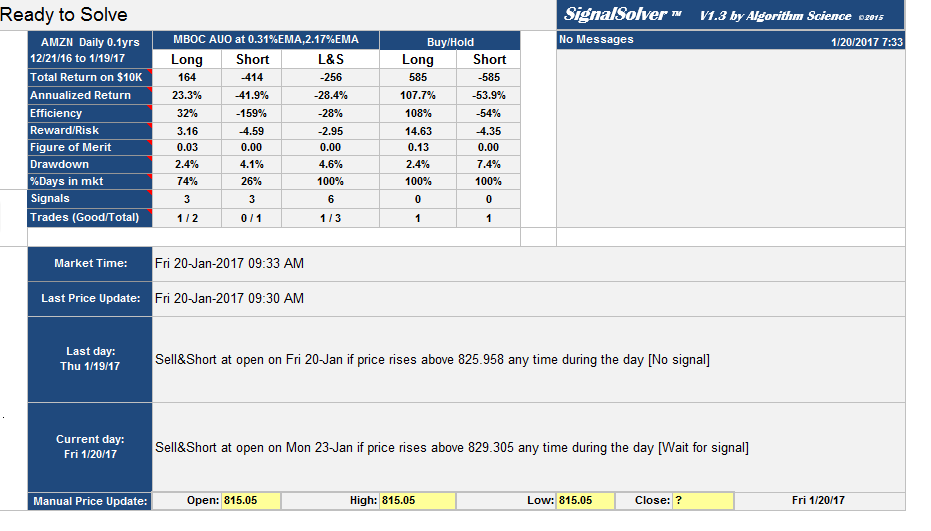

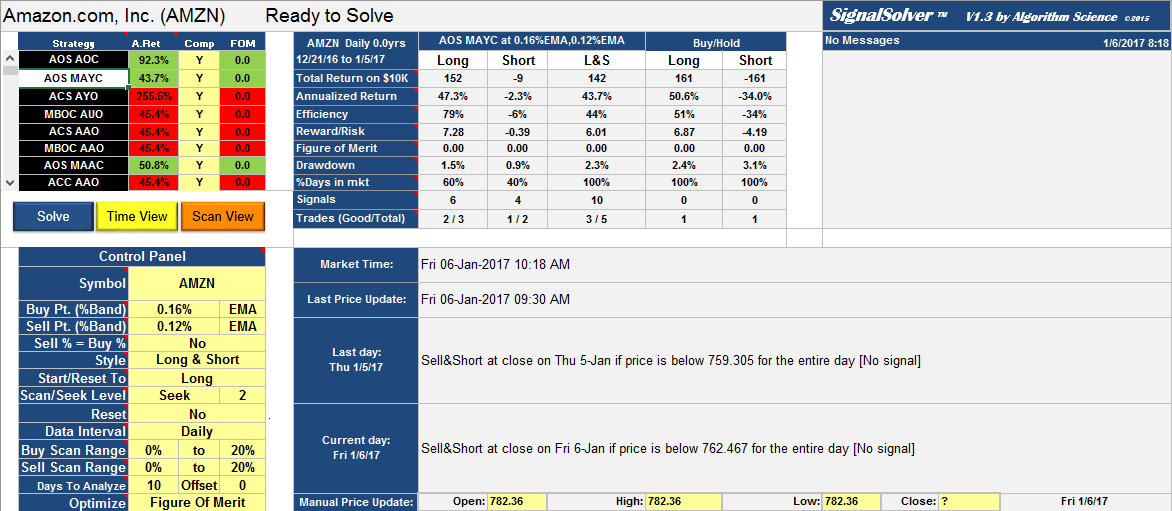

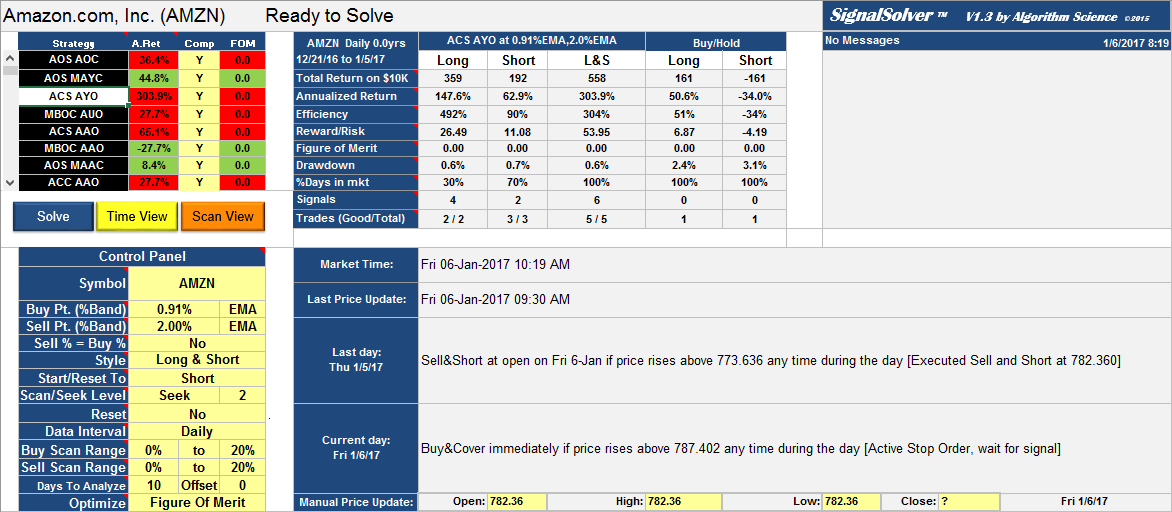

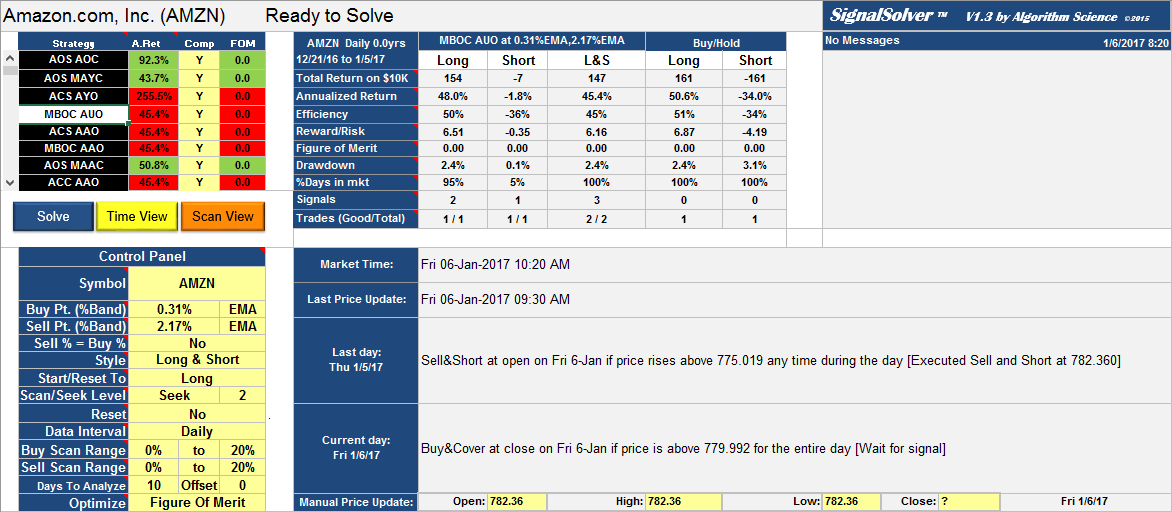

The out of sample multi-algorithm approach was quite successful for AMZN (see results) so lets do it live and see how it ends up. On Dec 21st, I did the optimization using the EMA band and Figure of merit optimization I have been talking about in the last few posts. For the next 25 trading days and maybe beyond, I will update the following trading guidelines for the top 4 algorithms. All these strategies were found using SignalSolver.

Update Feb 23rd 2017: Summary and Wrap Up: 10, 25 and 42 day

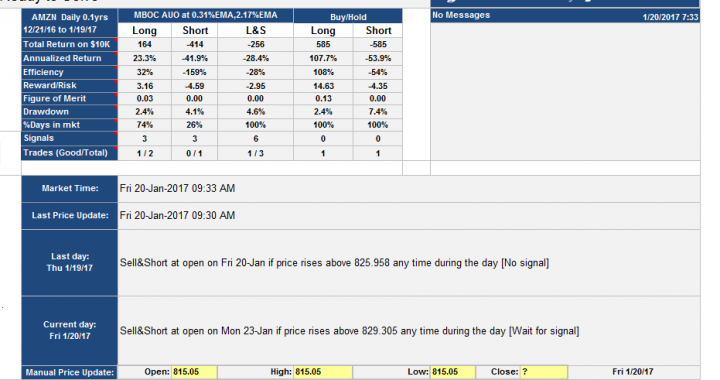

I'd like to wrap up this study by publishing the 25 day results as promised. Since yesterday was day 42, I've also added in the 42 day results although the algorithms were never expected to have a 42 day lifetime. I'm happy to report that the algorithms were profitable. As predicted, the 10 day results gave the best average annualized return (121%) for the algorithms, with a noticeable fall-off in the 25 day (56.6%) and subsequent 42 day (39.3%) results:

This study was done over a time period of unusual gains in the stock market and AMZN, the algorithms for 25 day and 42 day failed to keep up with buy/hold. But if you focus on that, you would be missing the most important point--that following the algorithms eliminates all the buy/sell/short/cover decision making.

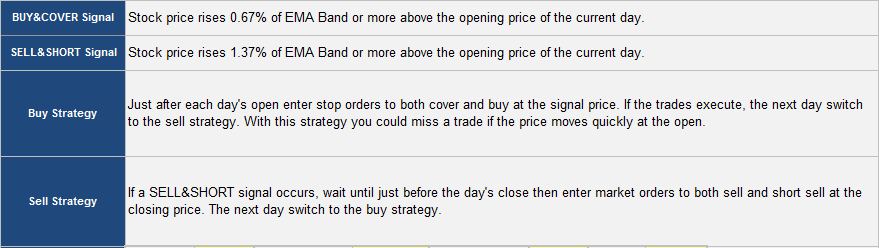

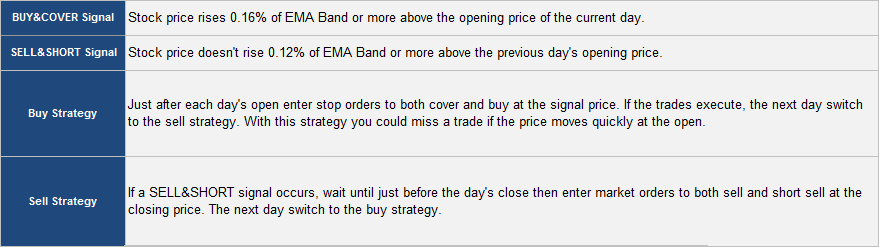

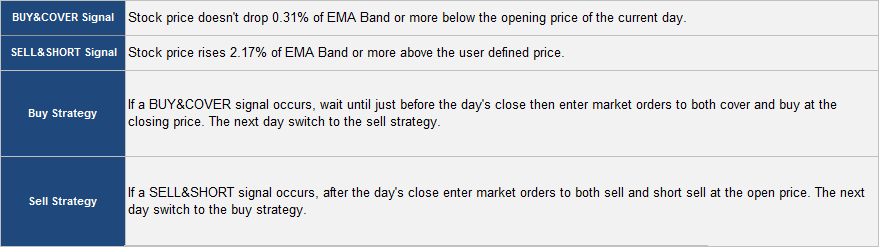

The Strategies

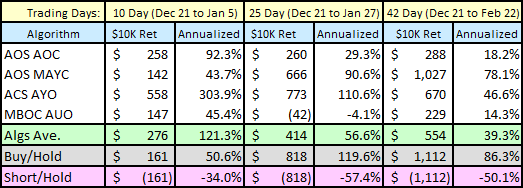

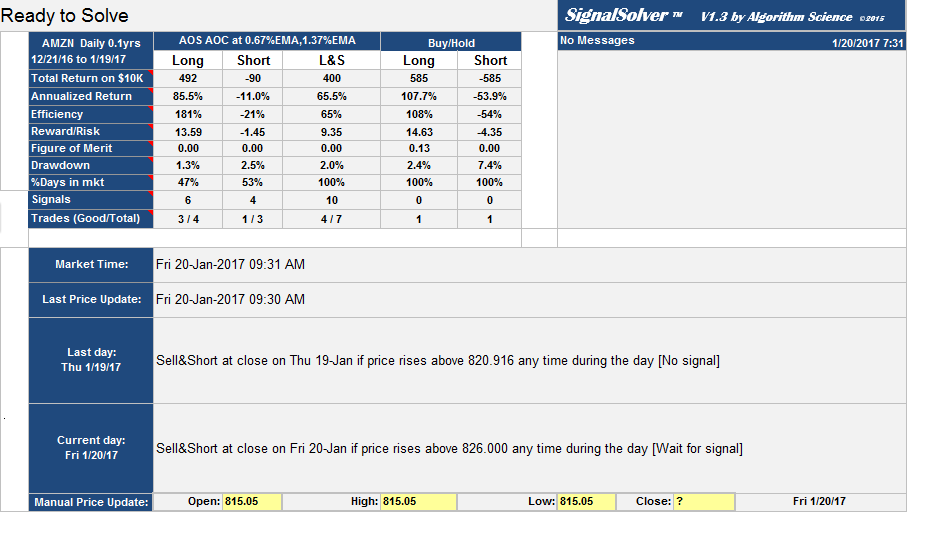

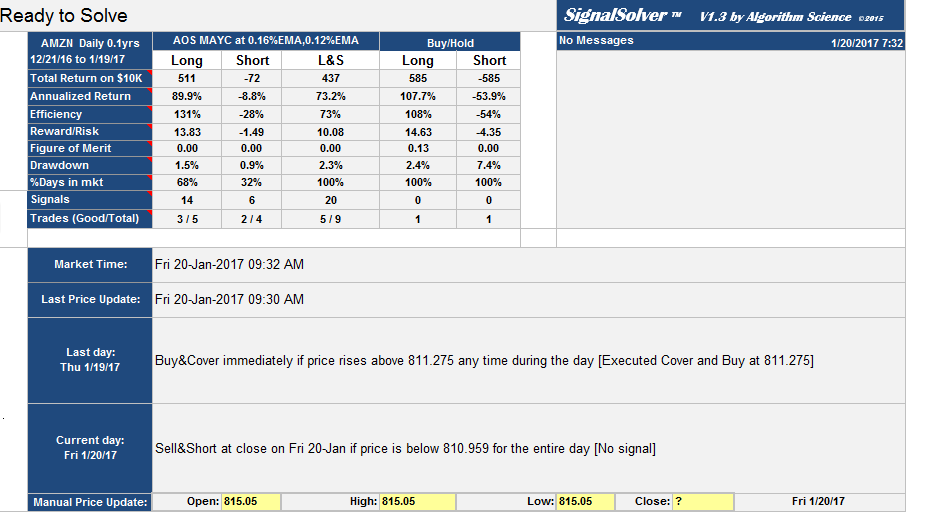

The following sections were updated daily during the course of the live study, so that readers could follow along with the four algorithms as they progressed day to day. The last day published this way was day 20 which is shown below.

AMZN Top 4 Algorithms: performance update at day 10 (Jan 5th 2017)

Happy new year. If you had been following along for the last 10 trading days you would have seen me publish a daily description of each the trade before and after it was made, including the type of order to be placed and when, so there was no cheating--this was a live, real-time test.

At trading day 10 (yesterday Jan 5th 2017) I am pleased to report that all 4 algorithms are showing a profit: For $10K invested in each, alg 1 profit was $258, alg 2 $142, alg 3 $558, alg 4 $147. This includes all trading costs ($7 per trade) and was for Long and Short sides combined (see L&S columns below). Just the long side did almost as well (Long column below). Of 15 total trades, 13 were profitable. Average profit was $276 or around 95% annualized return. For the same period, buy-hold return was $161 or 50.6% annualized.

The point to note here is that the combined algorithms showed a profit. Not only that, they did a much better job of exploiting the price movements than either buy-hold or short-hold. The SignalSolver algorithms make buy-sell decisions based purely on numerical analysis of past price movements. As a technical analysis methodology I must say it did a good job in this case.

I will continue to give daily trade instructions just after each NYSE open. I will report performance out again on day 25, the end of the test period, although I expect it to decline as the algorithms age. After that we need to re-optimize to new algorithms as I expect performance of these 4 to fall off.