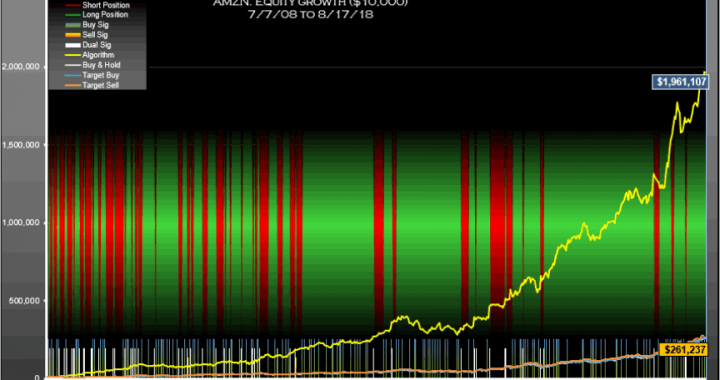

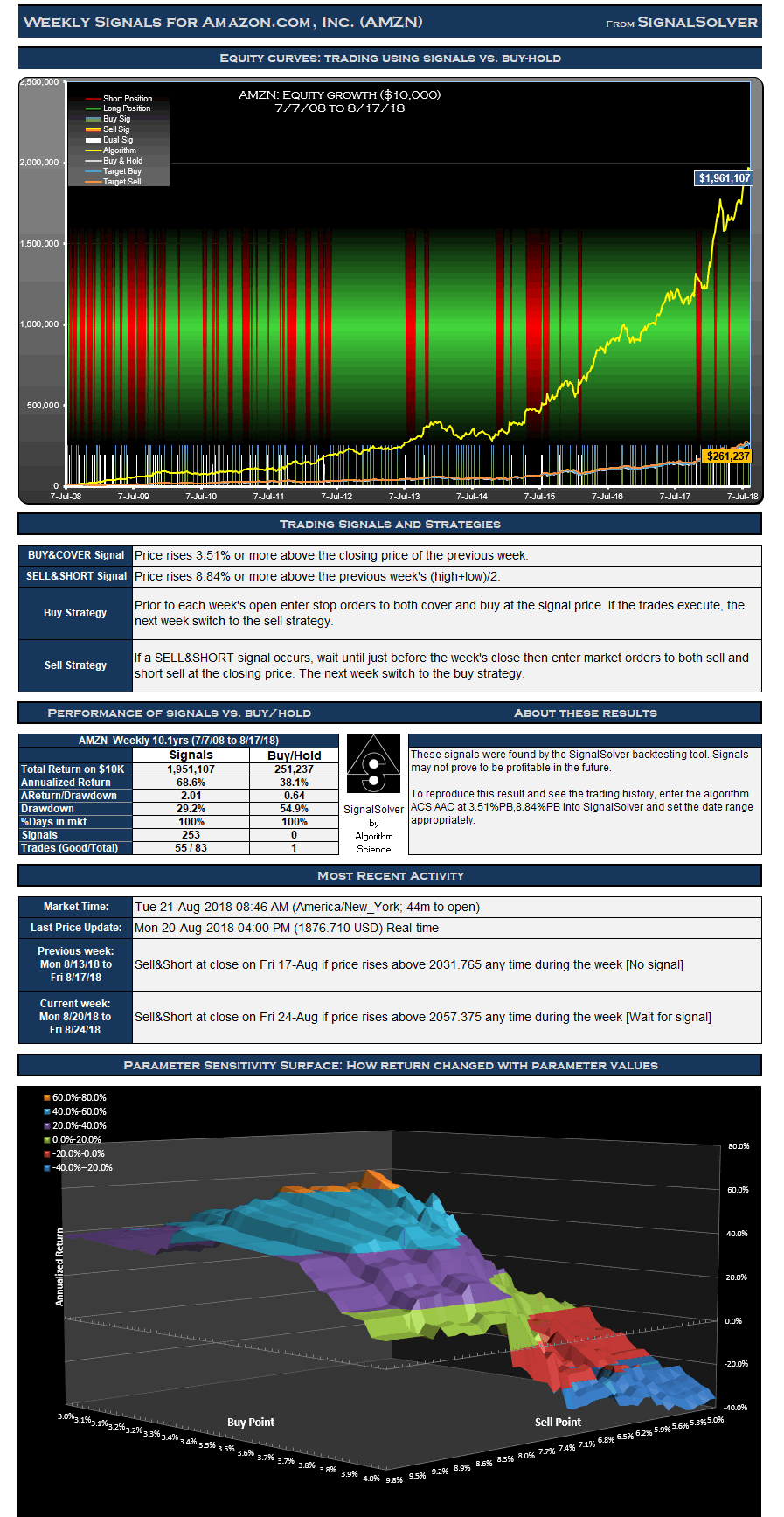

| For the 528 week (10.1 year) period from Jul 7 2008 to Aug 17 2018, these trading signals for Amazon.com, Inc. (AMZN) would have yielded $1,951,107 in profits from a $10,000 initial investment, an annualized return of 68.6%. If you had bought and held the stock for the same period the profit would have been $251,237 (an annualized return of 38.1%).

The trading style was Long & Short, meaning that you would be long or short the security at all times. For this type of strategy, not every signal is acted upon and signals are often reinforced. If you are long in the security, buy signals can be ignored, for example. Similarly if you are short you can ignore sell signals. For this particular AMZN strategy there were 198 buy signals and 55 sell signals.These led to 42 long trades of which 34 were good, and 41 short trades of which 21 were good. This is a weekly strategy, which means that weekly OHLC data is used to derive all signals and there is at most one buy and sell signal and one trade per week. Drawdown (the worst case loss for an single entry and exit into the strategy) was 29% vs. 55% for buy-hold. Using drawdown plus 5% as our risk metric, and annualized return as the reward metric, the reward/risk for the strategy was 2.01 vs. 0.64 for buy-hold, an improvement factor of around 3.2 |

Category Archives: Weekly Signals

Weekly signals are based on weekly Open High Low Close stock price data and lead to a maximum of one buy and one sell signal and one trade per week.

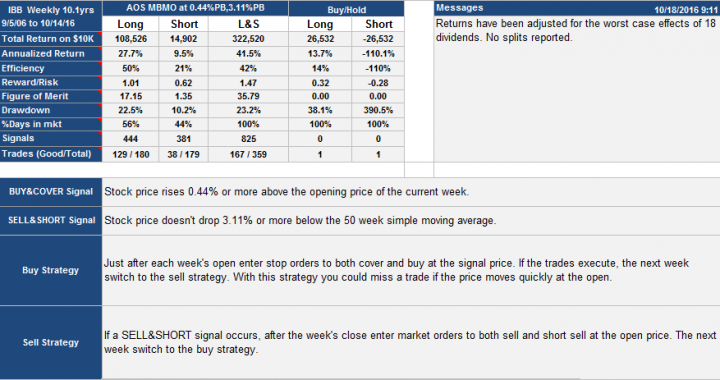

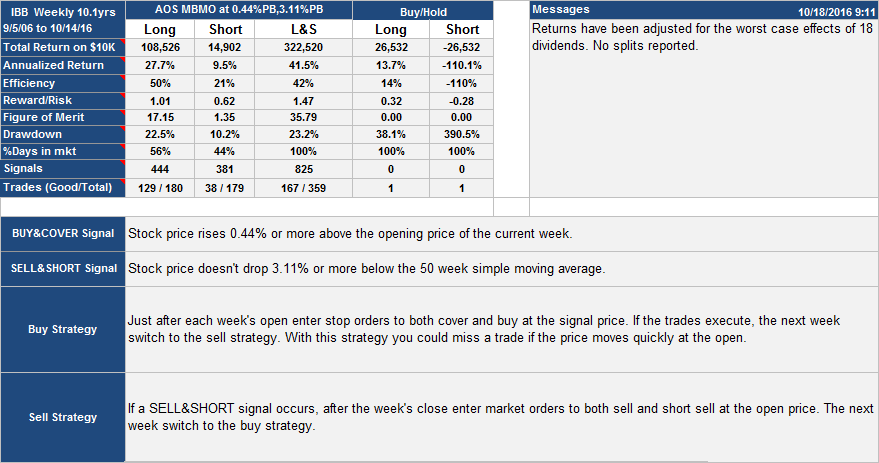

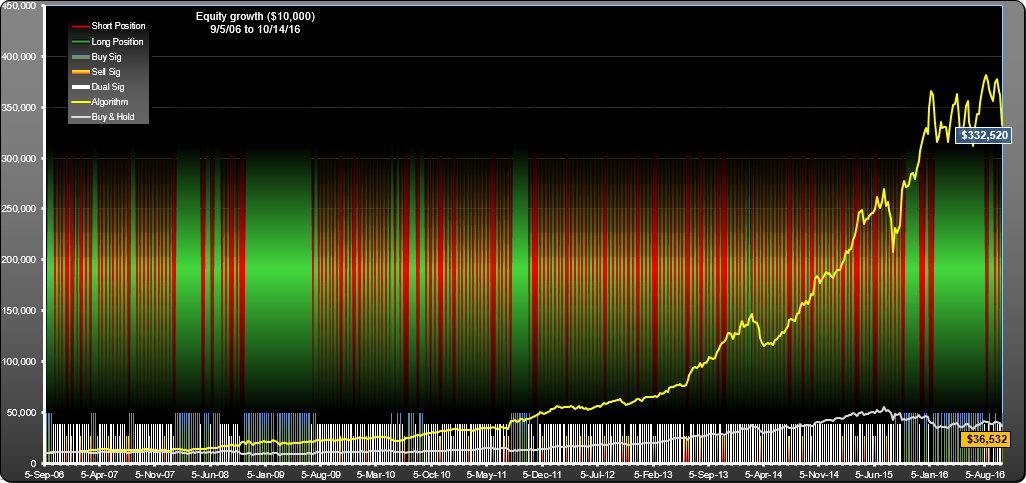

IBB Trading System (Weekly)

This weekly trading strategy for IBB had 3 times better annualized returns than IBB and more than 10 times better return over the 10.1 years. For each 2.5 year period within the 10 years, the annualized return was between 30 and 50%.

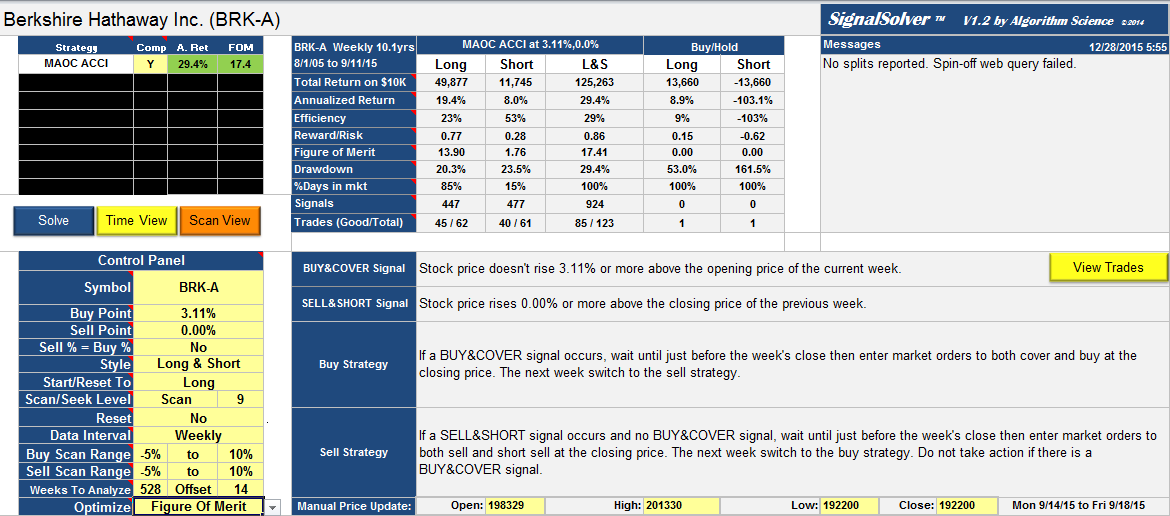

Berkshire Hathaway trading strategy

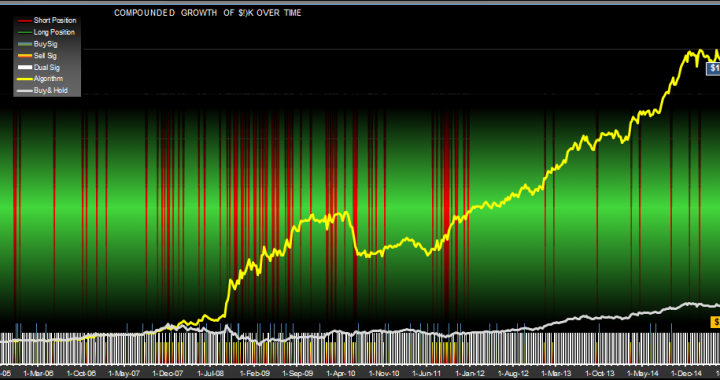

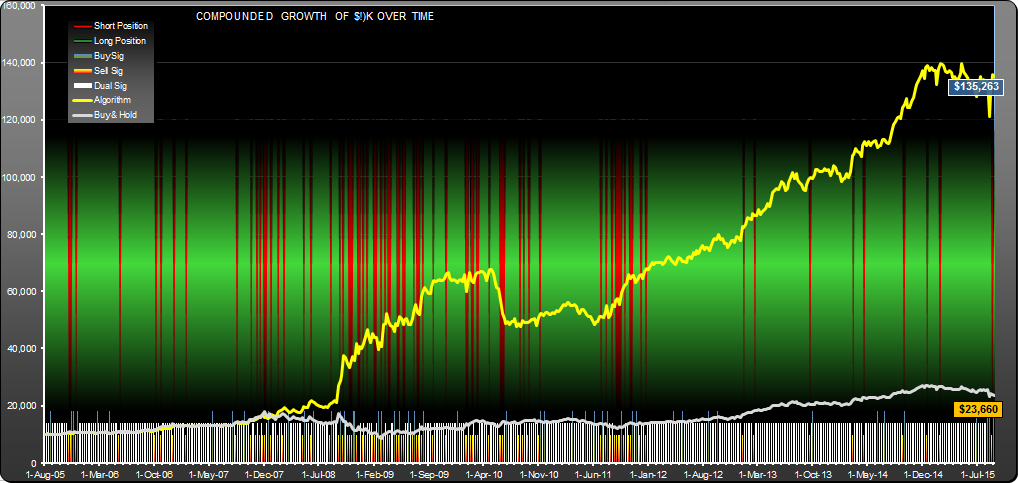

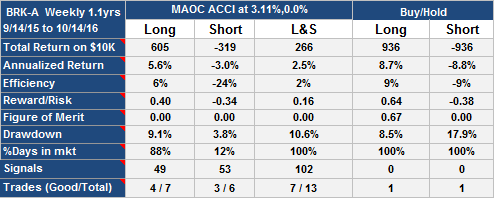

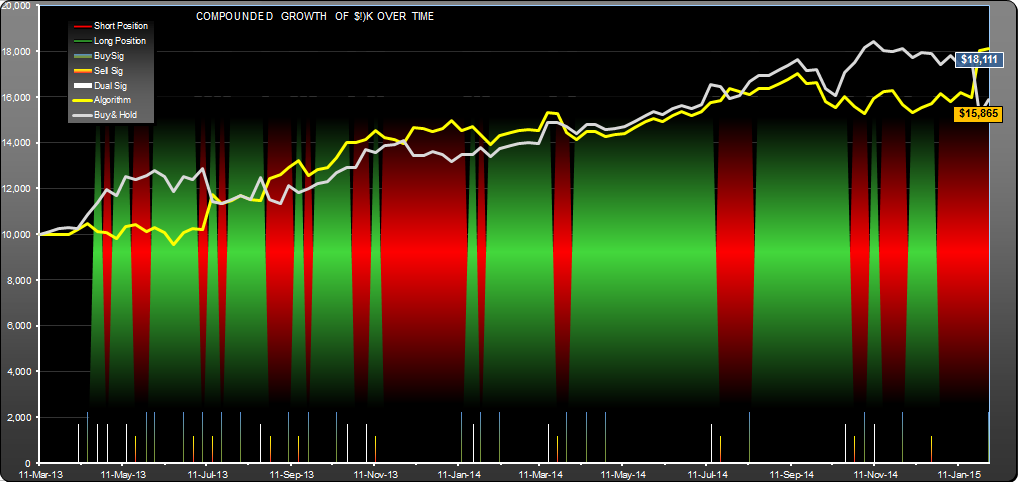

This is a Berkshire Hathaway trading strategy which would have given almost ten times the return performance of buy/hold over the last 10 years with half the drawdown. The strategy is detailed in the table below, it was straightforward, with 123 trades over the 10 year backtest period. All trading was done at the weekly close of business. This was a strategy where there was usually a buy and a sell signal every week (398 out of 528 weeks), but selling was initiated by the presence of a sell signal and an absence of a buy signal. There was a strong buy bias, appropriate for the underlying positive trend of the stock.

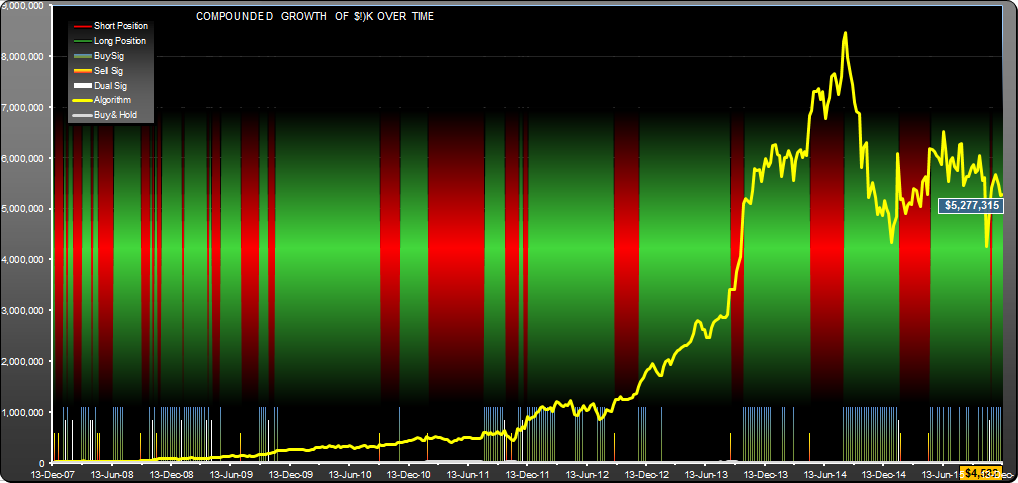

Equity curve, signals and positions are shown in the growth chart below. Notice the preponderance of white signals which indicate dual signal days.

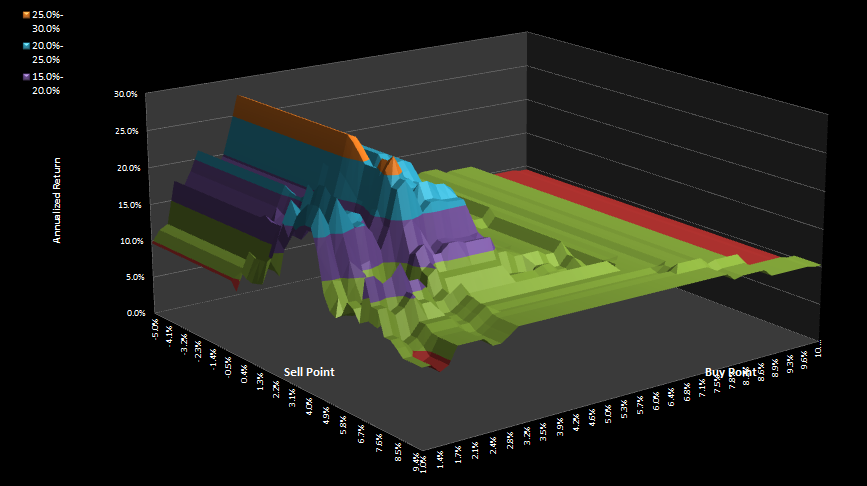

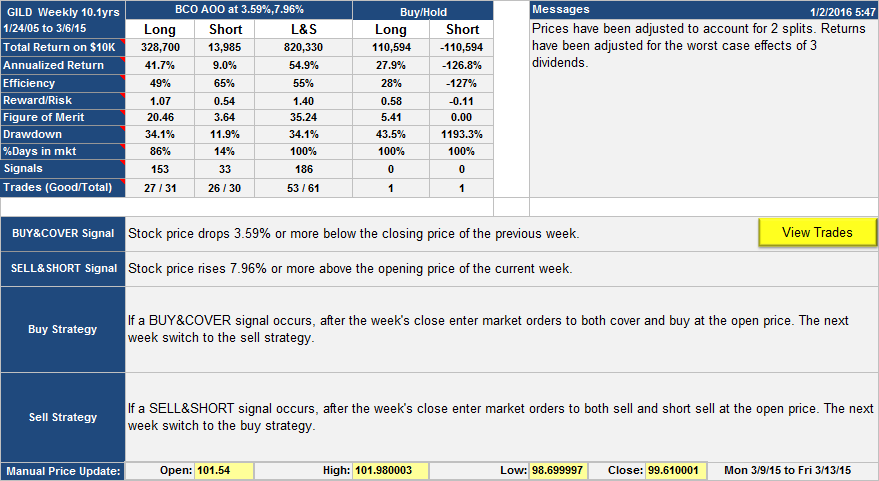

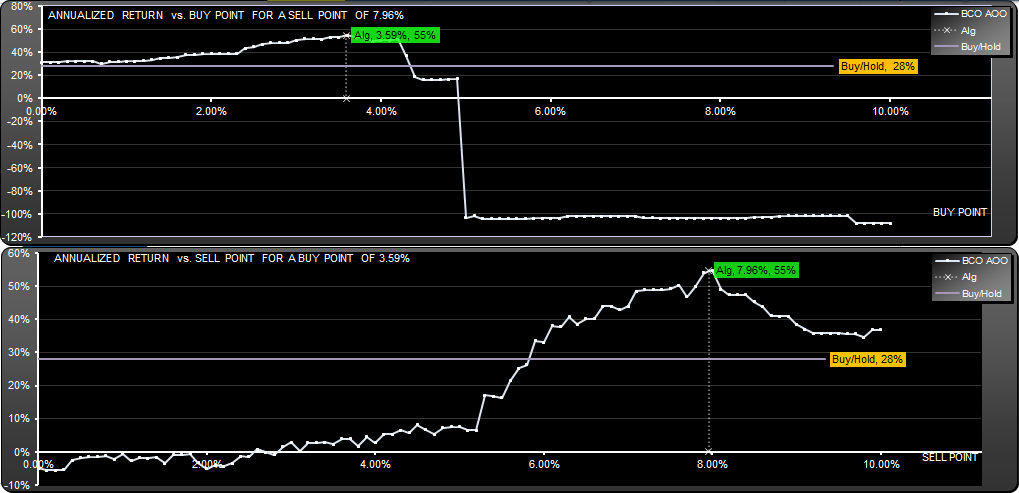

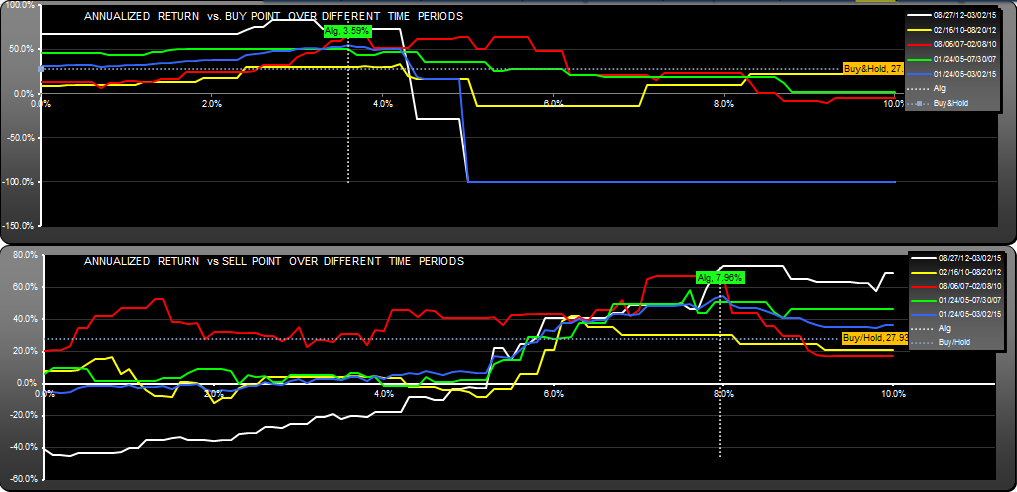

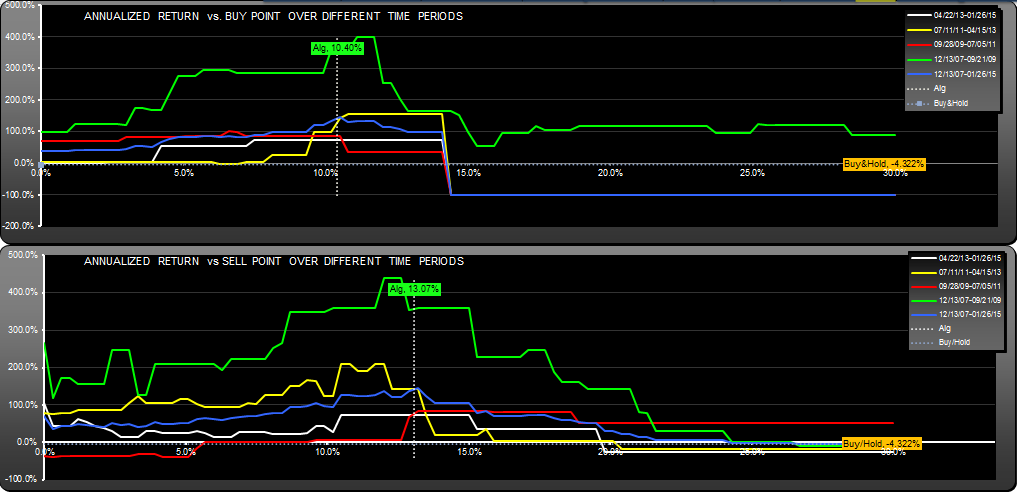

If the sell point was set at zero percent, the algorithm gave positive results for all buy points greater than 0.25%. Below we show how return varies with buy and sell parameters.

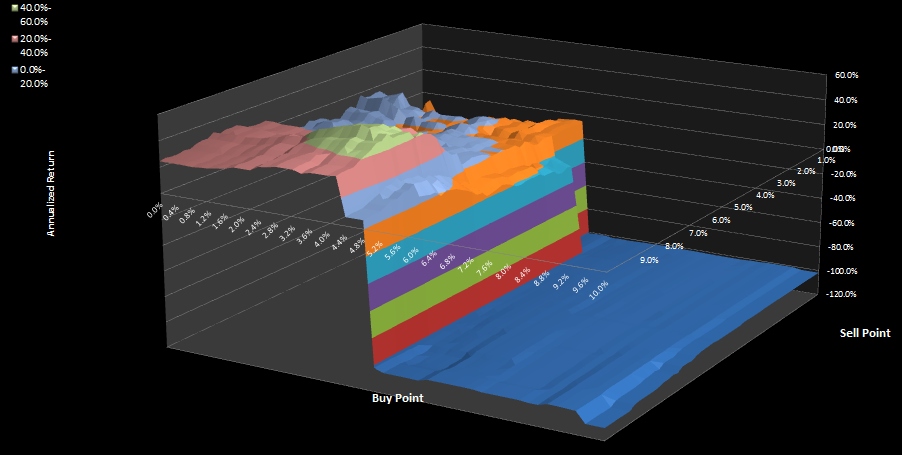

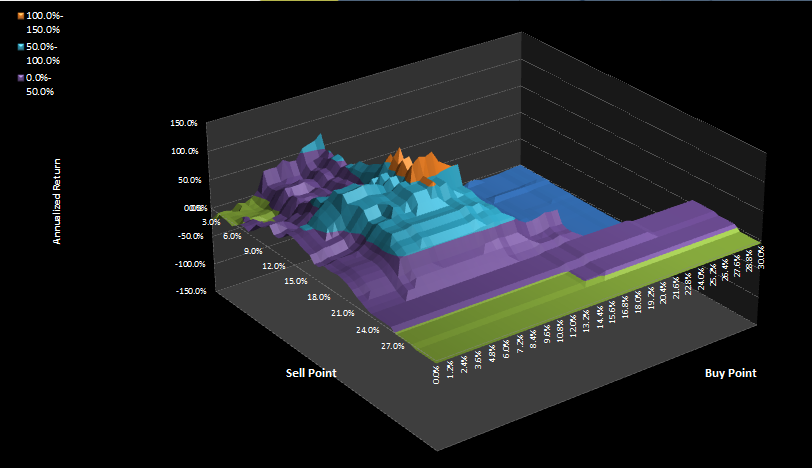

The returns for every combination of buy and sell parameter are shown in the surface plot below.

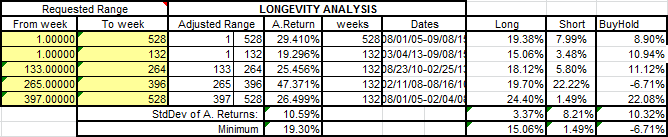

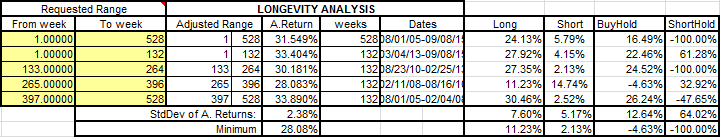

Looking at the minimum annualized returns for each of the four 132 week periods, you can see that the algorithm was much better behaved than the underlying stock, worst case was 19.26% which happened in the most recent quartus. The long side of the algorithm showed a min return of 15% with a stddev of only 3.37%, which is quite tight.

As always, this is not a recommendation to trade using this algorithm, just an interesting backtest result. For a list of trades, see here: BRKA.W Trades.

Please note, the above result was corrected 12/28/2015 to address a bug fix in the short side calculations.

Update Oct 21st 2016

GOOGL Trading Strategy (Weekly)

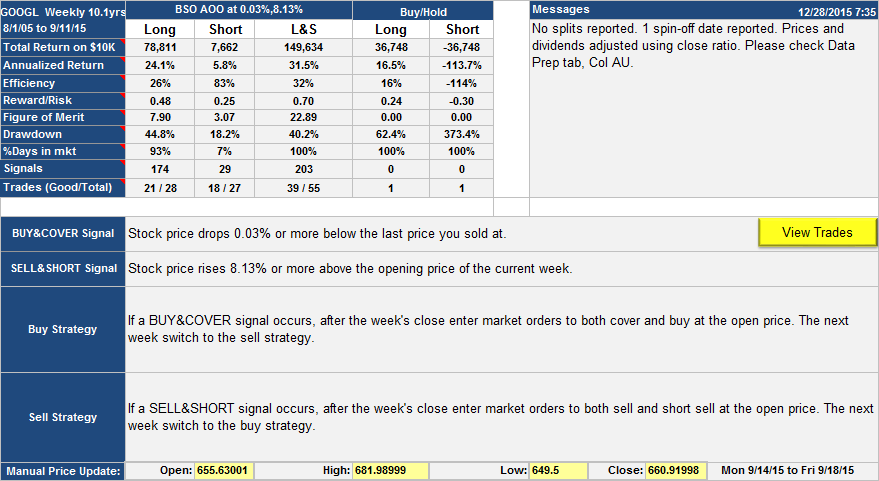

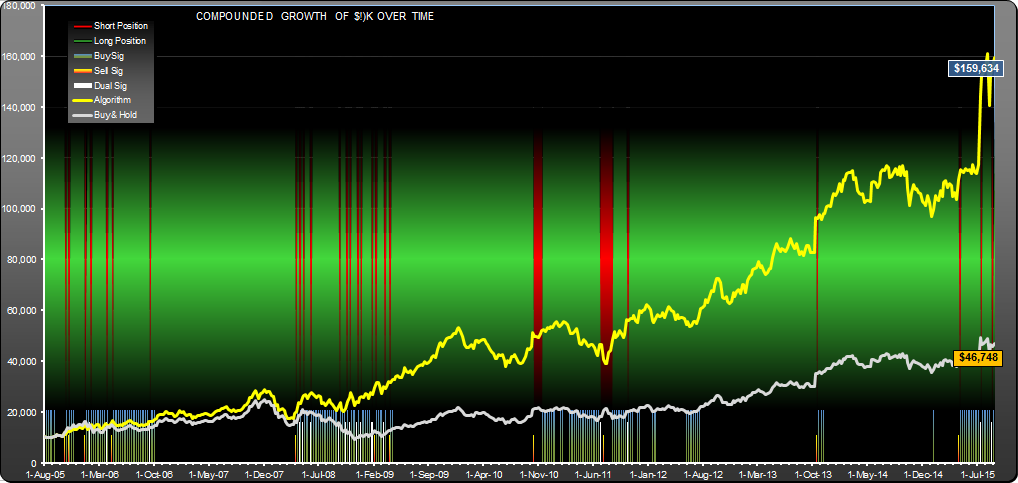

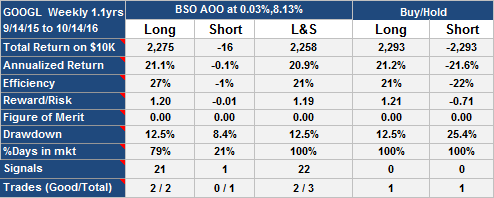

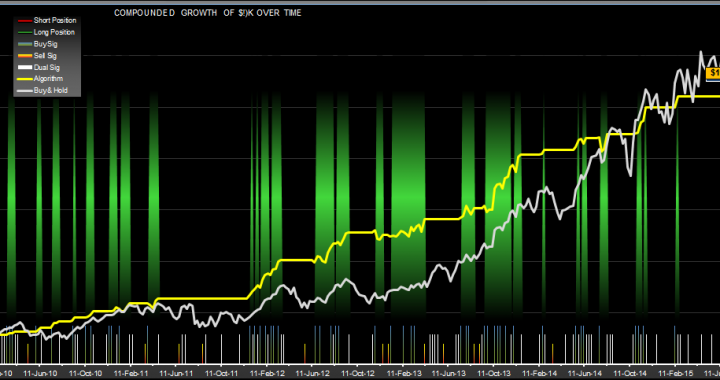

Here is a Google Inc (GOOGL) trading strategy with once a week intervention which would have performed significantly better than buy-hold over the last 10 years. Annualized return was 31.5% vs. 16.5% (returning $149K for 10K outlay vs $36.7K, compounded), drawdown was 40.2% vs. 62.4%, so reward/risk was better.

The buy and cover signal (see table below) was present every week where the price dropped 0.03% below the last price the stock was sold at which happened 174 times over the course of the 528 weeks of the analysis, and usually happened the week following a sell/short.

The sell and short signal happened every week the stock price rose 8.13% or more above the open price of the current week. This happened only 29 times, so there is a strong buy-side bias to this strategy. All trading would have been done at the open of the week following the signal.

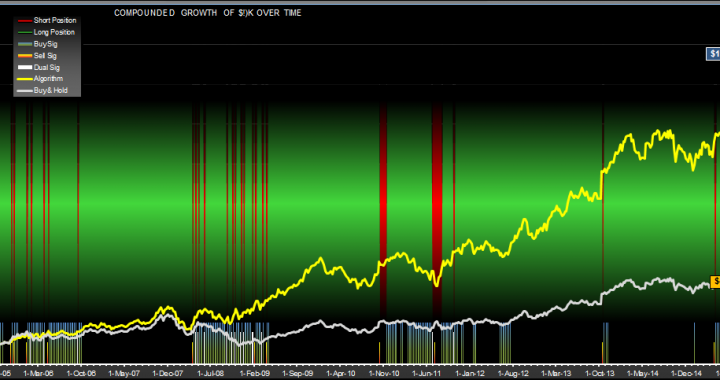

The equity curve for this GOOGL trading strategy shows that the stock was held short (the red bands in the background) for small periods, typically a week.

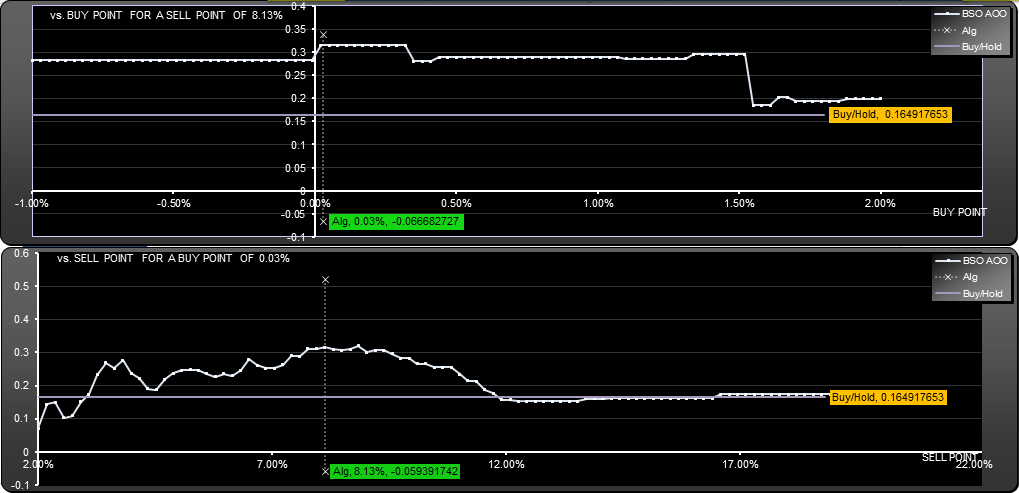

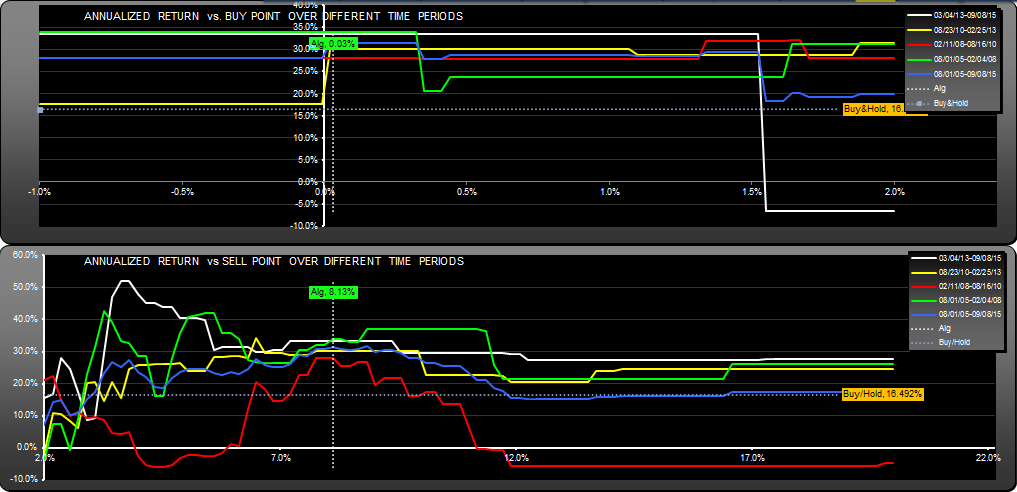

The scan below shows how the annualized return changed, had the buy and sell parameters changed. At 2.35% buy point, the algorithm gets stuck, resulting in a loss. This is characteristic of trading strategies which reference buy or sell prices. At 1.5% sell point and below, the algorithm made a loss, but returns for all buy points above that were positive, for the 0.03% buy point.

One nice characteristic this algorithm had was consistent returns for each of the 132 week periods in the backtest. You can see from the table below that the annualized return was between 28% and 34.8% for every period. Compare that with buy-hold which ranged from -4.6% to 26%

You can also see this characteristic on the scans for each quartus:

You can download the list of trades in .xlsx format: GOOGL.W Trades.

As of Sept 16th 2015, the algorithm is long, awaiting a sell signal if the price hits 708.933. Last sell price was 654.34.

Please note, while this is an interesting backtest result, it is not a suggestion to trade this way. As always I don’t know how this strategy will fare in the future, but will track it from time to time.

Andrew

This post was edited 12/28/15 to correct an error in the short-side returns.

Update Oct 21st 2016

This strategy has pretty much followed buy-hold long:

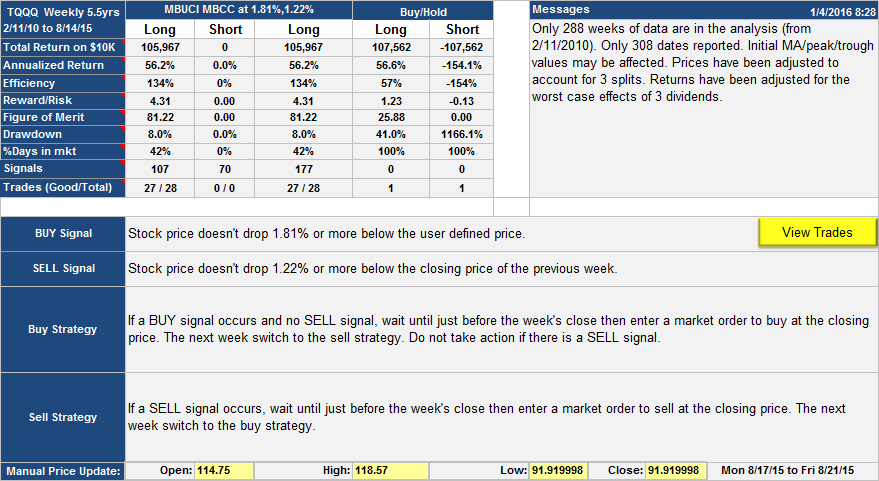

TQQQ Trading Strategy (Weekly)

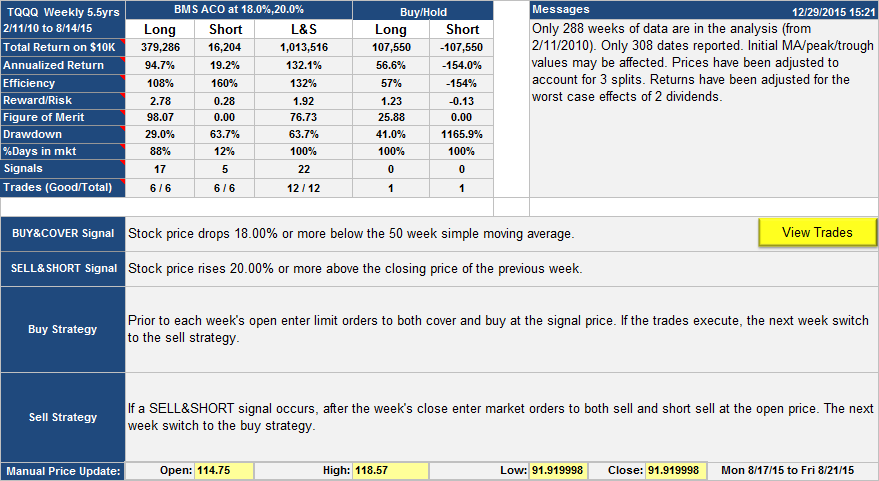

Today I present two TQQQ trading strategy backtest results with weekly setup with similar reward-risk but very different characteristics. TQQQ is the ProShares UltraPro QQQ, a triple leveraged ETF tracking the Nasdaq. The backtests were for the 288 weeks 2/11/10 through 8/14/15.

The first trading strategy was found by optimizing the scanner for low drawdown, (per Prasad’s request):

Backtest results for weekly TQQQ trading strategy showing low (8%) drawdown. The backtest is for the period 2/11/10 to 8/14/15.

This strategy gave similar return to buy/hold with much lower drawdown (8% vs. 41%). It only spent 42% of the time in the market, so it was quite efficient. The user defined price is found by averaging the open price of the current week, the previous week’s low price and the previous week’s high price. Here is the equity curve:

Equity curve for the low drawdown TQQQ trading strategy backtest. Return is about the same as buy/hold.

These results were corrected 1-4-2016 to fix the short-hold return.

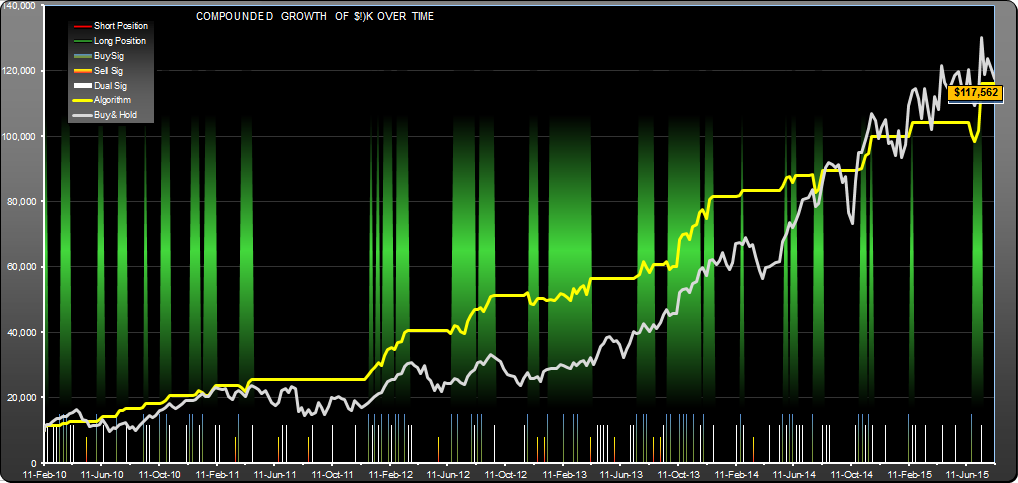

The second TQQQ trading strategy backtest was found by optimizing the SignalSolver scanner for returns:

This is a long & short strategy when you are were always in the market either long or short. The equity curve shows that this was not a frequent trader, in fact no trades since Dec 2011:

List of trades: TQQQ.W RR .

Andrew

Please note: All trading strategies are backtested on a single security and will typically not give similar results on other securities. All returns are compounded. Trading costs are assumed to be $7.00 per trade with zero slippage.

The posting was corrected 12/29/2015 for an error in the short-side returns of the BMS ACO algorithm.

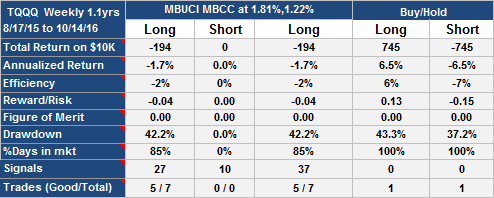

Update 10-20-2016

BMS ACO has continued to track buy-hold with no trades adding 7.45%.

This strategy peaked 11/30/2015.

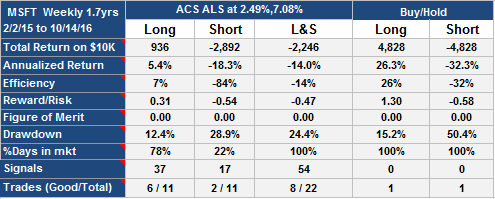

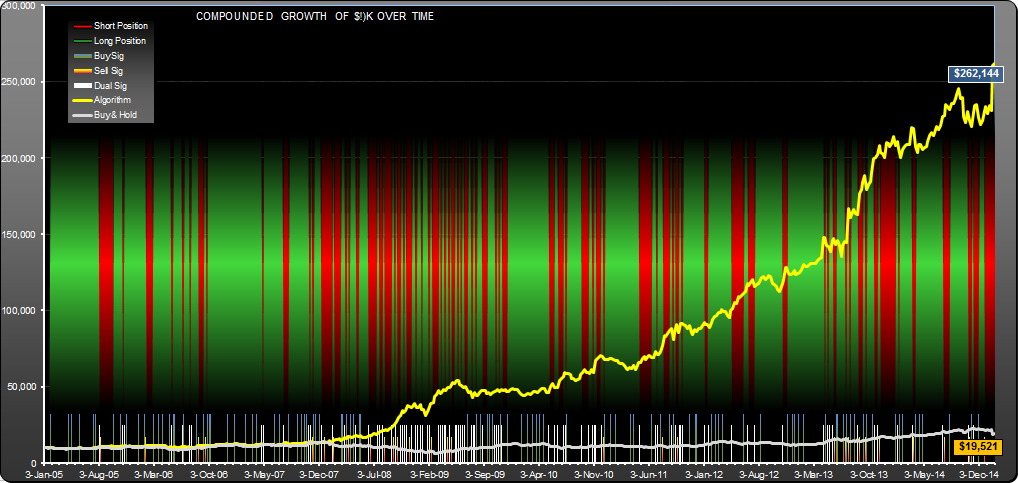

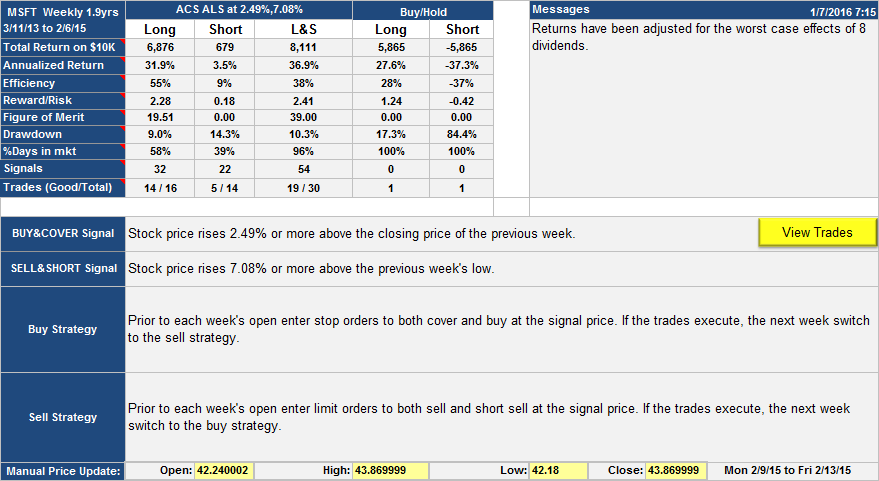

MSFT Trading System (Weekly)

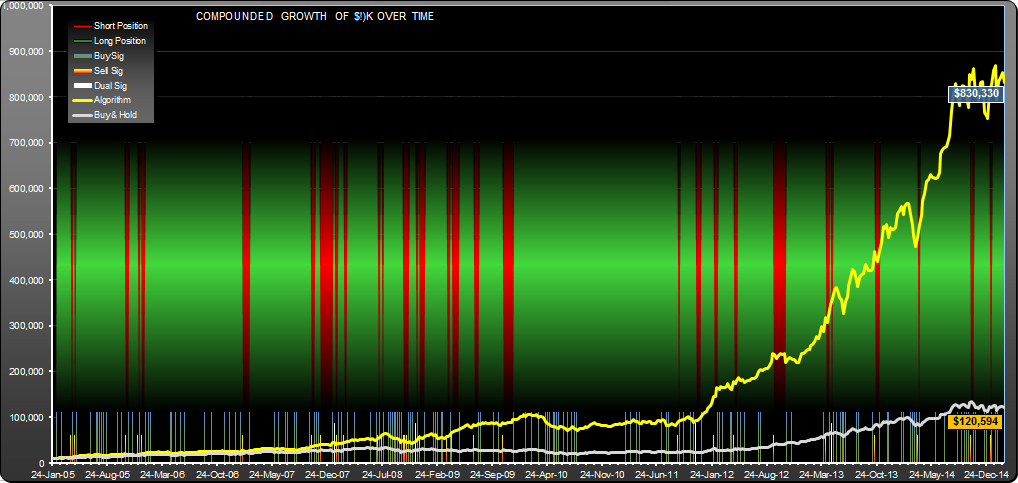

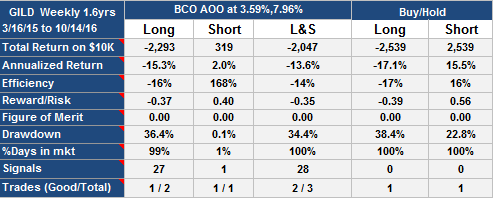

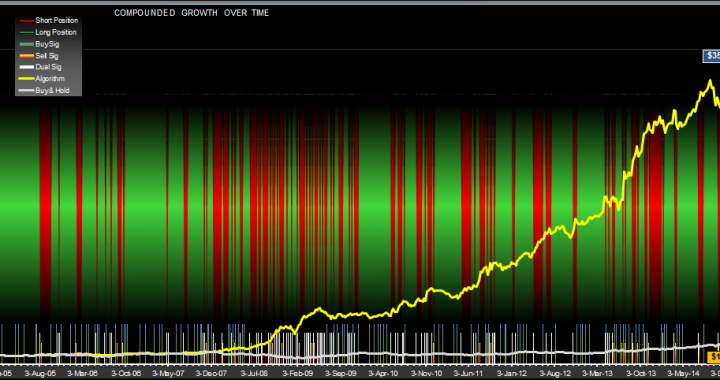

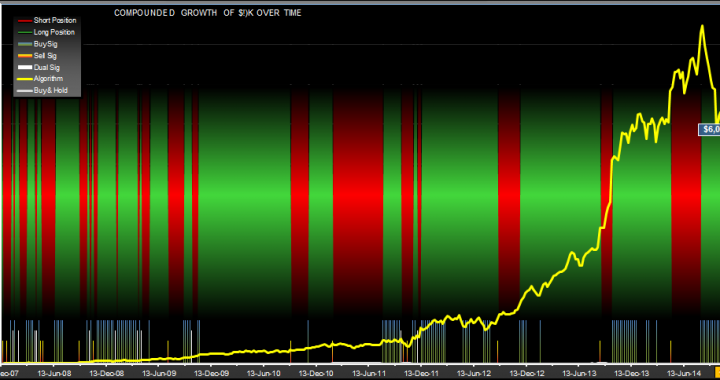

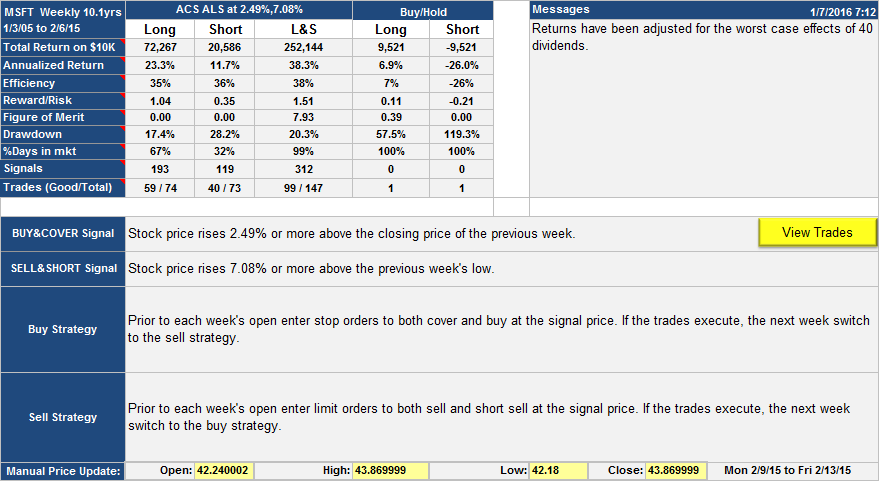

This graph shows the equity curve of the trading system for Microsoft (MSFT) over a ten year period, 1/3/05 to 2/6/15 for a $10K initial investment. The value increased to $262,144 vs. $19,521 for buy-hold. The background bands show if the stock was held long (green) or short (red). Note that most of the sell signals (shown at the bottom) are also dual signals as a buy signal generally occurs in the same time period. This is common with this kind of trading strategy.

The trading strategy works off weekly data, so it trades at most once a week and uses stop cover/buys and limit short/sells. The L&S column shows results for trading both Long and Short. Drawdown (20%) was much better than for buy-hold (57%).

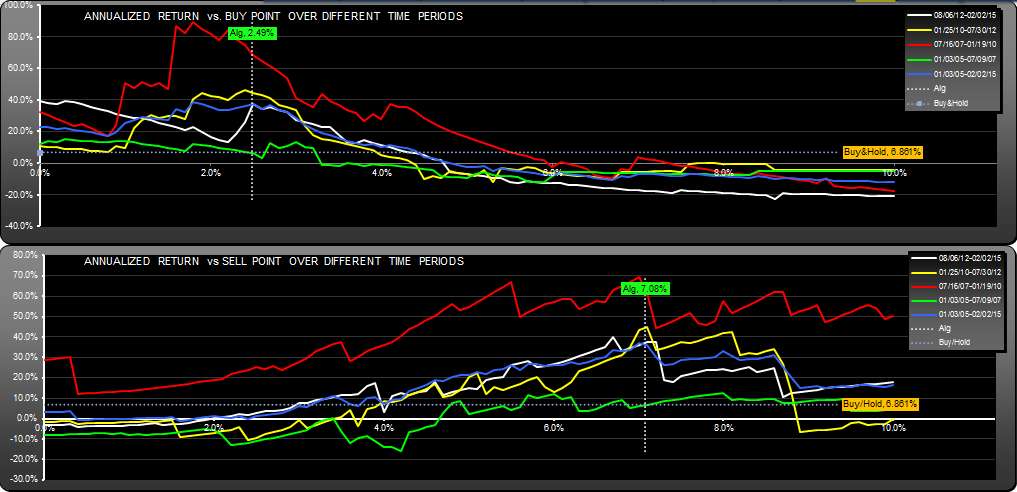

Here we compare the returns over different time periods, as they change with buy and sell point. We look for algorithms which give consistent returns–this one has one period of high returns (the red lines) and a period of returns similar to buy-hold (the green lines). Overall the returns were good (the blue lines).

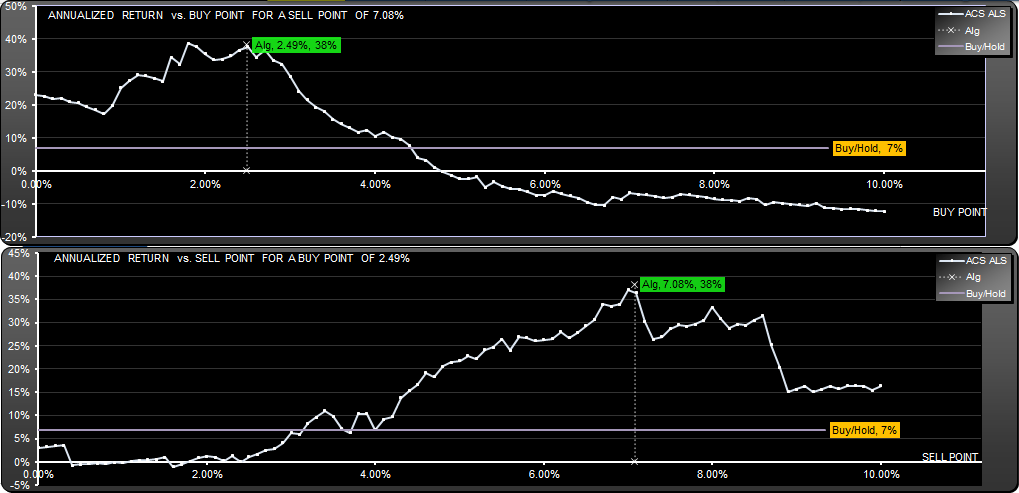

Plotting how returns change with buy and sell points gives us an idea how sensitive the algorithms are to changes in parameters. Here we see two broad peaks indicating that the algorithms are not overly sensitive to changes in parameters. In fact this buy point was profitable for all values of sell point from 2.5% to 10%.

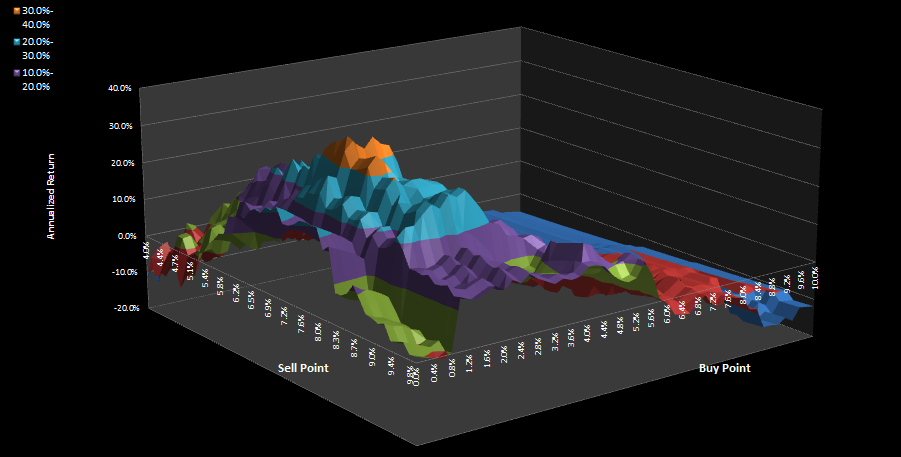

In the surface plot of return vs. buypoint/sellpoint we are looking for high ground, not too close to cliffs or valleys. For this algorithm there is a distinct hill feature showing a fairly stable exploit region.

Looking at 100 week performance for the same algorithm shows an improvement over buy-hold and better drawdown, although the equity curve (below) is similar.

Update 10/19/2016

This strategy has lost around 22% since inception, the underlying stock has gained 48%.

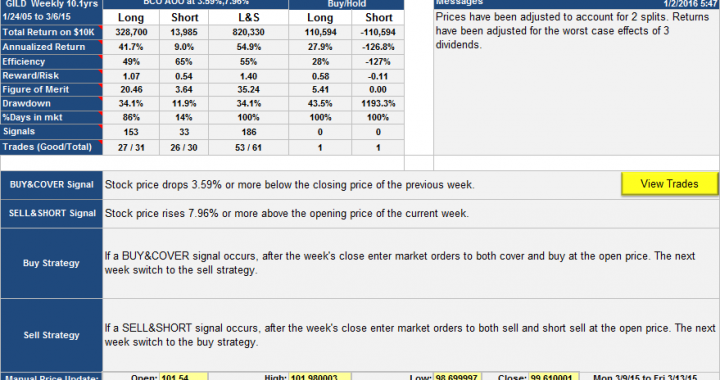

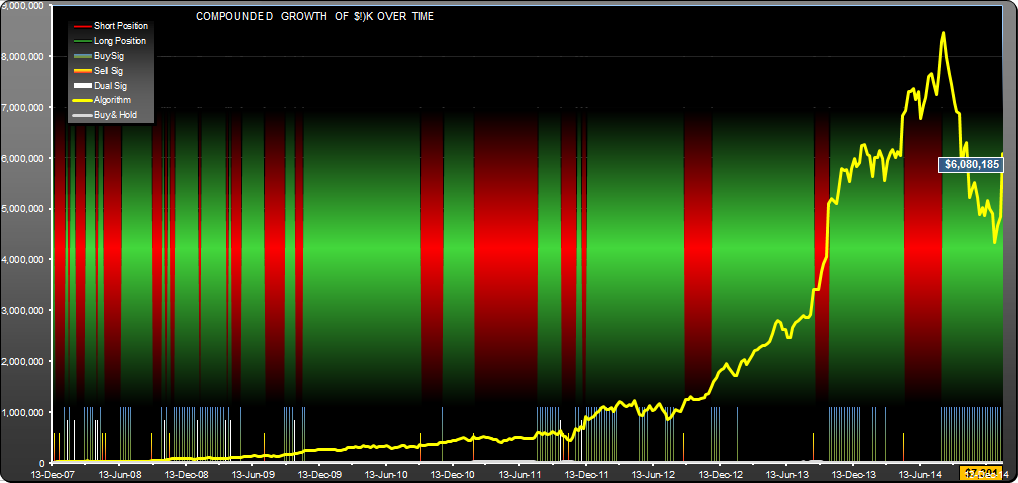

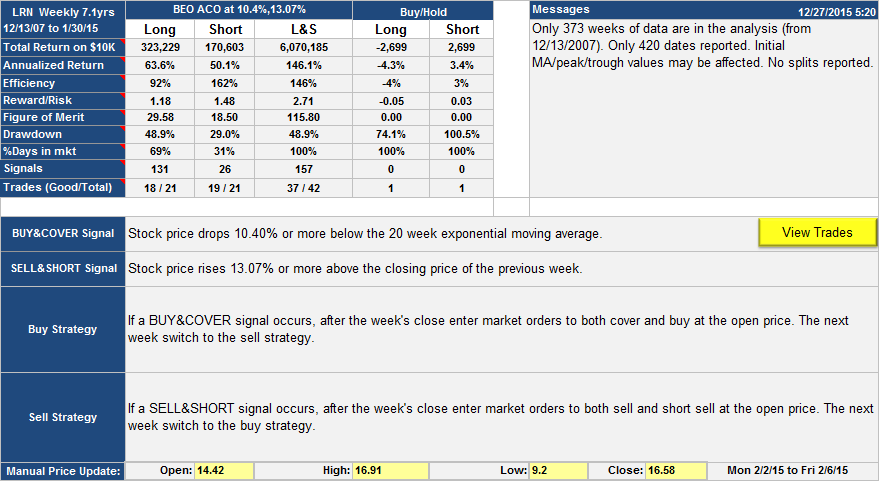

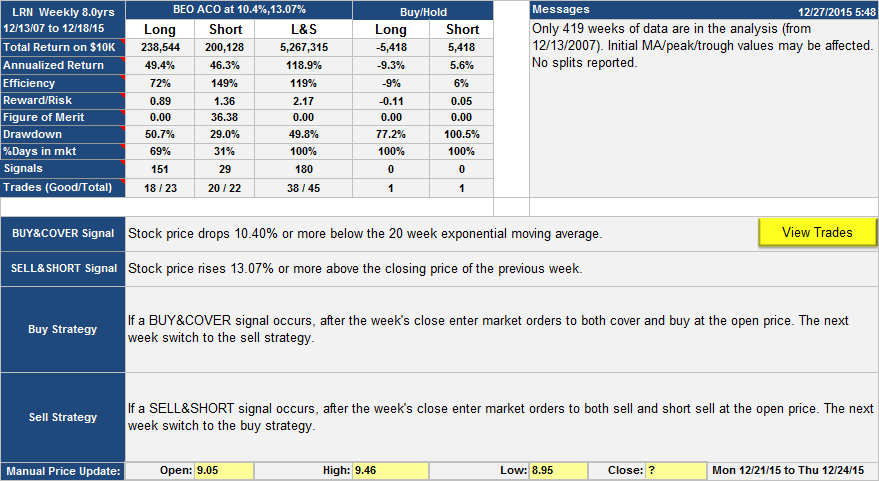

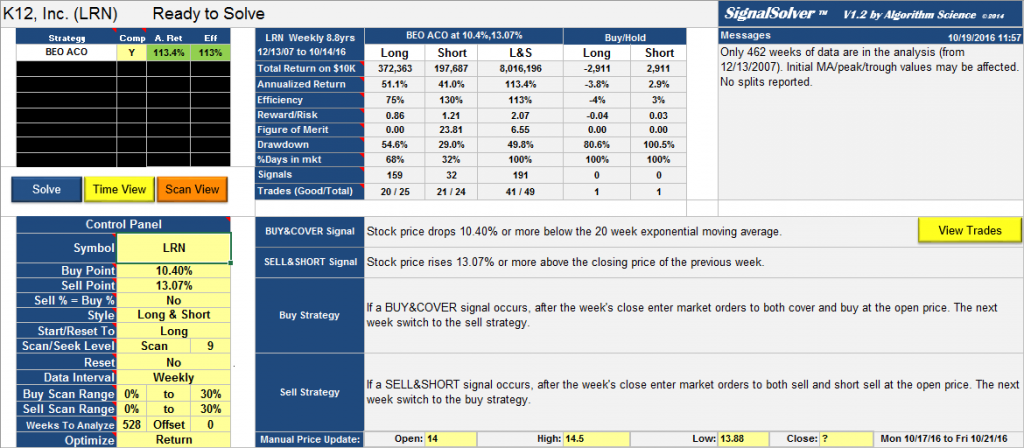

LRN Trading Strategy (Weekly)

K12 Inc (LRN)

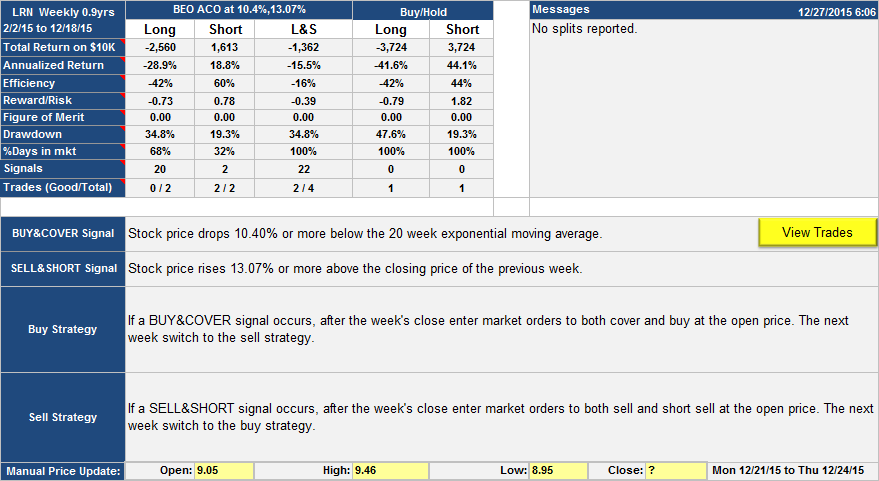

Update 12/27/2015

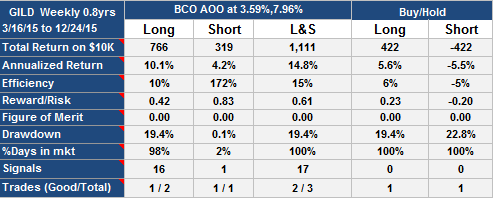

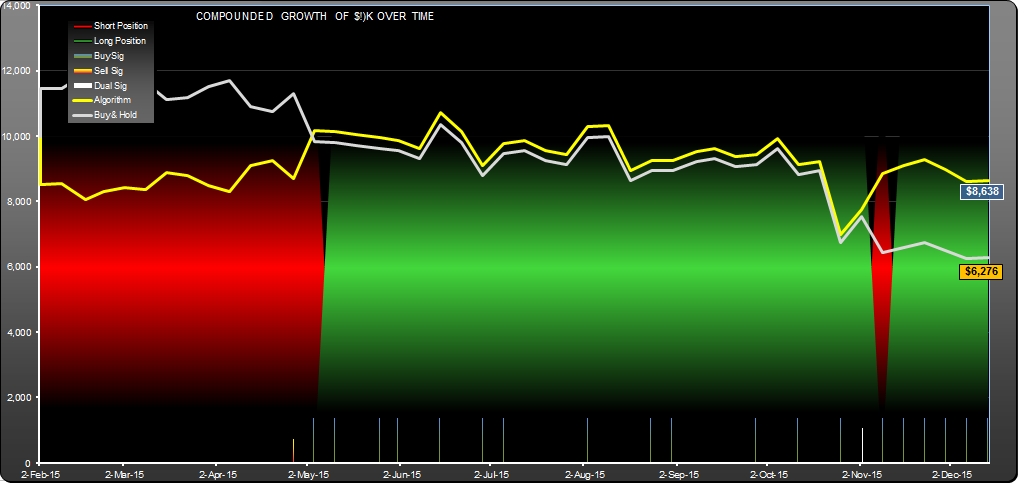

The above plots have been corrected for an error in the short side calculations. Below are updated equity curves and tables up until Dec 2015. The algorithm lost 13.6% over this time. The underlying stock dropped by 37.2%.

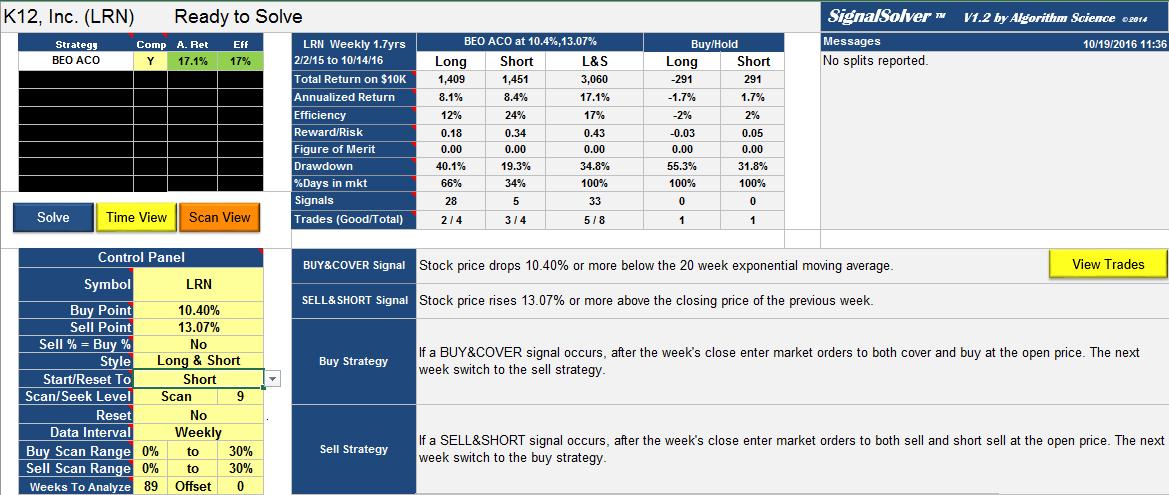

Update 10/19/2016

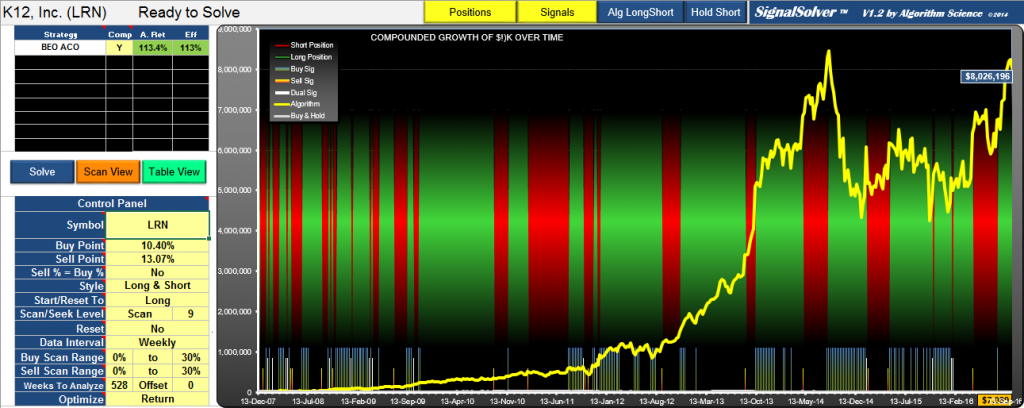

Since first publication in Feb 2015, this strategy has outperformed both buy-hold and short-hold. Here are the performance table and equity curve for the period since publication: