TECL trading using SignalSolver Sentiment

A sentiment driven trading strategy with adaptive thresholds

Methodology

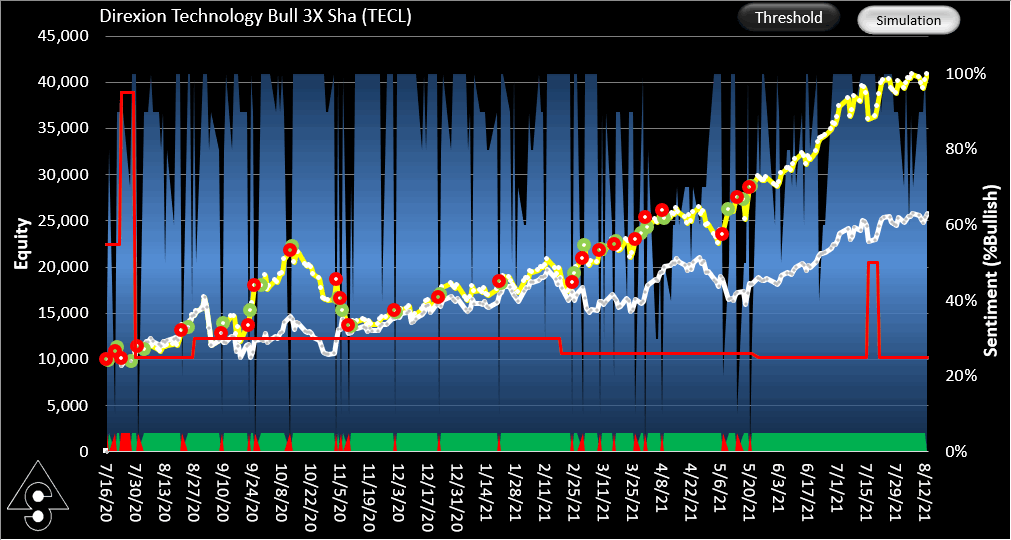

Sentiment is usually based on a consensus of opinions of expert humans, however SignalSolver sentiment is the consensus opinion of multiple backtest algorithms. In the same vein as the previous few posts, this is a TECL trading strategy using SignalSolver sentiment using an adaptive threshold. For a full explanation of the SignalSolver sentiment methodology and how to interpret the simulation results, please click here.

The adaptive threshold technique examines the thresholds surface every 5 trading days (configurable) and re-optimizes the thresholds accordingly. The threshold is currently at 25% but this could change as we move forward. The buy and sell thresholds are constrained to be equal for TECL.

Performance

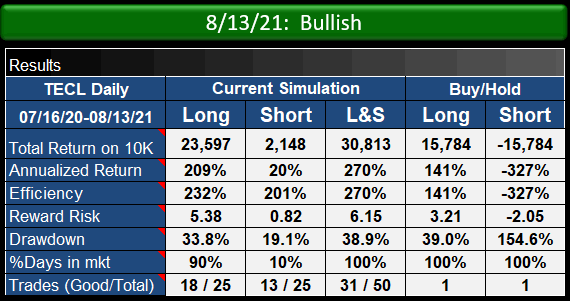

The TECL trading strategy using SignalSolver sentiment (L&S column above) has performed just under 2 times better in this simulation than buy-hold in terms of reward/risk,total return, and (CAGR). Drawdown has been around the same as for buy-hold. Just to re-iterate--this is not a backtest result, it is a walk-forward simulation using out-of-sample trading prices.

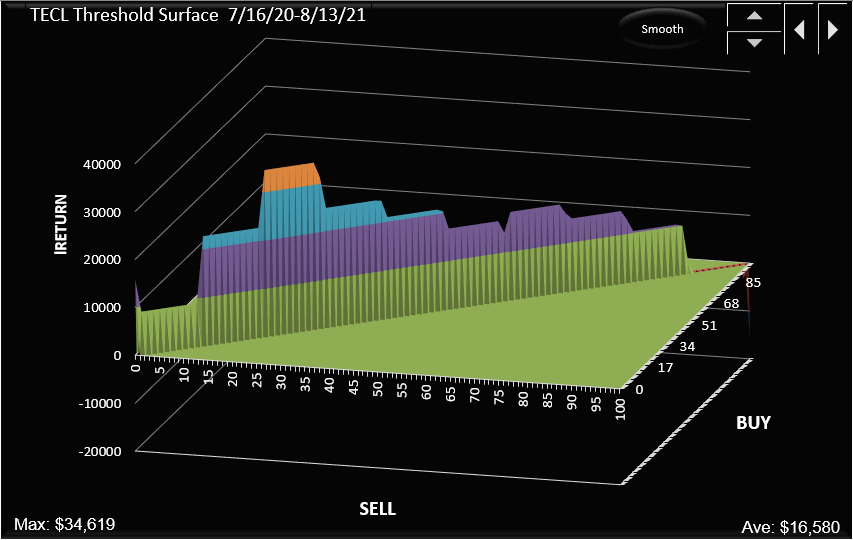

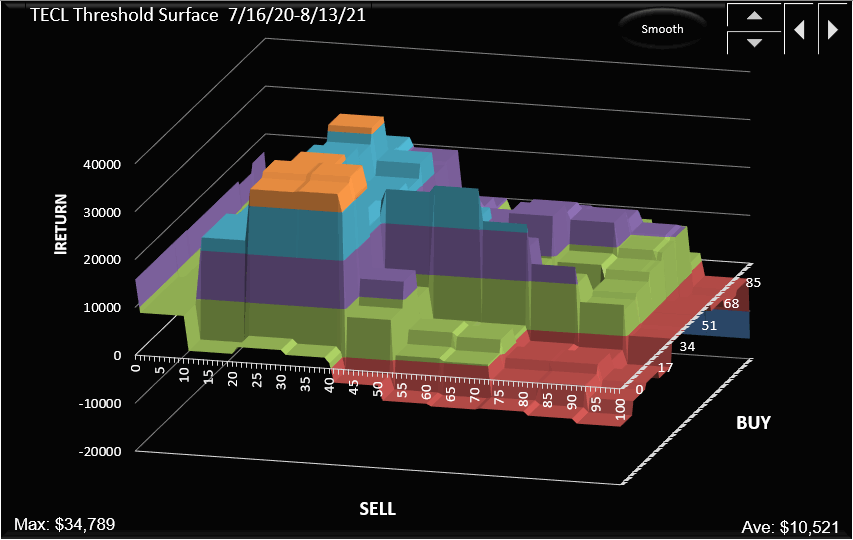

Below are the threshold surface for the entire window of 7/16/20 through 8/13/21, showing good structure both for the buy=sell constraint, and the entire surface. Note the peak is at $34,789.

Click here to see the SignalSolver settings for this strategy: TECL Sentiment Settings

We now move into the paper-trading phase for this project. Updates will be shown below.

Updates

Updates to this strategy and current sentiment can be found here.