Today I present two TQQQ trading strategy backtest results with weekly setup with similar reward-risk but very different characteristics. TQQQ is the ProShares UltraPro QQQ, a triple leveraged ETF tracking the Nasdaq. The backtests were for the 288 weeks 2/11/10 through 8/14/15.

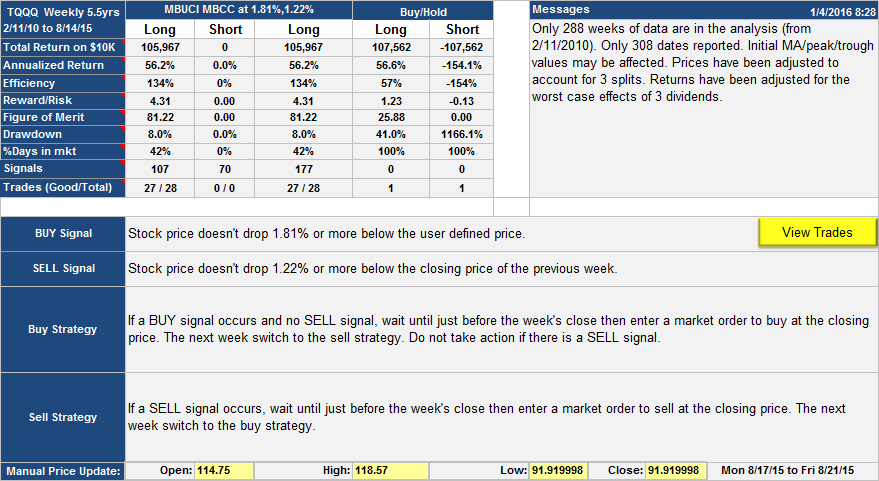

The first trading strategy was found by optimizing the scanner for low drawdown, (per Prasad’s request):

Backtest results for weekly TQQQ trading strategy showing low (8%) drawdown. The backtest is for the period 2/11/10 to 8/14/15.

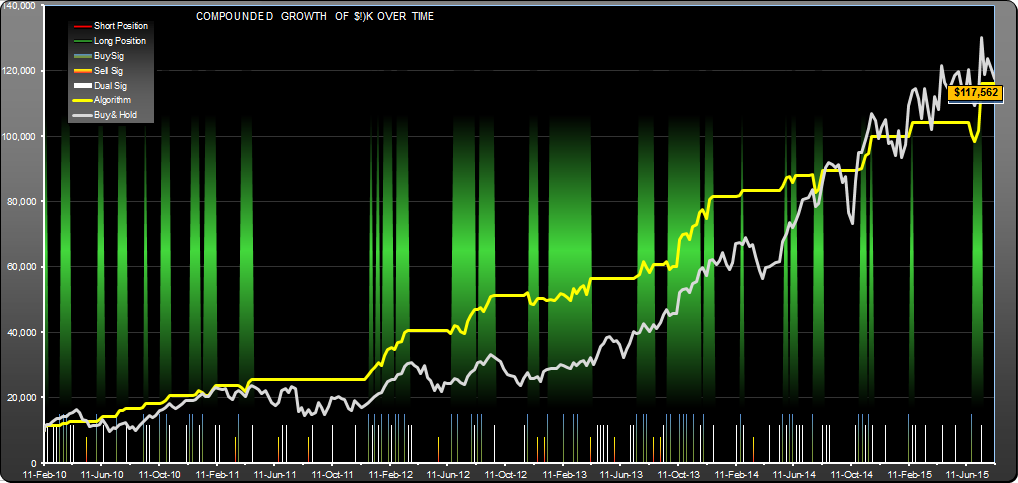

This strategy gave similar return to buy/hold with much lower drawdown (8% vs. 41%). It only spent 42% of the time in the market, so it was quite efficient. The user defined price is found by averaging the open price of the current week, the previous week’s low price and the previous week’s high price. Here is the equity curve:

Equity curve for the low drawdown TQQQ trading strategy backtest. Return is about the same as buy/hold.

These results were corrected 1-4-2016 to fix the short-hold return.

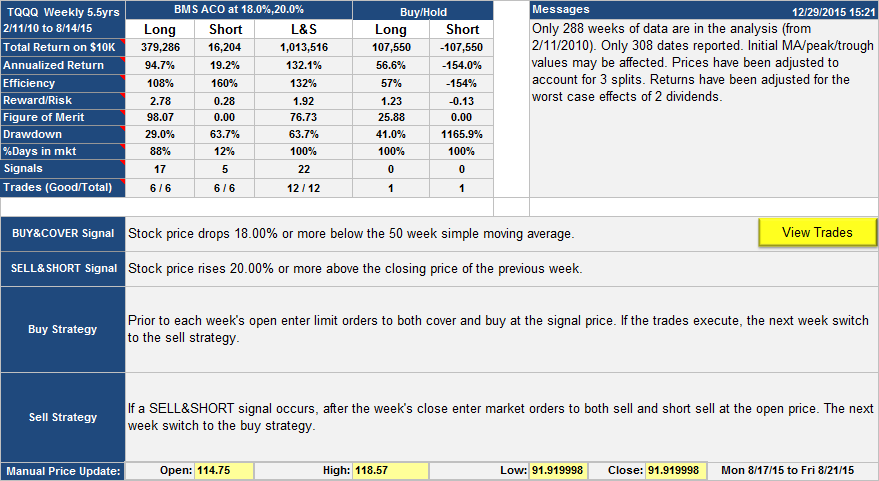

The second TQQQ trading strategy backtest was found by optimizing the SignalSolver scanner for returns:

This is a long & short strategy when you are were always in the market either long or short. The equity curve shows that this was not a frequent trader, in fact no trades since Dec 2011:

List of trades: TQQQ.W RR .

Andrew

Please note: All trading strategies are backtested on a single security and will typically not give similar results on other securities. All returns are compounded. Trading costs are assumed to be $7.00 per trade with zero slippage.

The posting was corrected 12/29/2015 for an error in the short-side returns of the BMS ACO algorithm.

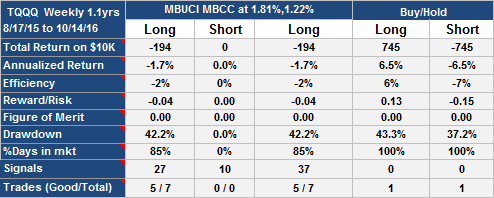

Update 10-20-2016

BMS ACO has continued to track buy-hold with no trades adding 7.45%.

This strategy peaked 11/30/2015.