TQQQ Trading strategy using SignalSolver Sentiment

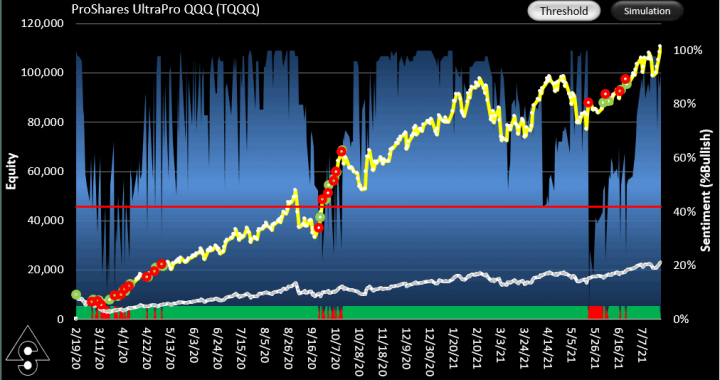

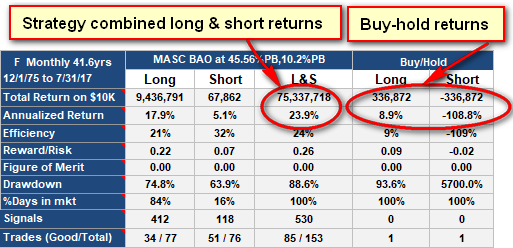

TQQQ trading using SignalSolver Sentiment Using multiple algorithms to drive trading strategy Original Post July 25 2021 Sentiment Sentiment usually refers to an analyst opinion on whether a financial instrument will increase in value (bullish sentiment), or decrease (bearish sentiment). However, in this TQQQ trading strategy using SignalSolver sentiment we are combining the opinion of […]