a low time in the market (18%), low drawdown (4.9%) and an annualized return which, while modest (38%), was better than the underlying ETF.

Andrew

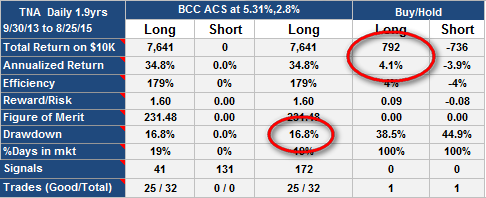

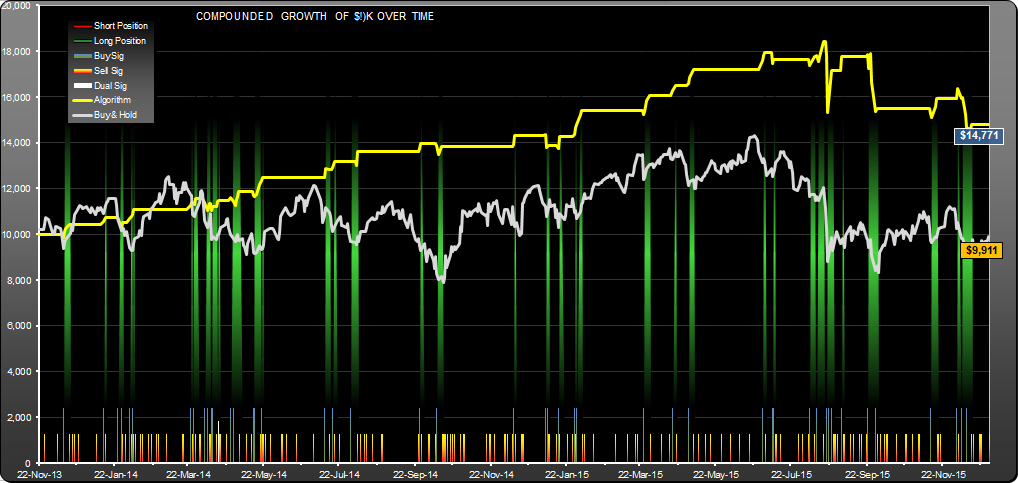

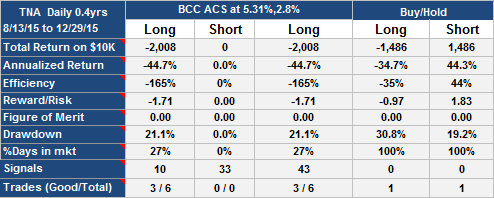

Update 11/26/15: This strategy got hit on 8/24/15 at the open when the price dropped to 60.47 and the drawdown increased to 16.8% (ouch). The stock had previously bought at the close on 8/20 at 72.62. It subsequently sold on 8/25 at 67.74, so the drawdown is now sitting at 6.8%. Since publication 8/11/15 the strategy has lost 3.35%, while TNA has lost 23.72%.