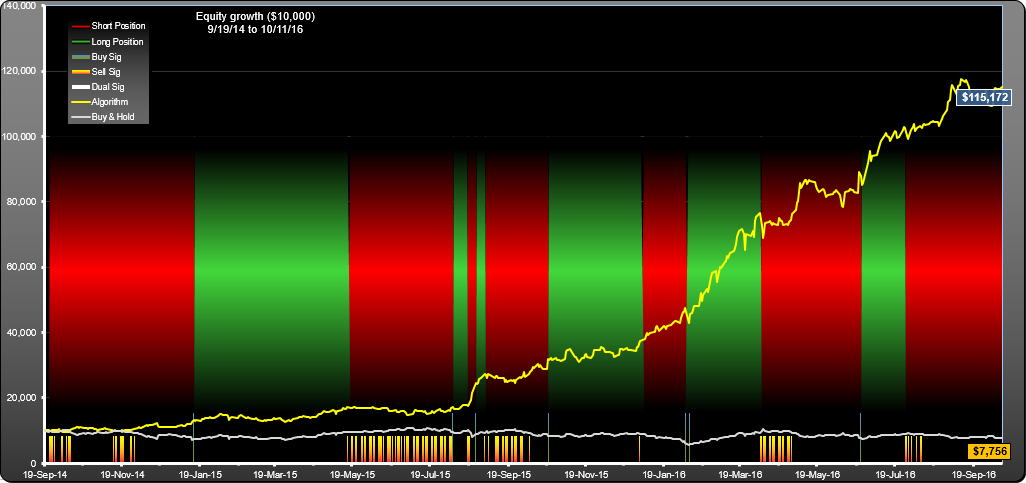

This update covers 26 strategies published 2/10/15 through 9/18/15. For the analysis we measure the results of investing $10K in each strategy on the day of publication. 17 of the strategies made a loss over the entire period, however 5 of these were strategies that broke down after showing a profit.

Overall Results vs Hold

Total return on all the strategies as of Oct 2016 ($10K starting capital) was $4600 or 1.8% of capital. This compares with a loss of $10,740 (-4.1% return) for buy-hold (or a gain of $10,740 for short-hold).

Successful Strategies

9 strategies ended the period with a profit, (BRK,GOOGL,TSLA,TQQQ,DUST,AAPL,PANW,MU,LRN). The combined profit was $36,280 or 40.3% of capital. We will continue to track these strategies.

Partially Successful Strategies

5 strategies (TQQQ,UWTI,NUGT,GILD,MSFT) made at least a 10% profit for a period (typically 100 days) then went on to make a loss over the entire period. Combined opportunity for profit was $28,377 (56%), final loss was $16,766 (33.5%), $10,000 of which was due to UWTI. These strategies will no longer be tracked.

Failed Strategies

There were 12 failed strategies (DIS,GLD,GLD,AAPL,TNA,TNA,FAS,IBM,GOOGL,SPY,WMT,MSFT) losing a combined $14,914 or 12.4%. Losses ranged between $109 through to $3786 for GOOGL. These strategies will no longer be tracked.

Best profits and worst losses

If a single exit for each strategy was timed perfectly, the best case profit for the strategies would have been $92,407 (35.5%). Worst case loss for the strategies was $73,490 (28.3%). Best case gain or loss for buy-hold/short-hold was $115,319--achieving this would have required correctly picking long or short and exiting each at the optimum time.

Strategies vs. 50 day MA crossover strategy

Strategies are sometimes compared with the results of a benchmark SMA crossover algorithm which buys when the price goes above a SMA and sells when the price crosses below an SMA. We compared the strategies with the performance of SignalSolver algorithm AMC 0% BMC 0% using 50 day, 10 week or 3 month (H+L)/2 averaging. AMC BMC gave a loss of $73,490, compared with a gain of $4600 for the strategies presented here. 16 strategies beat the SMA crossover strategy.

Spreadsheet:

summary-spreadsheet-oct-25-2016