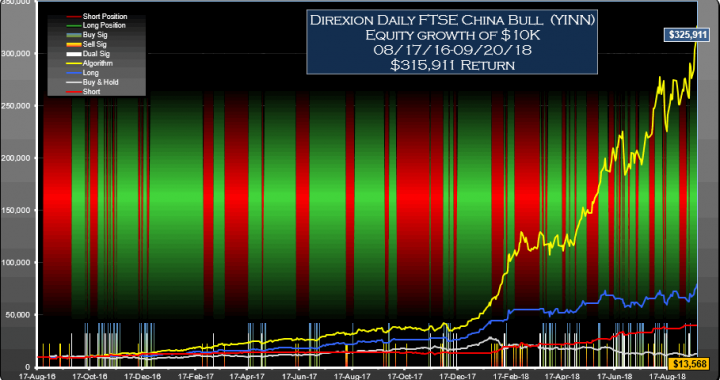

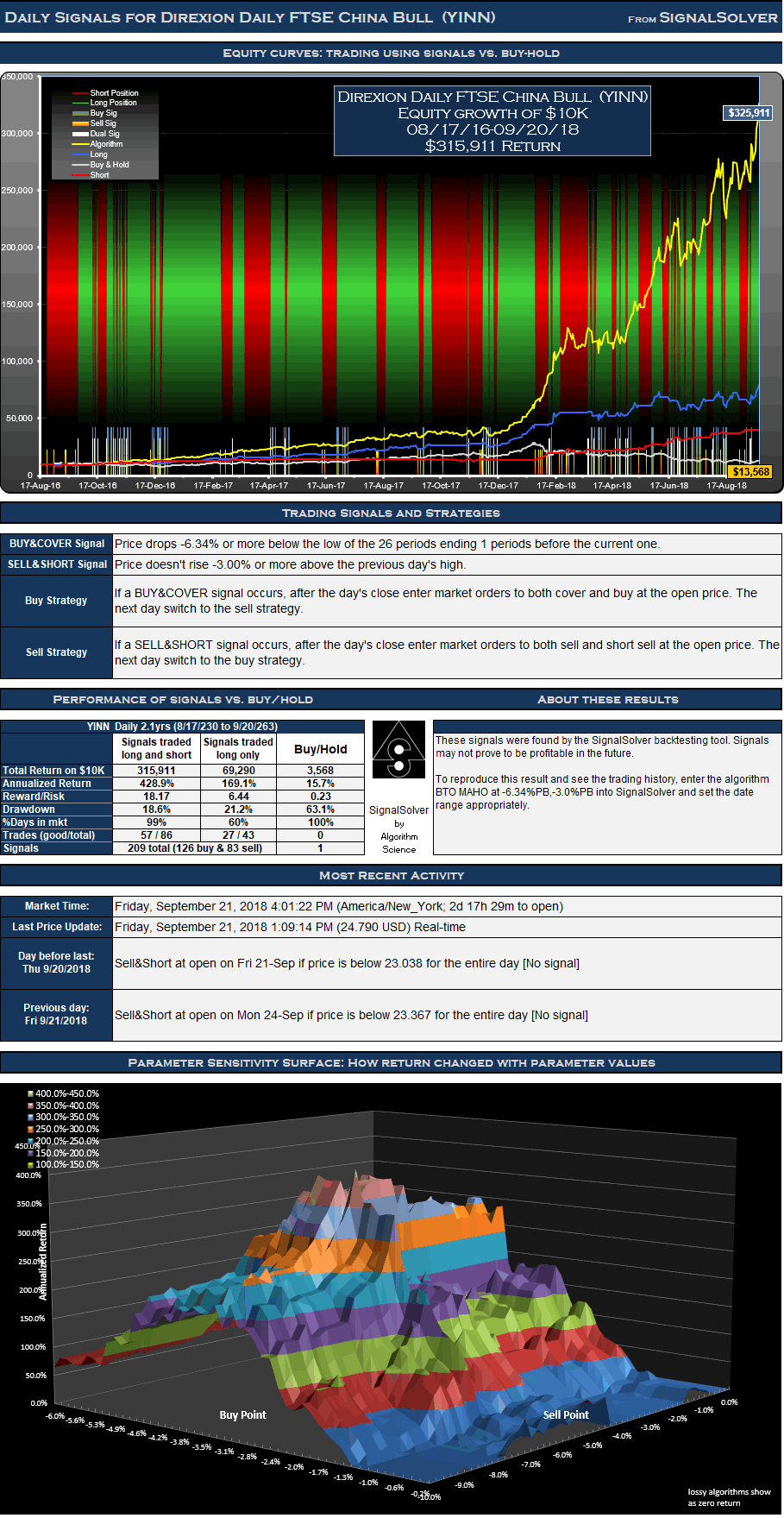

The Direxion Daily FTSE China Bull (YINN) signals shown below and traded as directed would have performed around 88.5 times better than buy-hold with an ROI of 3,159% for the period 17-Aug-16 to 20-Sep-18

The trading signals for Direxion Daily FTSE China Bull (YINN) were selected for their reward/risk and parameter sensitivity characteristics. Backtests don't always generate reliable signals which can be counted on moving forward but many traders find value in knowing what buy and sell signals would have worked well in the past.

Returns for the Direxion Daily FTSE China Bull (YINN) signals

For the 528 day (2.1 year) period from Aug 17 2016 to Sep 20 2018, these signals for Direxion Daily FTSE China Bull (YINN) traded both long and short would have yielded $315,911 in profits from a $10,000 initial investment, an annualized return of 428.9%. Traded long only (no short selling) the signals would have returned $69,290, an annualized return of 169.1%. 59.6% of time was spent holding stock long. The return would have been $3,568 (an annualized return of 15.7%) if you had bought and held the stock for the same period.

Signals and Trades

Not all signals are acted upon and signals are often reinforced in this type of strategy. If you are long in the security, buy signals are not acted on, for example. Similarly if you are short you must ignore sell signals. There were 126 buy signals and 83 sell signals for this particular YINN strategy .These led to 43 round trip long trades of which 27 were profitable, and 43 short trades of which 30 were profitable. This is a daily strategy; daily OHLC data is used to derive all signals and there is at most one buy and sell signal and one trade per day.

Drawdown and Reward/Risk

Drawdown (the worst case loss for an single entry and exit into the strategy) was 19% for long-short and 21% for long only. This compares to 63% for buy-hold. The reward/risk for the trading long and short was 18.17 compared to 0.23 for buy-hold, a factor of 78.7 improvement. If traded long only, the reward/risk was 6.44. We use drawdown plus 5% as our risk metric, and annualized return as the reward metric.

The backtests assume a commission per trade of $7.