The portfolio and methodology for this multi algorithm study are described in my previous post. Here are links to the results spreadsheets:

EMA/Figure of merit optimization periods: Sept 2014-15 Jan 2014-15 June 2015-16

PB/Return optimization period: Jun 2015-16

On these spreadsheets you can use the autofilter to include and exclude stocks of interest. For any stock you can click on the + sign on the left to see detailed results for each of the 8 algorithms used in the analysis. If you change the "Algs Included" cell, it will change the number of algorithms included in the averaging and summarized below the portfolio. For example, if you set it to 5 the top 5 algorithms for each stock in the portfolio (that is in the autofiltered list of stocks) will be averaged. If you set it to one, you will only include the top (best performing) algorithm. These calculations are also done automatically in the data tables below, and displayed on the graphs.

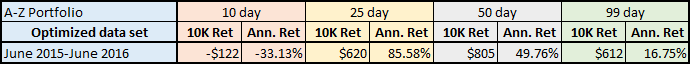

A-Z Portfolio June 2015-16 Optimizations

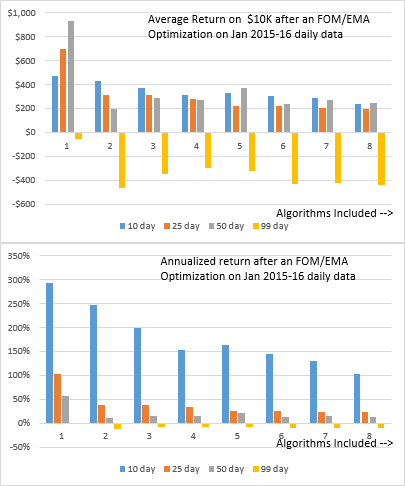

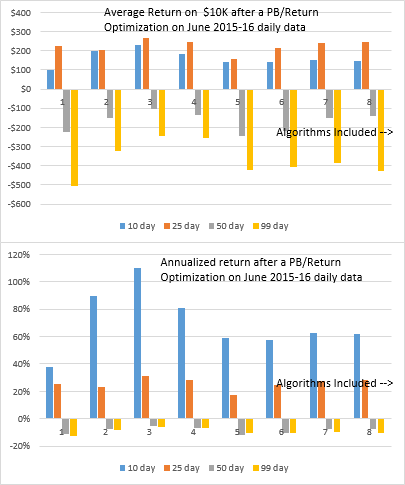

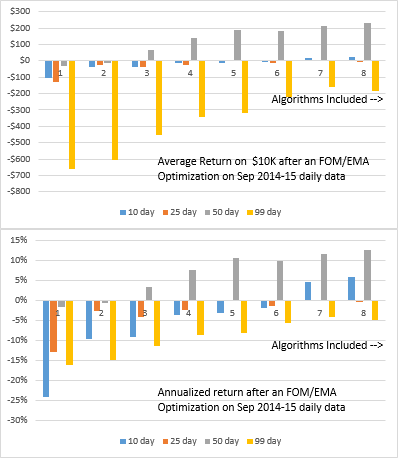

The top graph in each set shows the average return on $10K on running from one to 8 algorithms for a 10day, 25 day, 50 day or 90 day period on the out-of-sample data immediately following the 250 days of data the optimization were run on. So, for example, for the stock A (Agilent), the algorithms were found by using the data from June 15 2015 to June 9th 2016. The 10 day result was on the data from June 13th 2016 to June 24th 2016. The 25 day result was on data June 13th through July 18th 2016, and so on. These are trading days, not calendar days.

The buy-hold performance of this portfolio is shown below:

So if you had correctly guessed to go short for the 10 day period and long after that, you would have made more profit. On the other hand, if you had guessed wrongly, you would have been better off following the algorithms.

Percentage Band/Return optimization vs. EMA Band/Figure of Merit optimization

A three algorithm average for the PB/Return optimization for June 2015-16 gave the best Annualized Return (AR) results overall, much better than just running one algorithm. But there seems to be little point in running them beyond 10 days--profits barely increased for the next 15 days and by 50 days had soured into a loss.

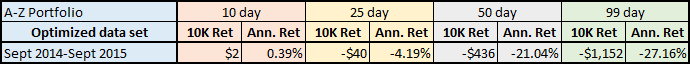

The EMA/FOM algorithms had better longevity and, on average, were not lossy until after 50 days. Peak profits were at 25 days and slightly better than those for PB/Return, but best AR was still at 10 days, the same as the PB/Return result but in most cases lower.

The Figure of Merit optimizations gave more consistent results than simply optimizing for return, especially when averaged over several algorithms.

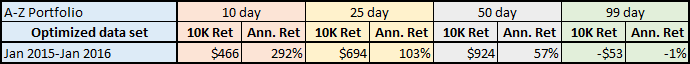

A-Z Portfolio Jan 2015-16 Optimizations

Again we see a breakdown in returns for the 99 day runs, but the shorter time-frame runs are all positive. Buy-hold performance for the same periods are shown below:

Again we see a breakdown in returns for the 99 day runs, but the shorter time-frame runs are all positive. Buy-hold performance for the same periods are shown below:

Running a single algorithm on each stock in the portfolio realized most of the potential profit for the 10 and 25 day periods, but running for 50 or 99 days gave disappointing results. Averaging across many algorithms did not lead to improvements.

Pingback: Multi-algorithm results for UWTI - Signalgorithm

Pingback: Multi-algorithm study results for NUGT DUST and X - Signalgorithm