SIGNALSOLVER

A backtester to find trading signals

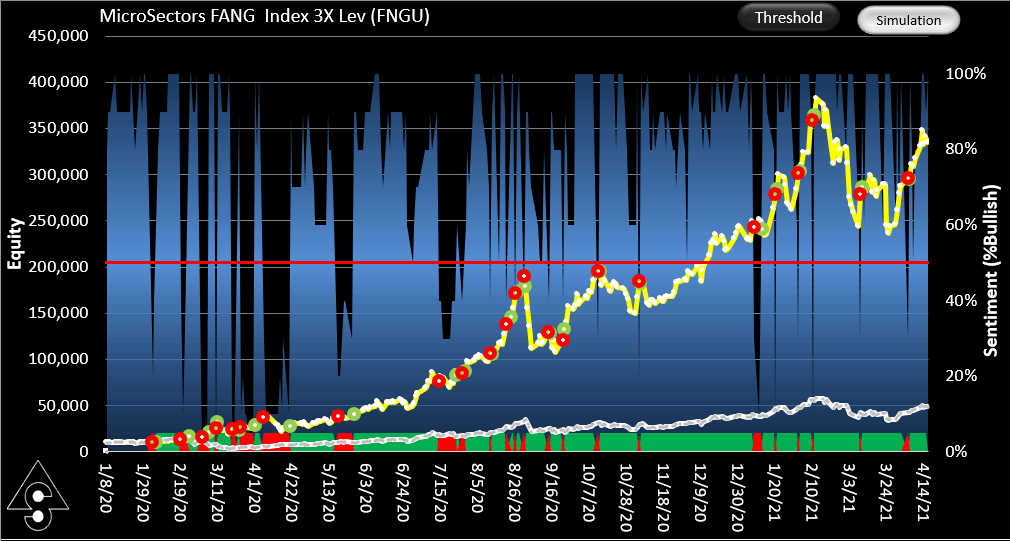

SignalSolver, is a backtesting program for finding which trading signals would have been winners in the past. In general, these signals will not work in the future. Below is an example using FNGU daily data with a $10,000 investment. You can see the buy-hold (white) return was $51,901 and the SignalSolver return (yellow) was $352,656.

Backtesting uses hindsight to find exploits of past price movements but lacks the foresight to fully exploit future price movements. Strategies found this way tend to have a limited and unpredictable lifetime.

SignalSolver Sentiment

A new feature in SignalSolver is the ability to take the pulse of multiple algorithms. On the day the above graph was made, the algorithm was long (bullish). If most other top algorithms were bullish on that day, then its a fair indication that you should be long (own) the security. We call the percentage of bullish algorithms the SignalSolver Sentiment.

As time progresses, algorithms move in and out of the rankings, and the sentiment adapts automatically to algorithms as they strengthen or weaken. No need to pick and choose algorithms, it's automatic.

The graph below shows the result of using SignalSolver Sentiment to trade FNGU. The Sentiment for the top ten algorithms is shown as a blue histogram. The white line is buy-hold. The yellow line is the simulated result of trading according to the daily sentiment reading. The trading system is simple, read sentiment after the close and buy at the next open if Sentiment crosses above 50%, but short sell if Sentiment crosses below 50%.

This result in this case was 10x better Reward/Risk than buy-hold. Its not always quite so easy to find a winning strategy without a little tweaking. But this example demonstrates quite well what the indicator is capable of.

TRADING SIGNALS AND STRATEGIES

See some of the signals and strategies we've found over the years