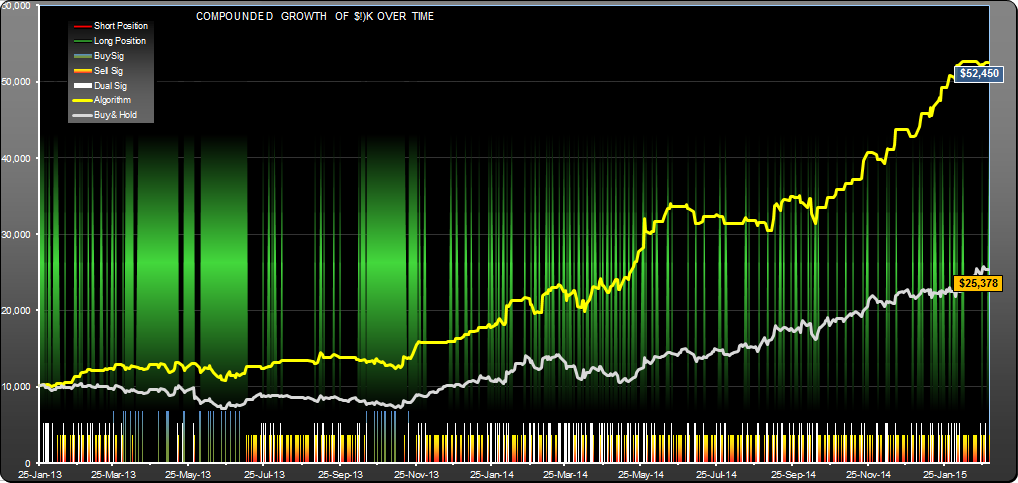

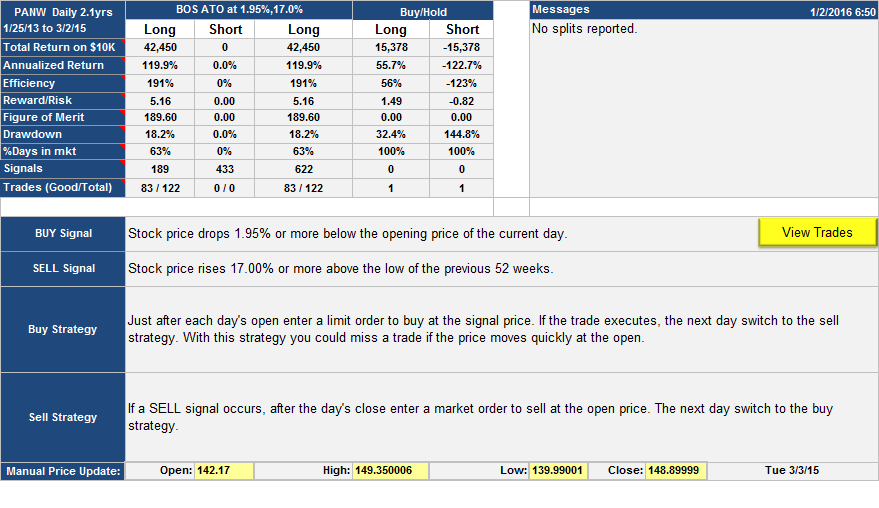

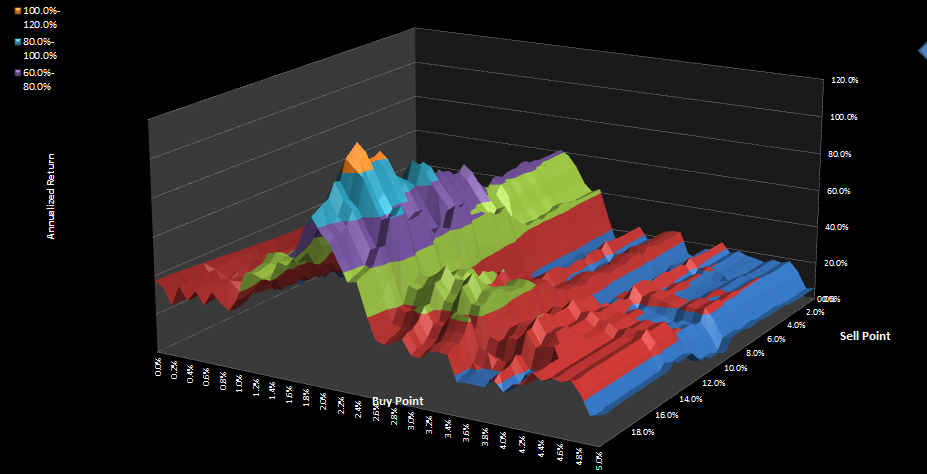

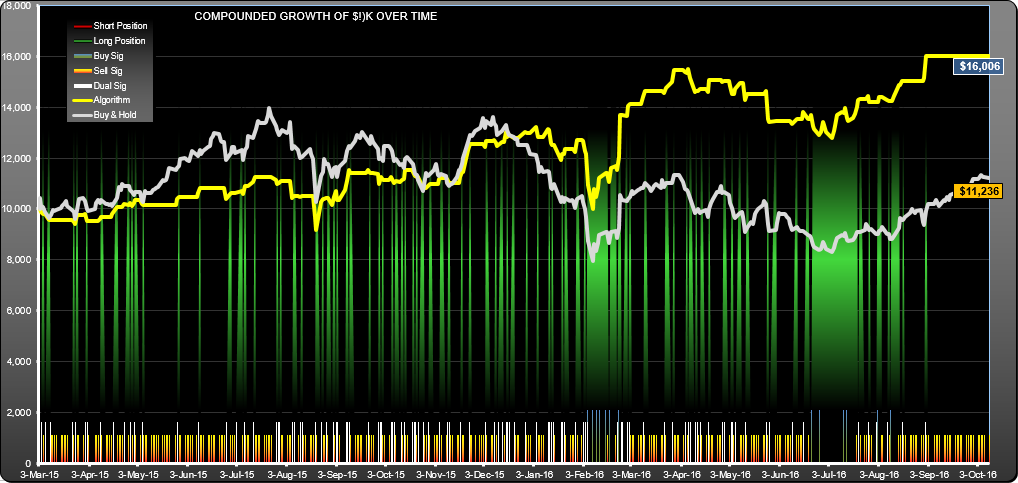

This Palo Alto Networks PANW trading strategy would have given a 119% annualized return. Here, I chose to show only the long side of the algorithm because its more impressive than the short side (which only gave 27% annualized return). To appreciate the algorithm more, notice that the efficiency of the algorithm was close to 200%. Efficiency (as we define it) is the annualized return divided by the percentage of time you were in the market. Its the return you would have received if you had realized the same return all the time as you had got while you were in the market. The theory is that since you are not in the market all the time, you could have invested the money elsewhere.

Efficiency only applies to long or short style algorithms, since if you were running both long and short (L&S) you are in the market 100% and efficiency equals annualized return.

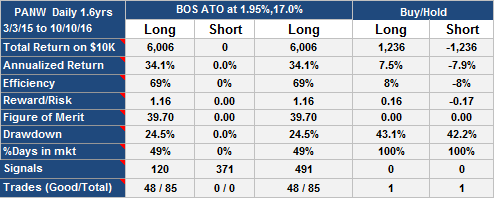

Update 10-10-2016

Algorithm continues to have better return, efficiency and drawdown than Buy/Hold. Buy-hold lost 12% annualized, this strategy made 28.7% annualized. Efficiency (55%) is what the strategy would have made annualized, had the money been invested at the same rate while the strategy was out of the market.

Here is a view of the performance since original publication in March 2015:

Update 5/26/2015

Since publication on 3/3/2015, the strategy has posted a gain of 1.5% while the PANW stock has posted a gain of 14.56%. There have been 11 trades, 5 profitable.

Andrew

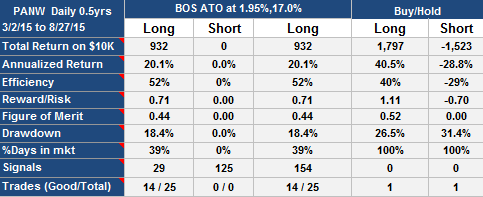

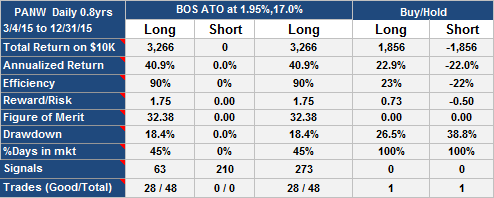

Update 8/28/2015:

Since the original post on 3/3/2015, the strategy has gained 7.16% with 18.4% drawdown while the stock has gained 12.68% with 26.5% drawdown. The reward-risk for the stock over this period is better than for the algorithm (1.11 vs 0.71). The algorithm was in the market 39% of the time making it a little more efficient than the stock (52% vs. 40%).