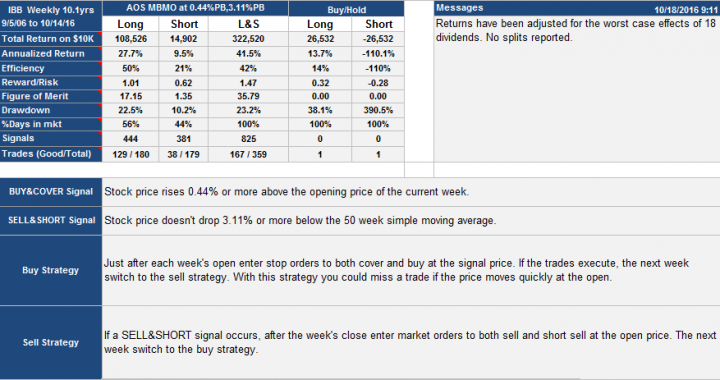

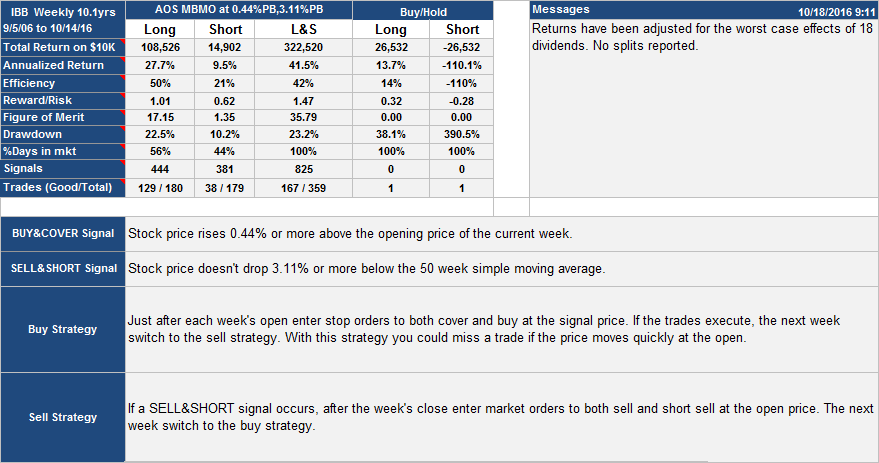

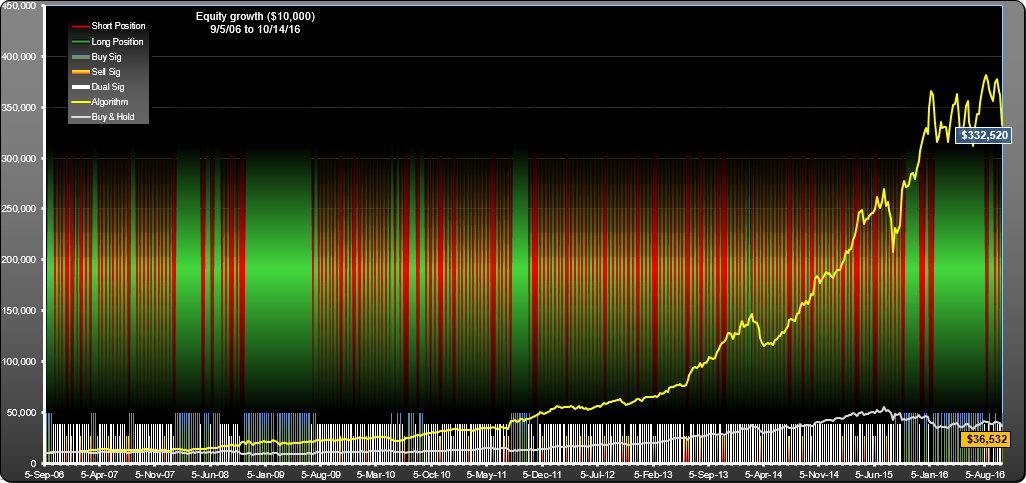

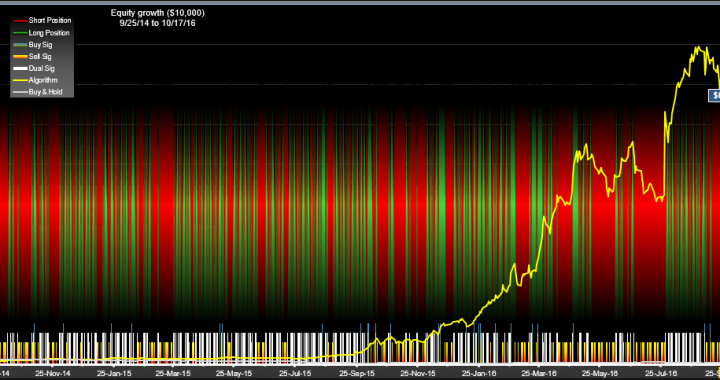

This weekly trading strategy for IBB had 3 times better annualized returns than IBB and more than 10 times better return over the 10.1 years. For each 2.5 year period within the 10 years, the annualized return was between 30 and 50%.

Category Archives: Uncategorized

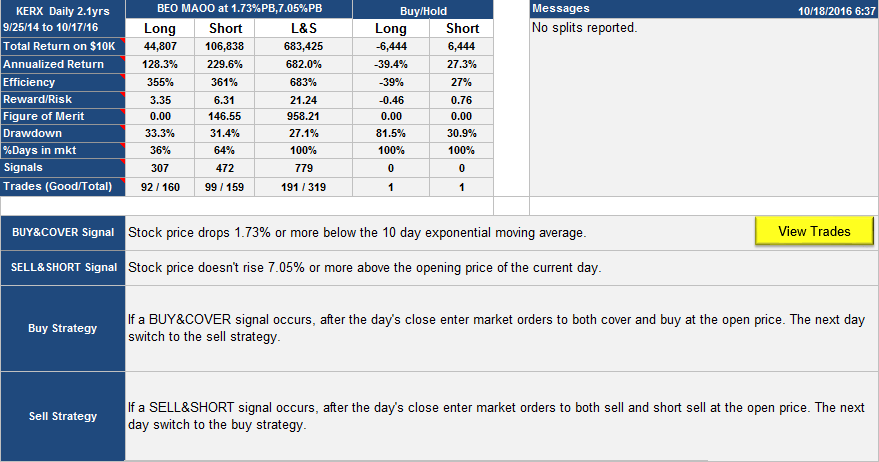

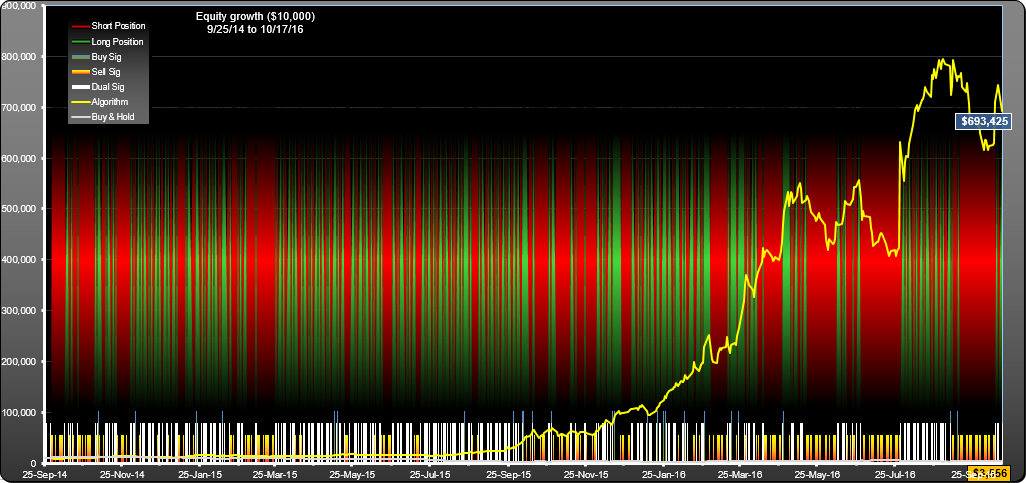

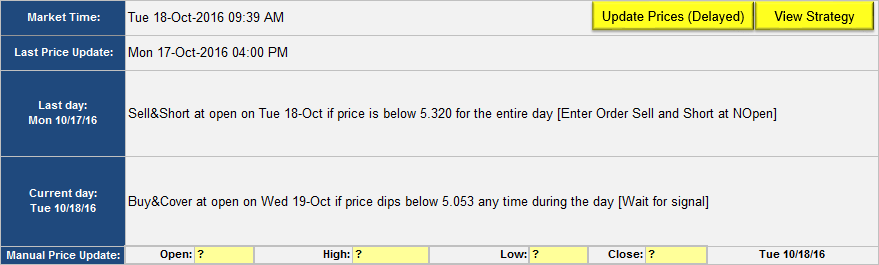

KERX Trading System

This is a trading system for Keryx Biopharmaceuticals Inc. (KERX). It requires daily intervention, trading at the open of business.

KERX Trading System: Trades Spreadsheet

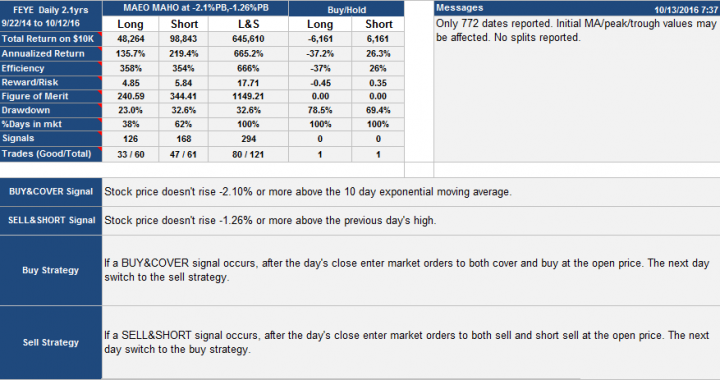

FEYE Trading System

A trading system which worked for FEYE (FireEye). This is based on daily data, so traded at most once per day.

FEYE Trading System: Trades List

As always, future performance is not guaranteed.

TSLA Daily Trading System

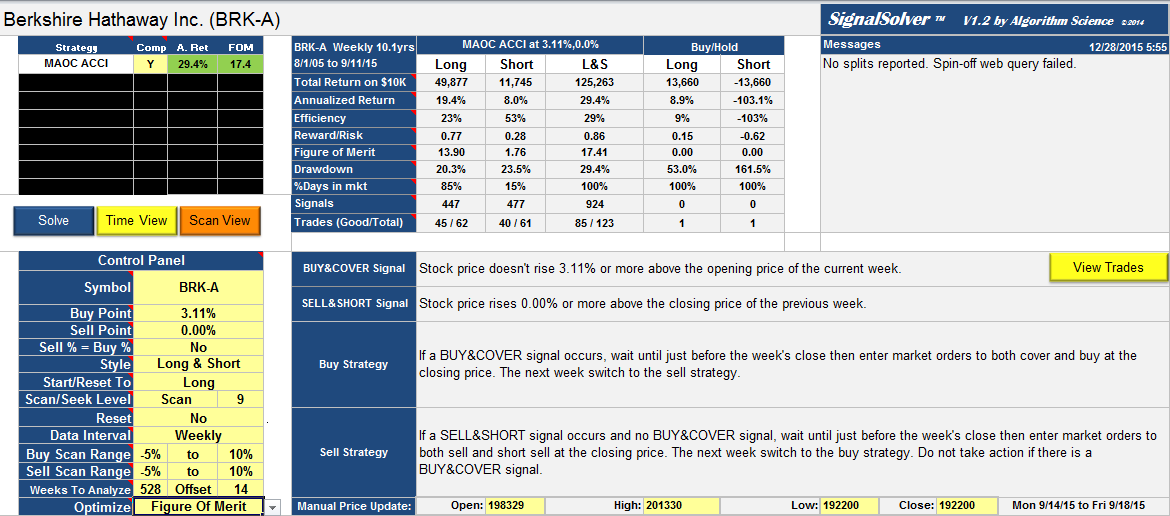

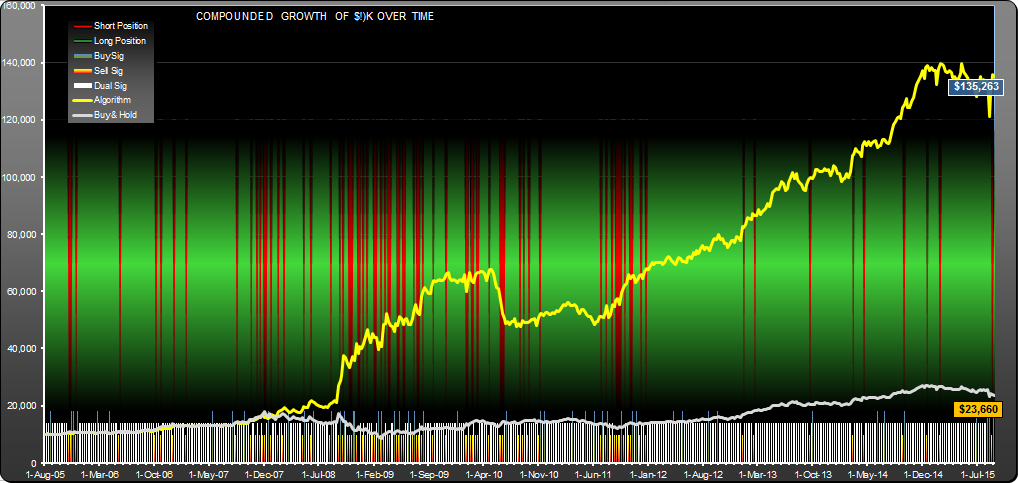

Berkshire Hathaway trading strategy

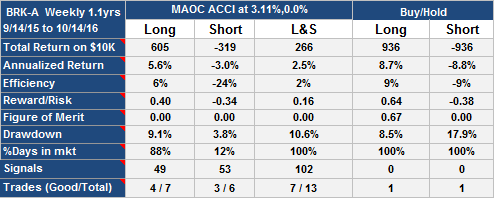

This is a Berkshire Hathaway trading strategy which would have given almost ten times the return performance of buy/hold over the last 10 years with half the drawdown. The strategy is detailed in the table below, it was straightforward, with 123 trades over the 10 year backtest period. All trading was done at the weekly close of business. This was a strategy where there was usually a buy and a sell signal every week (398 out of 528 weeks), but selling was initiated by the presence of a sell signal and an absence of a buy signal. There was a strong buy bias, appropriate for the underlying positive trend of the stock.

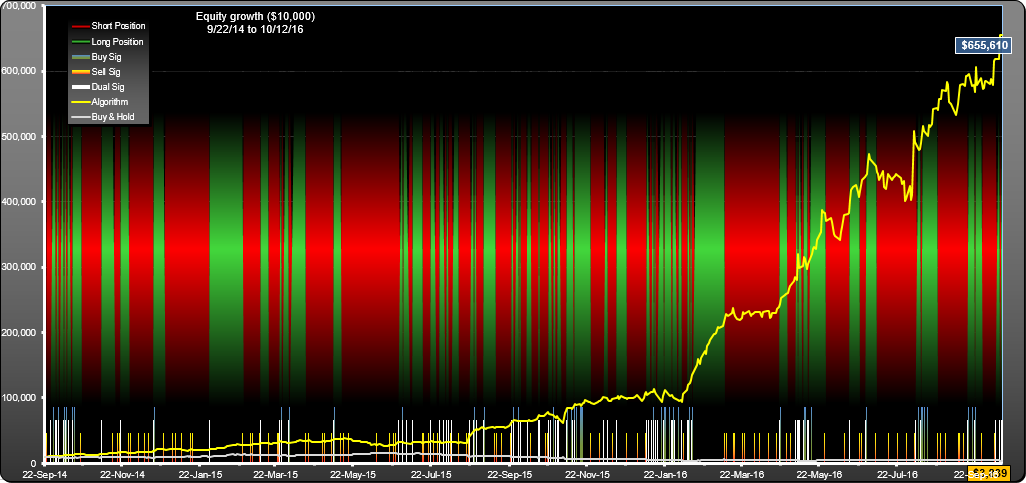

Equity curve, signals and positions are shown in the growth chart below. Notice the preponderance of white signals which indicate dual signal days.

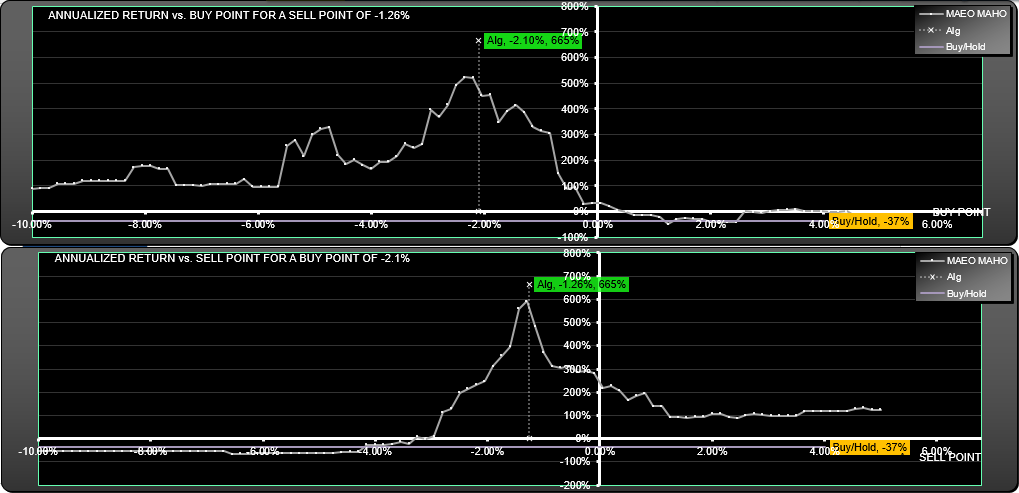

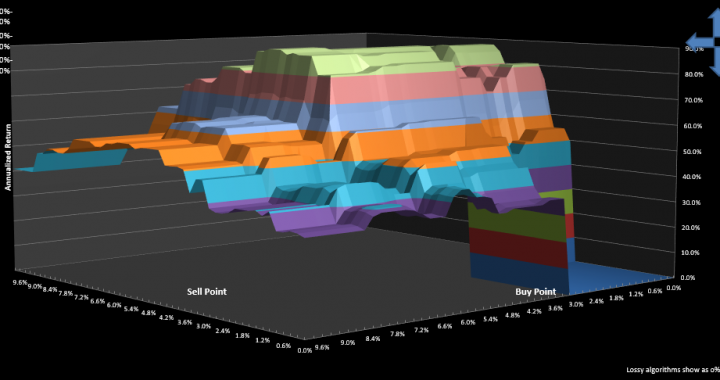

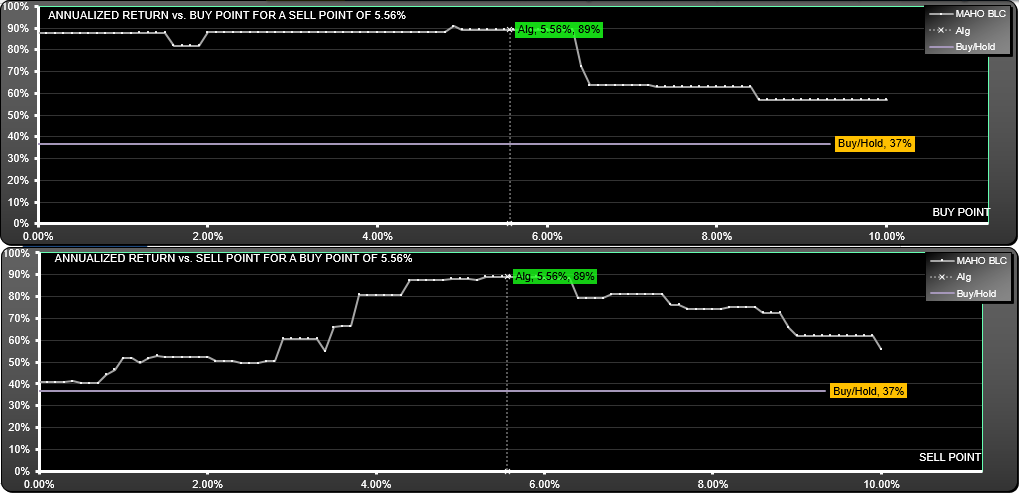

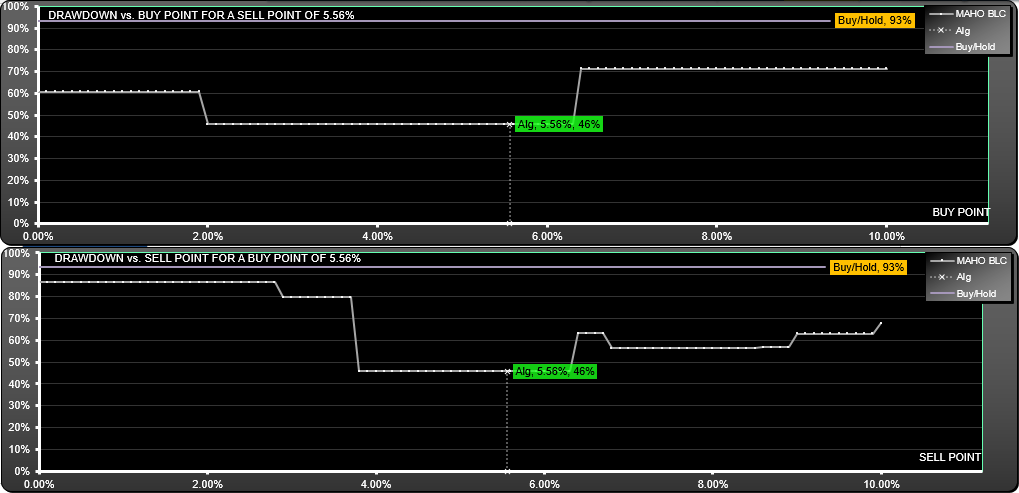

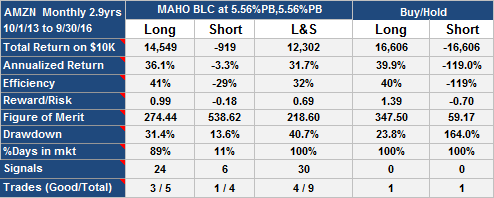

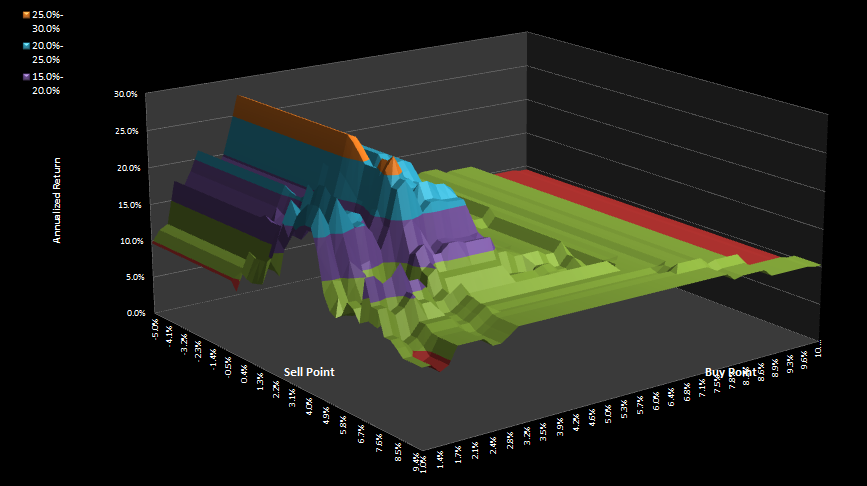

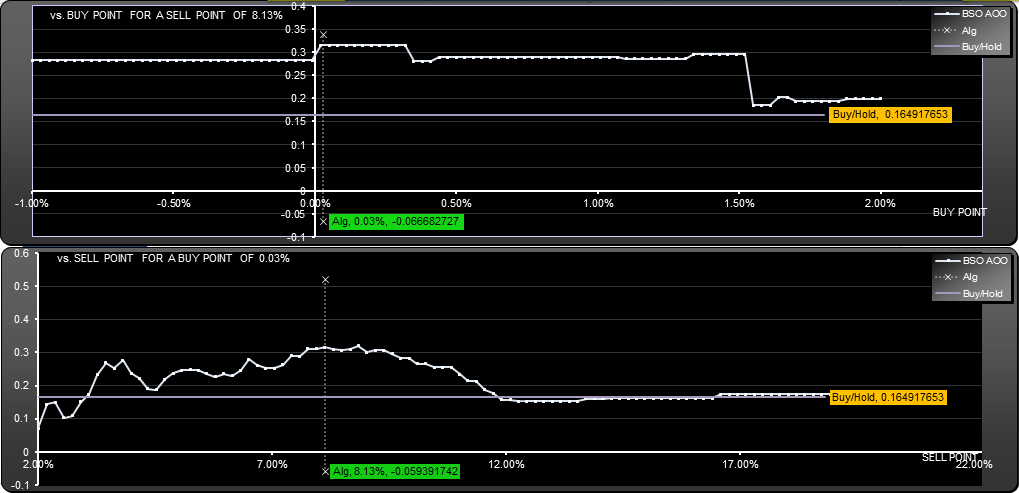

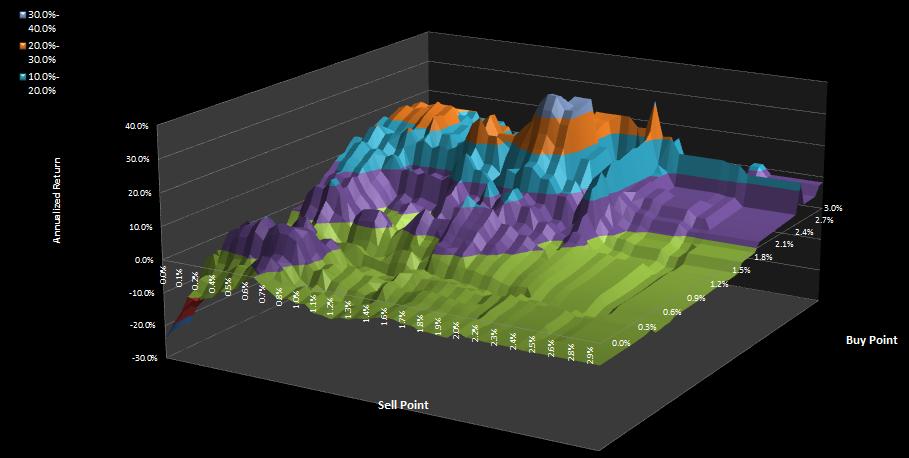

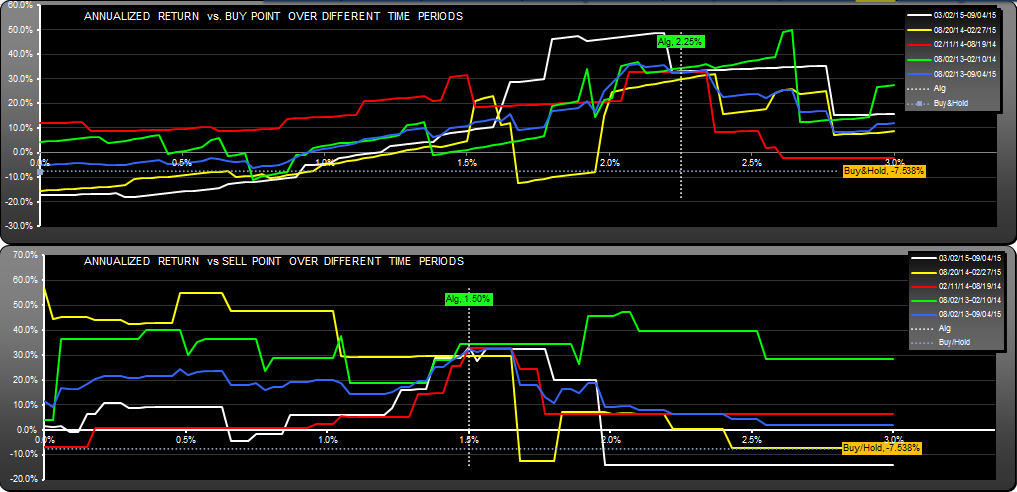

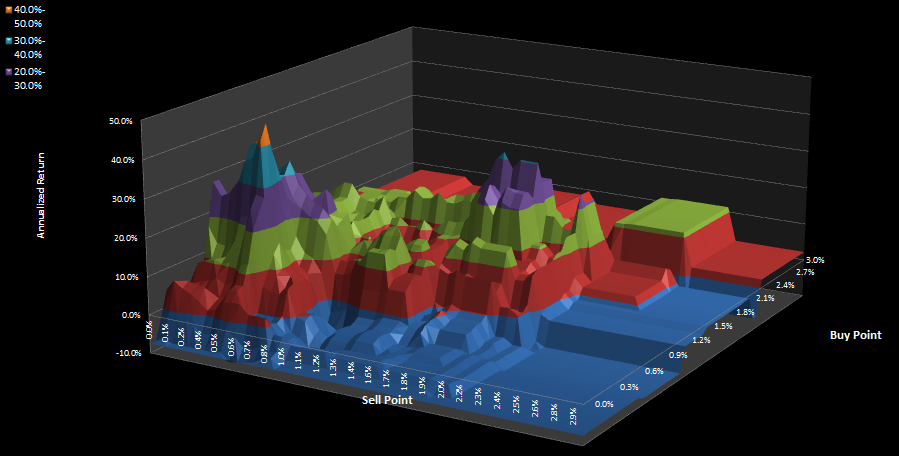

If the sell point was set at zero percent, the algorithm gave positive results for all buy points greater than 0.25%. Below we show how return varies with buy and sell parameters.

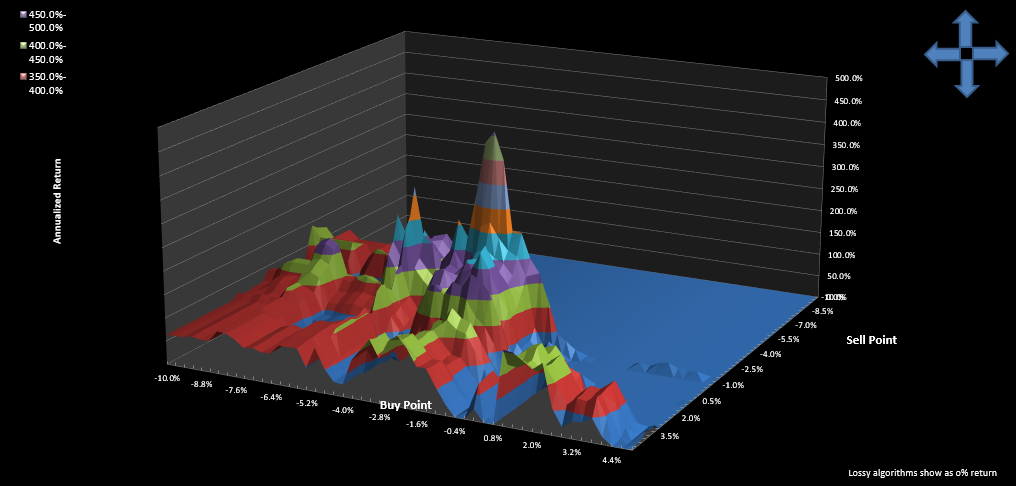

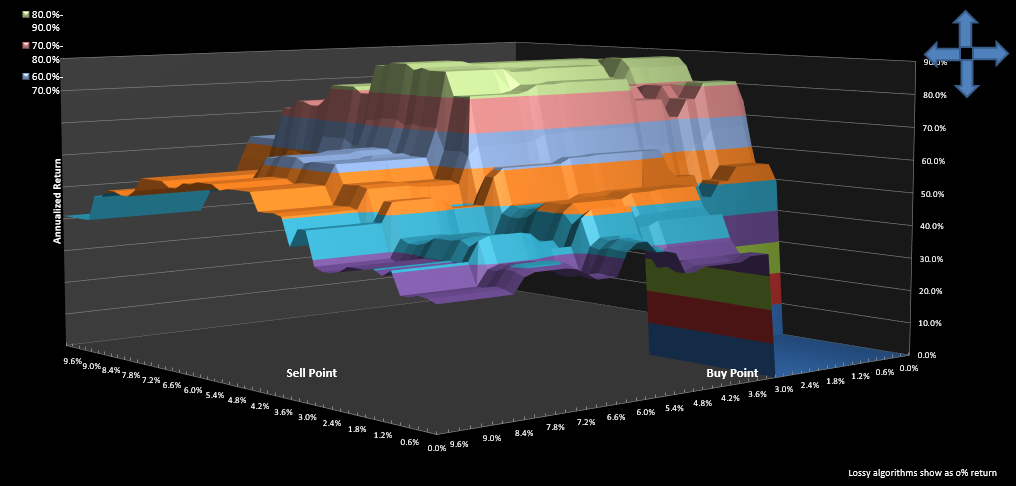

The returns for every combination of buy and sell parameter are shown in the surface plot below.

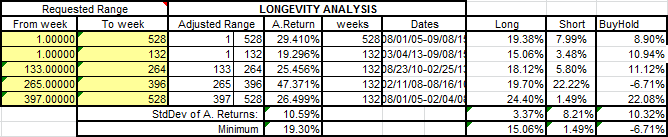

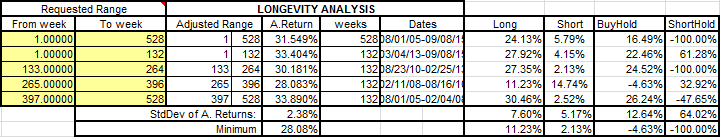

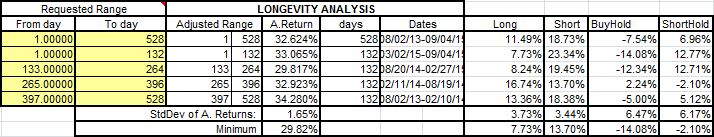

Looking at the minimum annualized returns for each of the four 132 week periods, you can see that the algorithm was much better behaved than the underlying stock, worst case was 19.26% which happened in the most recent quartus. The long side of the algorithm showed a min return of 15% with a stddev of only 3.37%, which is quite tight.

As always, this is not a recommendation to trade using this algorithm, just an interesting backtest result. For a list of trades, see here: BRKA.W Trades.

Please note, the above result was corrected 12/28/2015 to address a bug fix in the short side calculations.

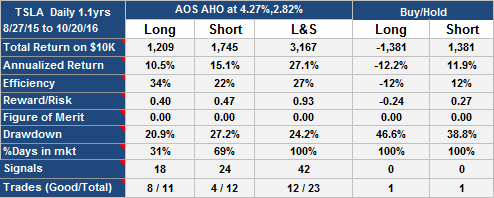

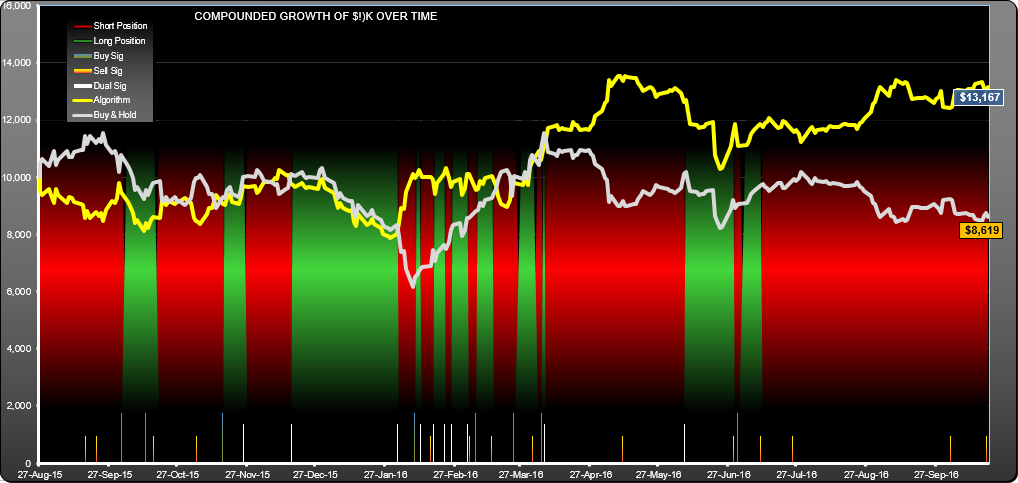

Update Oct 21st 2016

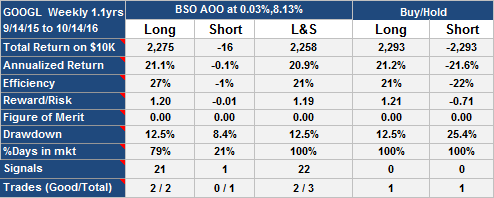

GOOGL Trading Strategy (Weekly)

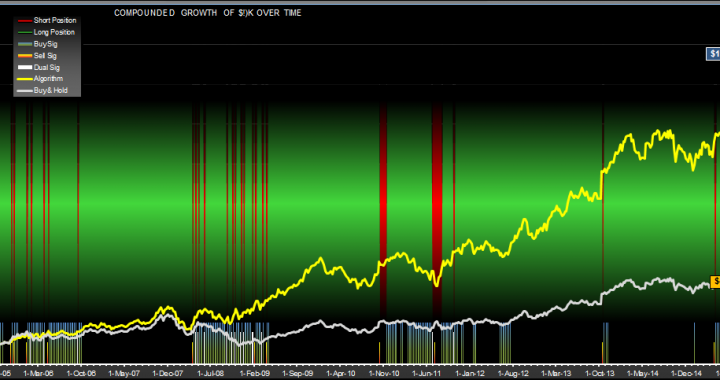

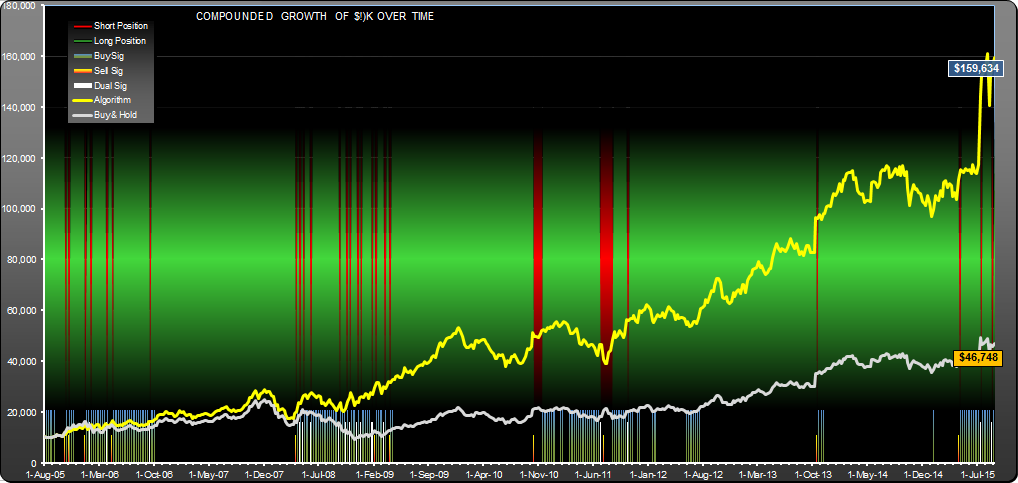

Here is a Google Inc (GOOGL) trading strategy with once a week intervention which would have performed significantly better than buy-hold over the last 10 years. Annualized return was 31.5% vs. 16.5% (returning $149K for 10K outlay vs $36.7K, compounded), drawdown was 40.2% vs. 62.4%, so reward/risk was better.

The buy and cover signal (see table below) was present every week where the price dropped 0.03% below the last price the stock was sold at which happened 174 times over the course of the 528 weeks of the analysis, and usually happened the week following a sell/short.

The sell and short signal happened every week the stock price rose 8.13% or more above the open price of the current week. This happened only 29 times, so there is a strong buy-side bias to this strategy. All trading would have been done at the open of the week following the signal.

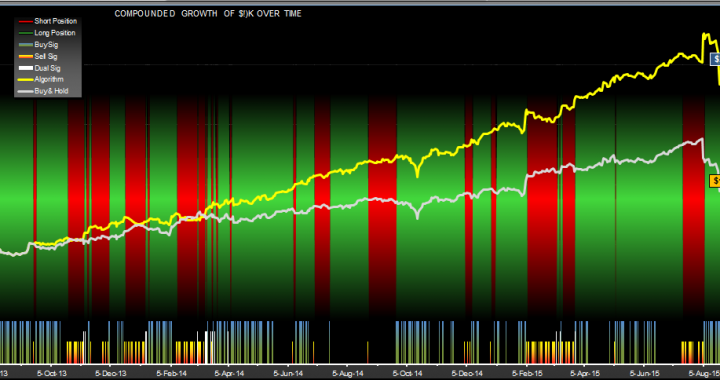

The equity curve for this GOOGL trading strategy shows that the stock was held short (the red bands in the background) for small periods, typically a week.

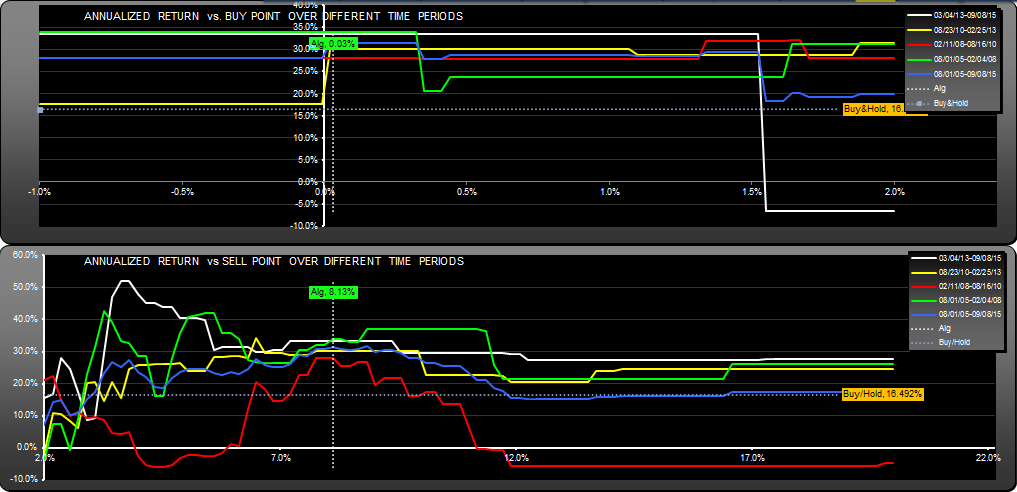

The scan below shows how the annualized return changed, had the buy and sell parameters changed. At 2.35% buy point, the algorithm gets stuck, resulting in a loss. This is characteristic of trading strategies which reference buy or sell prices. At 1.5% sell point and below, the algorithm made a loss, but returns for all buy points above that were positive, for the 0.03% buy point.

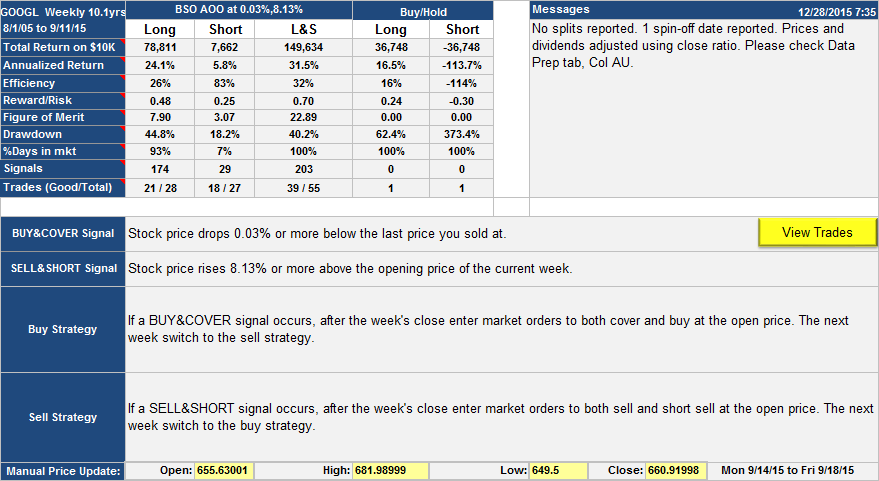

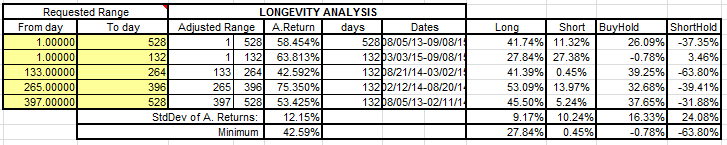

One nice characteristic this algorithm had was consistent returns for each of the 132 week periods in the backtest. You can see from the table below that the annualized return was between 28% and 34.8% for every period. Compare that with buy-hold which ranged from -4.6% to 26%

You can also see this characteristic on the scans for each quartus:

You can download the list of trades in .xlsx format: GOOGL.W Trades.

As of Sept 16th 2015, the algorithm is long, awaiting a sell signal if the price hits 708.933. Last sell price was 654.34.

Please note, while this is an interesting backtest result, it is not a suggestion to trade this way. As always I don’t know how this strategy will fare in the future, but will track it from time to time.

Andrew

This post was edited 12/28/15 to correct an error in the short-side returns.

Update Oct 21st 2016

This strategy has pretty much followed buy-hold long:

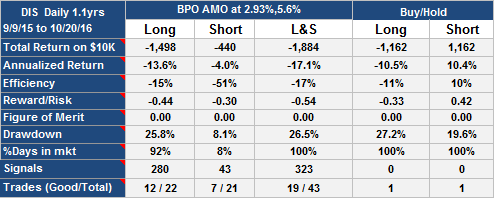

DIS Trading Strategy

Here is a Walt Disney Company (DIS) trading strategy with daily maintenance which had quite nice characteristics; 59% annualized return over the last 2 years.

The performance was better than long buy-hold with lower drawdown and about three times the reward-risk. Signal reinforcement was good, and not many dual signal days.

Below I show the return for the DIS trading strategy for each 6 month period going back 2 years. Comparing with long buy-hold you can see better consistency (higher minimum and lower StdDev).

Please note that this is simply a measurement, not an opinion or financial advice.

This post was corrected 1/8/2016 to correct a miscalculation in the short-side returns.

Update Oct 21st 2016

Strategy peaked 11/23/15, shortly after the stock price peaked.

Two GLD Trading Strategies (Daily)

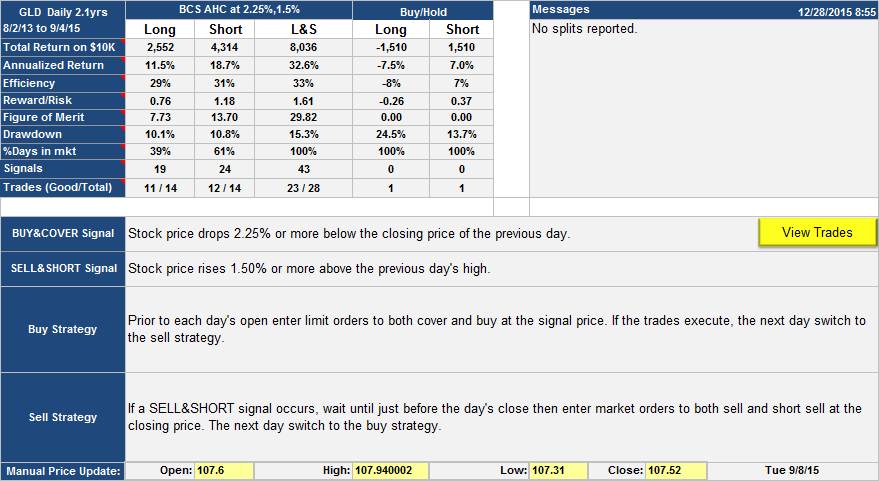

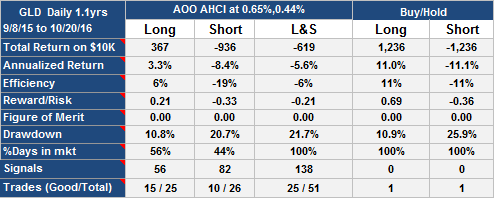

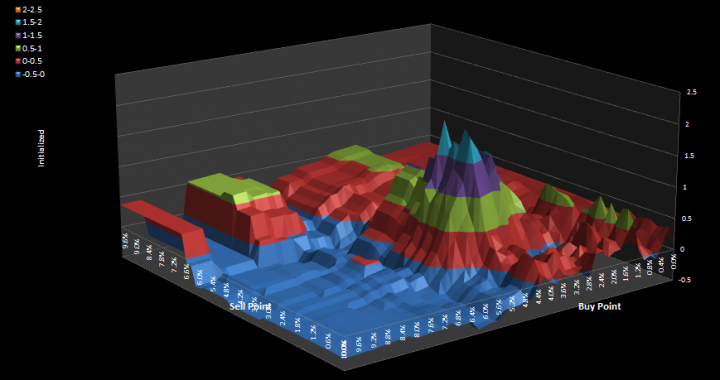

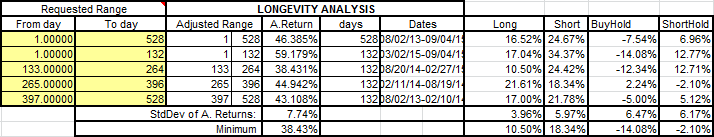

GLD is the much traded SPDR Gold Trust ETF. I find these two GLD trading strategies interesting because they gave reasonable results (32.6% and 48% annualized return) for each of the four 6 month periods of the analysis. The strategies require daily intervention.

Strategy 1: BCS AHC

This is a buy on fall, sell on rise strategy using the close price as the buy reference and the high price as the sell reference. As you can see from the life chart and the longevity analysis, the lowest return for the last four 6 month periods was close to 30% annualized. You can easily find algorithms with over 50% annualized return for GLD, but they are not as consistent, with lowest quartus returns of around 14%.

I would prefer to see more reinforcement on the signals, but there it is. As of Sat Sept 5th, this strategy is Short with no transactions pending.

You can view the trades in spreadsheet format here: GLD.D Trades

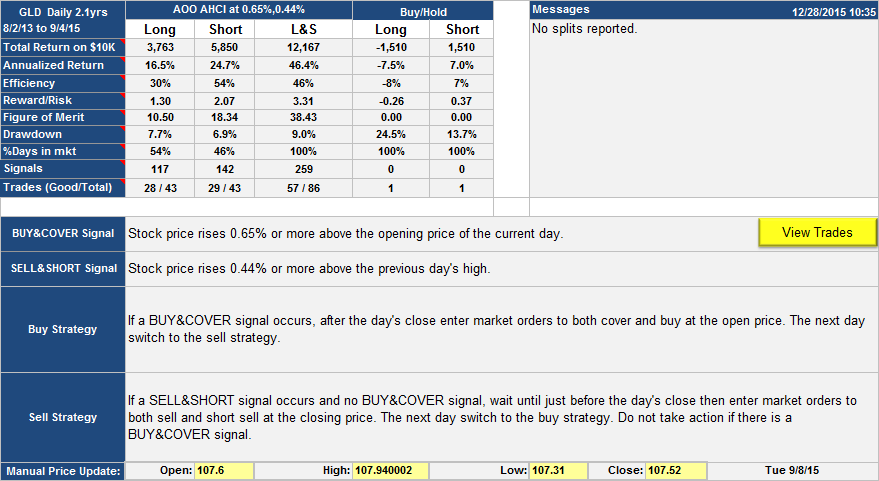

Strategy 2: AOO AHCI

In many ways this strategy shows better results than the BCS AHC strategy, for example there was lower drawdown, higher return, better signal reinforcement and good consistency (minimum 6 month quartus return of 38.43%). On the other hand, signals were cluttered, with 67 dual signal days, 50 buy signal days and 75 sell signal days. Also, its not an trading strategy that makes intuitive sense; buy on rise, sell on rise. Maybe it is one of those serendipitous occurrences, we shall see. Notice the sell strategy is almost the same as for BCS AHC but the sell signal percentage is quite different.

As of Sat Sept 5th, the strategy is Short with no transactions pending.

For a list of trades in Excel format: GLD.D2 Trades. For a more detailed explanation of the above charts, please go here.

For a list of trades in Excel format: GLD.D2 Trades. For a more detailed explanation of the above charts, please go here.

Algorithms were discovered by SignalSolver.

Please note, the above analysis was corrected on 12/28/2015 to reflect a bug fix in SignalSolver. Original returns were $9530 and $12753 respectively.

Update Oct 21st 2016

Both algorithms peaked 12/30/2015.

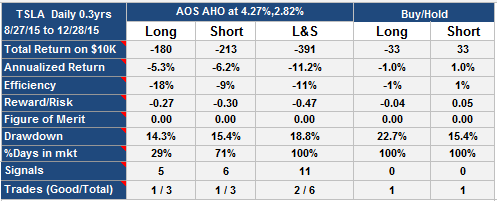

TSLA Trading Strategy (Daily)

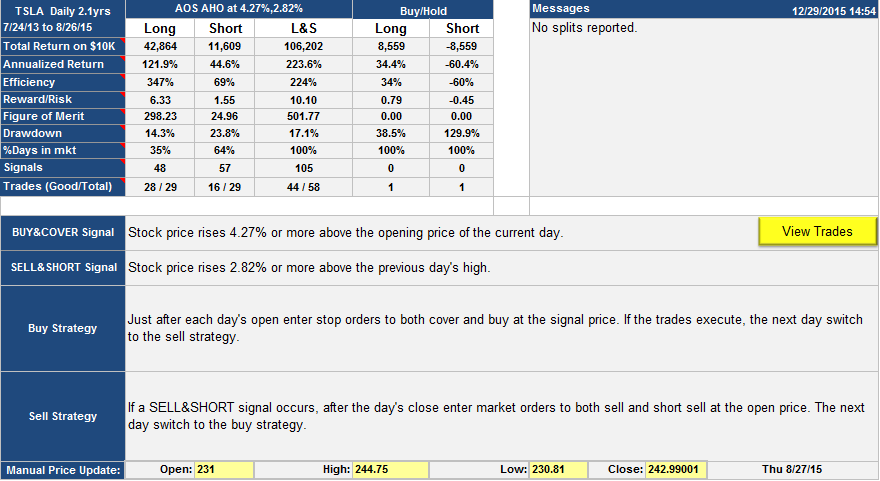

This TSLA trading strategy would have given a 1062% return over 2.1 years vs. a buy-hold return of 86% for the same period. The strategy is based on buying and selling when the stock price rises above specific thresholds. The buy side keyed off the day’s open price; the buy and cover signal appeared when the price rose 4.27% above the open price of the day, and the buy is at the signal price, so you would have to set up stop orders for the buy and the cover.

The sell and short signals came along when the price rose 2.82% above the previous day’s high, and the sell actions occured at the subsequent open using market orders. Every day you would have to recalculate the buy or sell point to find the new buy or sell price. SignalSolver will re-calculate the prices each time you update the prices from the web or enter the latest prices manually. Here is the list of trades.

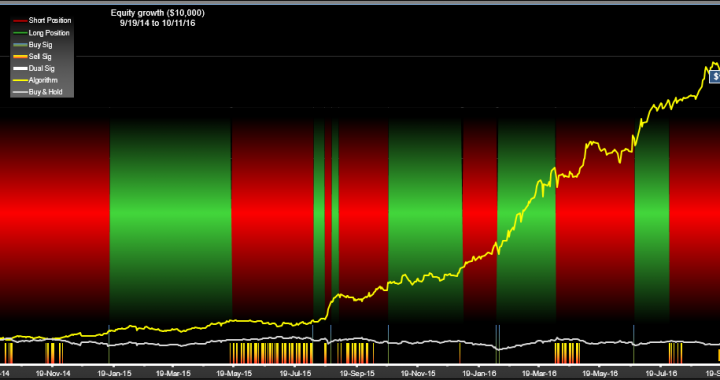

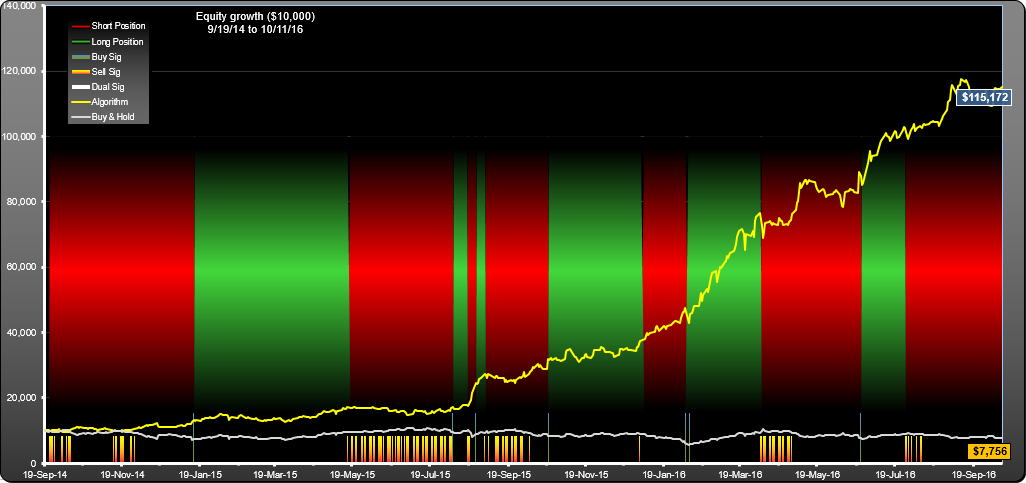

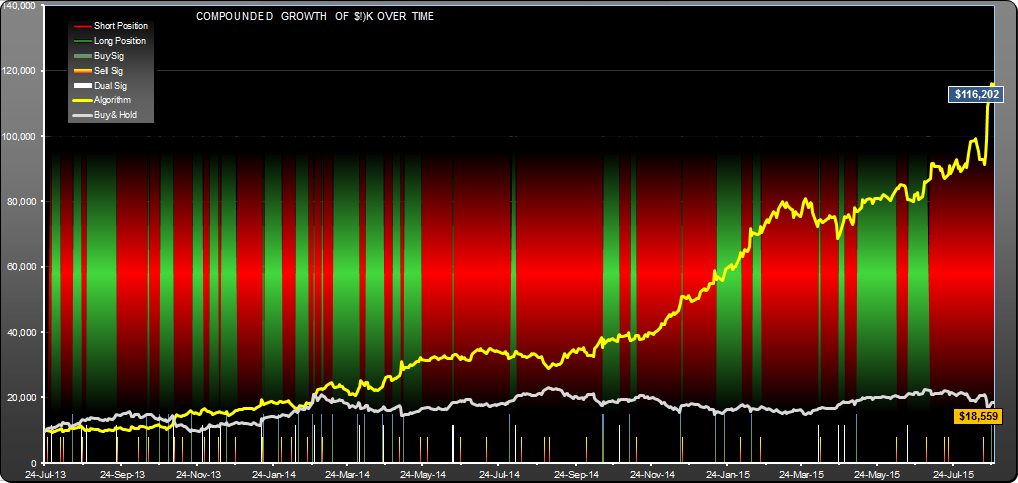

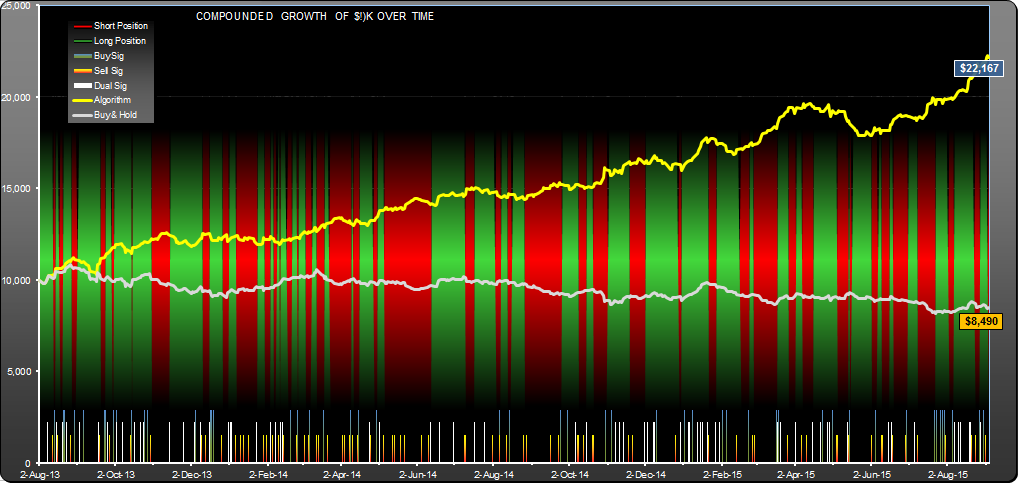

The equity curve shows the return of $10,000 over time for the algorithm (yell0w) and buy-hold (gray):

This algorithm spent 64% of its time short. Looking at the signals at the bottom of the chart, you may notice that they are fairly thin, and there are 21 dual signal days, 28 buy signal days and 36 sell signal days. There is occasional reinforcement of signals, OK but not great.

From the performance table you can see that the long side of the algorithm worked much harder than the short side (the leftmost two columns), but the combination (always being long or short) gave annualized return of 223%.

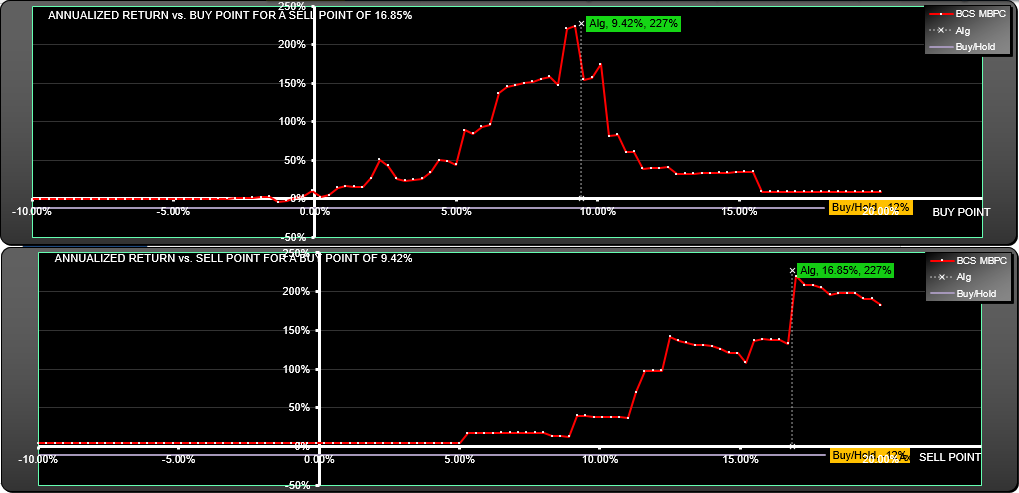

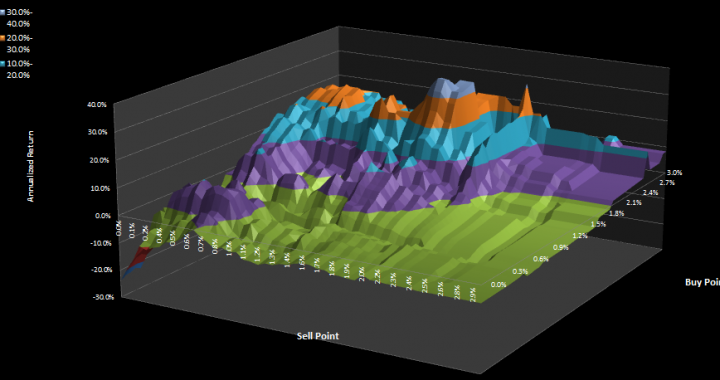

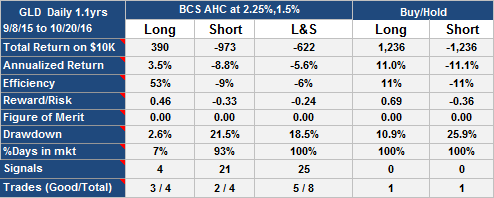

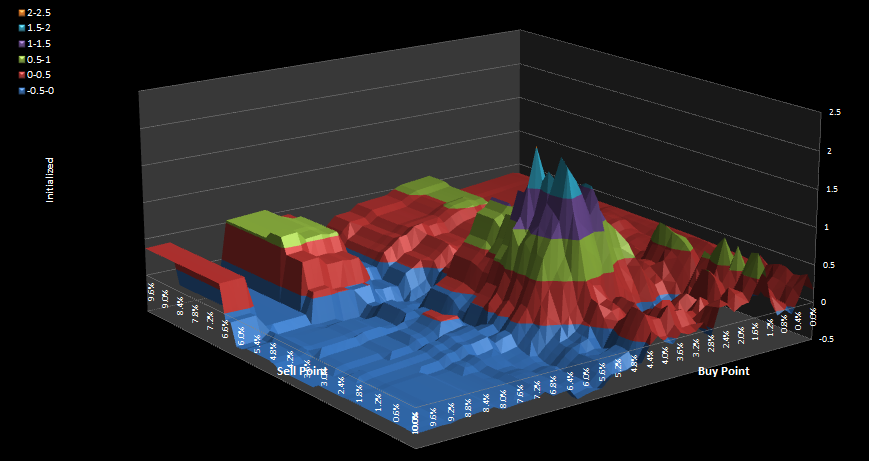

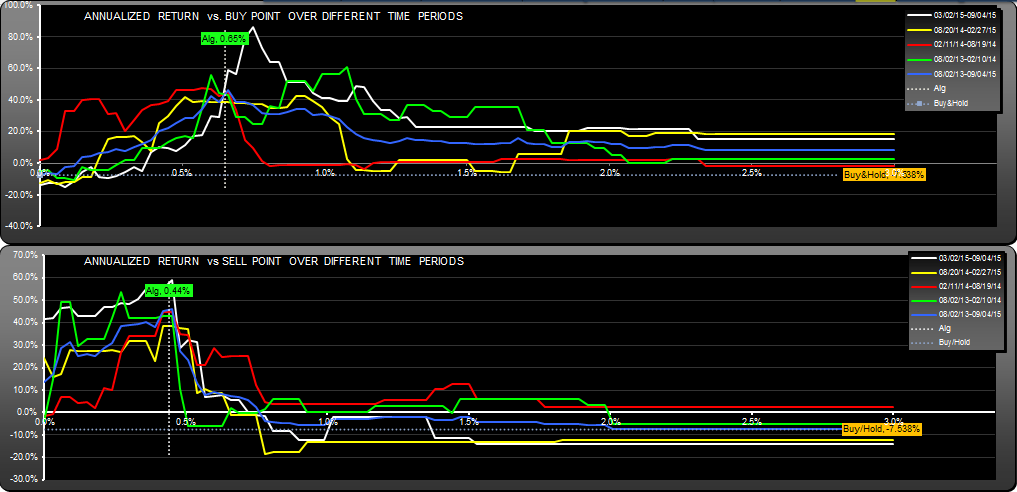

Lets look at sensitivity to the buy and sell parameters.

The dotted line is buy-hold annualized return at 34.45%. The colored lines are the return for different values of buy and sell percentage in different time periods. The blue line is the overall performance for the whole 2.1 year period (528 daily data points), the other green, red, yellow and white lines each represent one quarter of the data (which I call a quartus). As you move the buy or sell point out of the region, you can see that some quartus’s would have been lossy. The worst performing quartus for the chosen buy and sell points was the most recent one, 02/19/15 to 08/26/15, and the annualized return was 161%. The algorithm was found by instructing SignalSolver to find strategies with the best minimum quartus return.

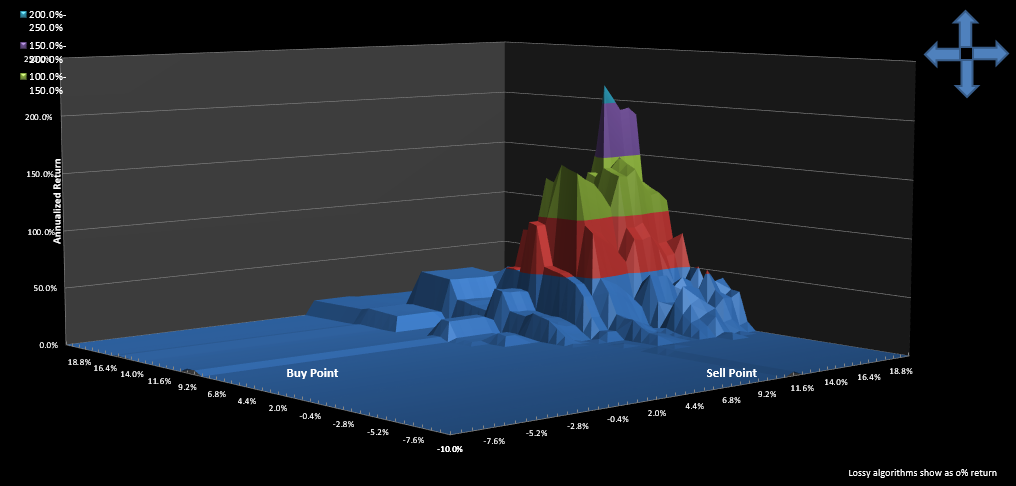

If you map the return for a large range of buy and sell points you notice that the overall surface is a little peaky.

While there is a fair amount of space under the peaks, there are also steep cliffs in the vicinity, so if the buy and sell points were to move around over time you would be in trouble. For that reason I would not expect such high gains in the future.

I will be paper trading this strategy for a while and will post the results from time to time.

Andrew

The above analysis has been corrected 12/29/15 for a bug in the short side return.

Update 12/29/2015:

Update Oct 21st 2016